The investment world is buzzing with news that legendary investor Cathie Wood has doubled down on her crypto conviction, pouring an additional $93 million into digital asset-related companies. This strategic move by the ARK Invest CEO highlights her unwavering belief in blockchain technology and cryptocurrency infrastructure. Cathie Wood’s crypto stock investments now span major players, including Circle, Coinbase, Block, and Bullish, signaling a significant vote of confidence in the digital asset ecosystem. As traditional finance continues to intersect with blockchain innovation, Wood’s latest investment spree provides crucial insights into where institutional money is flowing and which crypto-adjacent companies are positioned for long-term success in this evolving landscape.

Cathie Wood’s Latest Crypto Investment Strategy

CathieWood’sd crypto stocks portfolio expansion represents more than just a routine allocation adjustment—it’s a calculated bet on the future of digital finance. As founder and CEO of ARK Invest, Wood has built a reputation for identifying disruptive technologies before they reach mainstream adoption. Her firm’s recent $93 million injection into cryptocurrency-related equities demonstrates a conviction that transcends short-term market volatility.

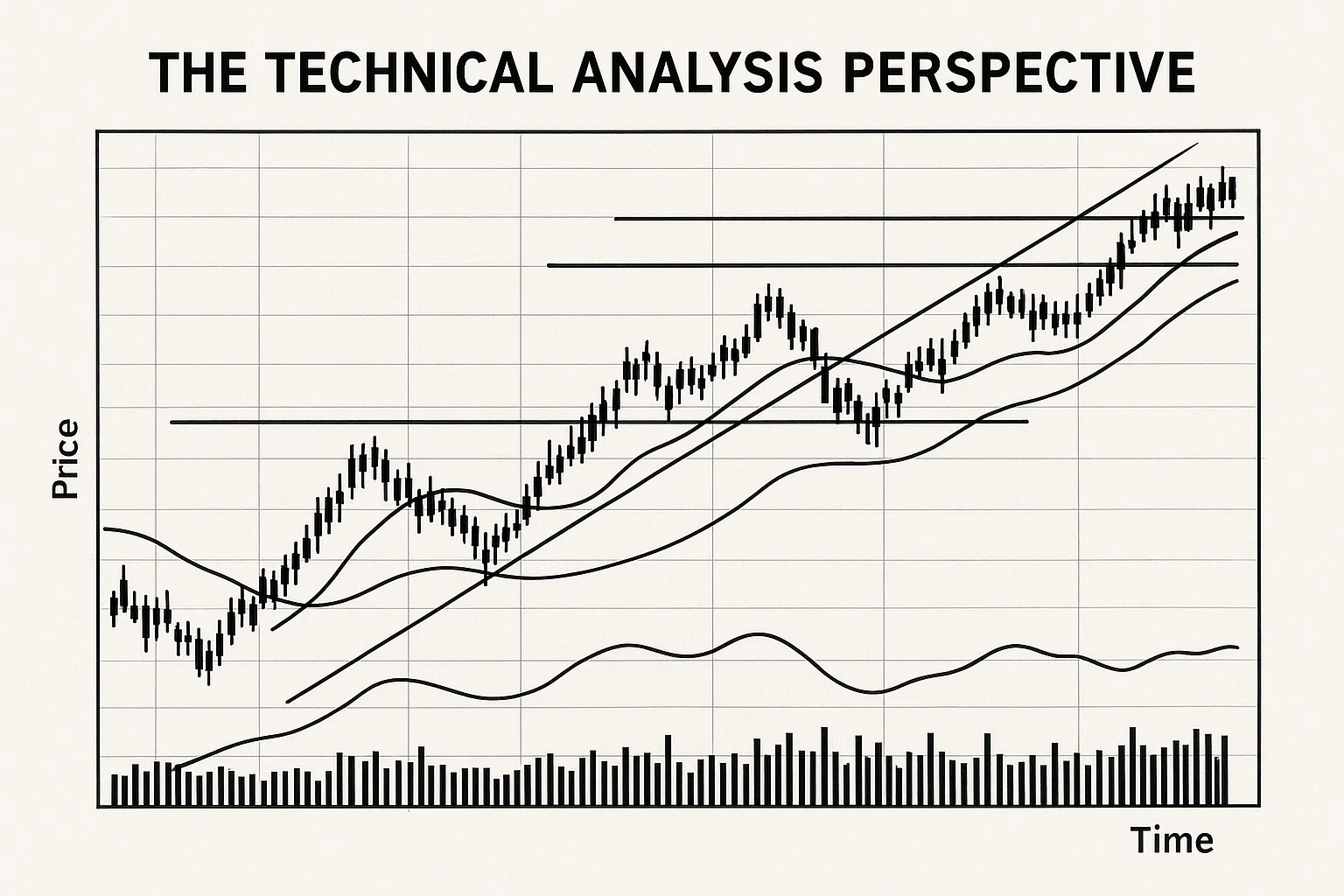

The timing of these investments is particularly noteworthy. While crypto markets have experienced considerable turbulence, Wood’s strategy focuses on the infrastructure layer—the companies building the rails for digital asset adoption rather than the volatile cryptocurrencies themselves. This approach provides exposure to blockchain technology’s upside while potentially mitigating some of the extreme volatility associated with direct cryptocurrency holdings.

Breaking Down the $93 Million Investment Allocation

ARK Invest’s latest disclosure reveals a carefully diversified approach across four key companies:

Circle Internet Financial emerges as a cornerstone holding, with Wood recognizing the critical role of stablecoins in the digital economy. As the issuer of USDC, one of the world’s largest and most trusted stablecoins, Circle has positioned itself as essential infrastructure for crypto transactions, remittances, and decentralized finance applications.

Coinbase Global continues to receive significant backing from ARK portfolios. Despite facing regulatory headwinds and market volatility, Coinbase remains the premier cryptocurrency exchange in the United States, offering retail and institutional investors a regulated gateway to digital assets. Wood’s continued investment suggests confidence in Coinbase’s ability to navigate regulatory challenges and maintain market leadership.

Block Inc. (formerly Square) represents Wood’s bet on mainstream crypto adoption through consumer-facing applications. With Cash App’s bitcoin features and Square’s merchant services, Block has integrated cryptocurrency functionality into products used by millions of Americans, creating a bridge between traditional finance and digital assets.

Bullish Global rounds out the portfolio with its focus on institutional-grade cryptocurrency trading infrastructure. This Gibraltar-based exchange backed by Block. one aims to serve sophisticated traders and institutions, addressing a growing market segment as professional investors increase their crypto allocations.

Why Cathie Wood Remains Bullish on Crypto Infrastructure

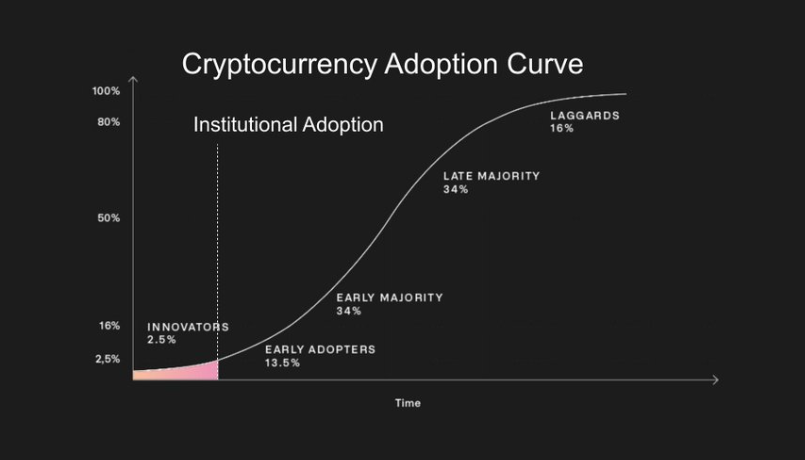

The Cathie Wood crypto stocks investment thesis rests on several fundamental convictions about technology adoption and financial system evolution. Wood has consistently articulated her belief that blockchain technology will fundamentally reshape finance, creating more accessible, efficient, and transparent systems.

Regulatory Clarity as a Catalyst

One factor driving Wood’s confidence is the gradual emergence of regulatory frameworks around digital assets. While uncertainty remains, progress toward clear guidelines in major markets could unlock institutional capital that has remained on the sidelines. Companies like Coinbase, which have invested heavily in compliance infrastructure, stand to benefit disproportionately as regulations crystallize.

The approval of spot Bitcoin ETFs in the United States marked a watershed moment, validating cryptocurrency as an investable asset class for traditional portfolios. This regulatory milestone has opened floodgates for institutional adoption, and the companies providing infrastructure for this adoption—exactly those in Wood’s portfolio—are positioned to capture significant revenue growth.

Technological Innovation Driving Adoption

Beyond regulatory tailwinds, Wood recognizes the relentless pace of technological improvement in the blockchain space. Layer-2 scaling solutions, improved user experiences, and cross-chain interoperability are addressing many early criticisms of cryptocurrency technology. As these technologies mature, the companies building on and supporting these platforms will likely see expanding addressable markets.

Circle’s stablecoin technology exemplifies this innovation. USDC has evolved from a niche cryptocurrency trading tool to a fundamental component of international payments, treasury management, and decentralized applications. With traditional payment rails often slow and expensive—especially for cross-border transactions—blockchain-based alternatives offer compelling advantages that are driving adoption among both consumers and enterprises.

Circle: The Stablecoin Infrastructure Play

Among Cathie Wood’s crypto stock portfolio, Circle represents a unique value proposition. Unlike exchanges that primarily generate revenue from trading fees, Circle’s business model centers on stablecoin issuance and the financial services built around digital dollars.

The USDC Advantage in Digital Payments

USD Coin (USDC) has established itself as a preferred stablecoin for institutional users and compliance-conscious platforms. With transparent reserves, regular attestations, and a commitment to regulatory cooperation, USDC addresses many concerns that have plagued other stablecoins. This positioning becomes increasingly valuable as regulators worldwide develop stablecoin frameworks.

Circle’s revenue model benefits from both circulation growth and interest income. As USDC circulation expands—currently hovering around tens of billions in market capitalization—Circle earns returns on the reserves backing these tokens. In rising interest rate environments, this creates a substantial revenue stream that scales with adoption.

The company has also expanded beyond simple stablecoin issuance into infrastructure services for businesses wanting to integrate blockchain payments. Circle’s APIs and developer tools enable companies to accept crypto payments, manage treasury operations, and build blockchain-native applications without developing deep technical expertise in-house.

Global Expansion and Regulatory Compliance

Circle’s international expansion strategy aligns with Wood’s thesis about blockchain’s role in financial inclusion. The company has secured regulatory approvals in multiple jurisdictions and is actively pursuing full banking licenses in key markets. This regulatory-first approach may limit short-term growth compared to less compliant competitors but builds durable competitive moats for the long term.

The stablecoin market continues to evolve rapidly, with traditional financial institutions exploring their own digital dollar products. However, Circle’s first-mover advantage, established partnerships, and technological infrastructure create significant barriers to entry. As banks and financial technology companies integrate stablecoins into their offerings, many are choosing to partner with Circle rather than building competing solutions from scratch.

Coinbase: Navigating the Crypto Exchange Landscape

Cathie Wood’s crypto stocks investment in Coinbase represents conviction in the leading U.S. cryptocurrency exchange despite ongoing challenges. Coinbase has weathered multiple crypto winters, regulatory scrutiny, and intense competition, emerging as a brand synonymous with cryptocurrency in America.

The Retail and Institutional Gateway

Coinbase’s dual focus on retail users and institutional clients creates diversified revenue streams less dependent on retail trading volume alone. While retail trading generates substantial fees during bull markets, institutional services—including custody, staking, and prime brokerage—provide more stable, recurring revenue that persists through market cycles.

The company’s institutional custody service manages tens of billions in digital assets for hedge funds, family offices, and even publicly traded companies. As more traditional investors allocate to cryptocurrency, trusted custody solutions become essential. Coinbase’s regulatory compliance, insurance coverage, and security infrastructure address key concerns preventing larger institutions from entering the space.

Coinbase has also expanded into blockchain infrastructure with Base, a Layer-2 scaling solution built on Ethereum. This strategic move positions Coinbase not just as an exchange but as a core infrastructure provider for the decentralized application ecosystem. As developers build on Base, Coinbase benefits from increased blockchain activity while diversifying beyond trading fee dependency.

Regulatory Challenges and Opportunities

The SEC’s ongoing scrutiny of Coinbase has created near-term headwinds, with legal ambiguity surrounding which digital assets constitute securities. However, Wood’s investment suggests confidence that Coinbase will successfully navigate these challenges. The company has invested heavily in compliance, legal, and government relations teams, positioning itself as a cooperative partner in developing sensible regulatory frameworks.

A favorable regulatory outcome—whether through litigation, legislation, or agency guidance—could serve as a major catalyst for Coinbase stock. Clear rules would enable the company to expand its product offerings, list additional tokens with confidence, and potentially offer services currently restricted by regulatory uncertainty.

Beyond domestic challenges, Coinbase is expanding internationally, with particular focus on markets with clearer cryptocurrency regulations. This geographic diversification reduces dependence on U.S. regulatory developments while capturing growth in regions enthusiastically embracing digital assets.

Block: Mainstream Crypto Adoption Through Consumer Products

Block Inc. represents Wood’s investment in the integration into everyday financial life. Unlike companies serving crypto natives, Block brings blockchain technology to mainstream consumers through products they already use and trust.

Cash App’s Cryptocurrency Integration

Cash App, Block’s peer-to-peer payment platform with tens of millions of users, has seamlessly integrated bitcoin buying, selling, and custody into its user experience. This integration introduces cryptocurrency to consumers who might never visit a dedicated exchange, dramatically expanding the addressable market for digital asset adoption.

The friction-reducing approach of Cash App’s crypto features cannot be overstated. Users can purchase Bitcoin with the same ease as sending money to friends or buying stocks, eliminating intimidating technical barriers that have historically limited cryptocurrency adoption. As younger, tech-savvy demographics increasingly use Cash App for everyday transactions, their familiarity with and comfort around cryptocurrency grow organically.

Block also enables millions of merchants to accept bitcoin payments through Square’s point-of-sale systems. While cryptocurrency payments remain a small fraction of transaction volume, this infrastructure creates optionality for merchants and consumers as adoption grows. The company’s investment in Lightning Network integration aims to address speed and cost concerns that have limited Bitcoin’s use in retail transactions.

Bitcoin Treasury Strategy and Corporate Commitment

Block’s corporate bitcoin holdings demonstrate leadership’s conviction beyond just offering cryptocurrency products. By holding bitcoin on its balance sheet, Block aligns its financial interests with the success of the broader cryptocurrency ecosystem. This commitment signals to employees, customers, and investors that cryptocurrency represents a strategic priority rather than a peripheral product experiment.

The company’s ongoing bitcoin purchases, regardless of price fluctuations, reflect a long-term accumulation strategy similar to MicroStrategy’s approach. As more corporations consider cryptocurrency treasury allocations, Block’s experience and infrastructure could position it as a service provider helping other companies execute similar strategies.

Block’s recent initiatives in decentralized identity and Web5—a vision for a decentralized web layer—extend its blockchain ambitions beyond payments. While these projects remain in early stages, they demonstrate Wood’s investment targets companies thinking expansively about blockchain’s potential applications rather than narrowly focusing on speculation and trading.

Bullish: Institutional Infrastructure for Professional Traders

Bullish Global represents perhaps the most specialized component of Cathie Wood’s crypto stocks portfolio. Unlike consumer-facing platforms, Bullish targets professional traders and institutional investors seeking sophisticated trading infrastructure.

Advanced Trading Features for Sophisticated Users

Bullish differentiates through features appealing to professional market participants: advanced order types, deep liquidity pools, and institutional-grade security. The platform combines centralized exchange performance with decentralized finance principles, attempting to offer the best of both worlds.

The exchange’s automated market maker integration provides continuous liquidity even for less-traded pairs, addressing a persistent challenge in cryptocurrency markets. By algorithmically managing liquidity provision, Bullish creates more efficient markets with tighter spreads, benefiting all participants but particularly institutional traders executing large orders.

Bullish also offers unique tokenized loyalty programs where users earn platform tokens proportional to their trading activity. This model creates network effects—as more traders join and earn rewards, the token’s utility increases, incentivizing continued platform use. For institutions managing long-term cryptocurrency strategies, such loyalty benefits can meaningfully reduce effective trading costs over time.

Regulatory Positioning in Gibraltar

Bullish’s Gibraltar domicile provides regulatory clarity currently unavailable in many larger markets. Gibraltar has developed comprehensive blockchain and cryptocurrency regulations, offering licensed exchanges legal certainty about operational boundaries. This regulatory framework appeals to institutional investors requiring compliance with fiduciary duties and risk management protocols.

As cryptocurrency regulation continues evolving globally, exchanges with established regulatory licenses in credible jurisdictions possess significant advantages. Bullish can point to its regulatory status when onboarding institutional clients concerned about counterparty risk and legal compliance—concerns that have kept many traditional finance participants on the sidelines.

The exchange is backed by Block. One, which developed the EOSIO blockchain protocol, provides additional technical credibility and resources. While EOS itself has faced challenges capturing market attention amid intense blockchain competition, the technical expertise and financial resources from Block. one give Bullish advantages in platform development and market making.

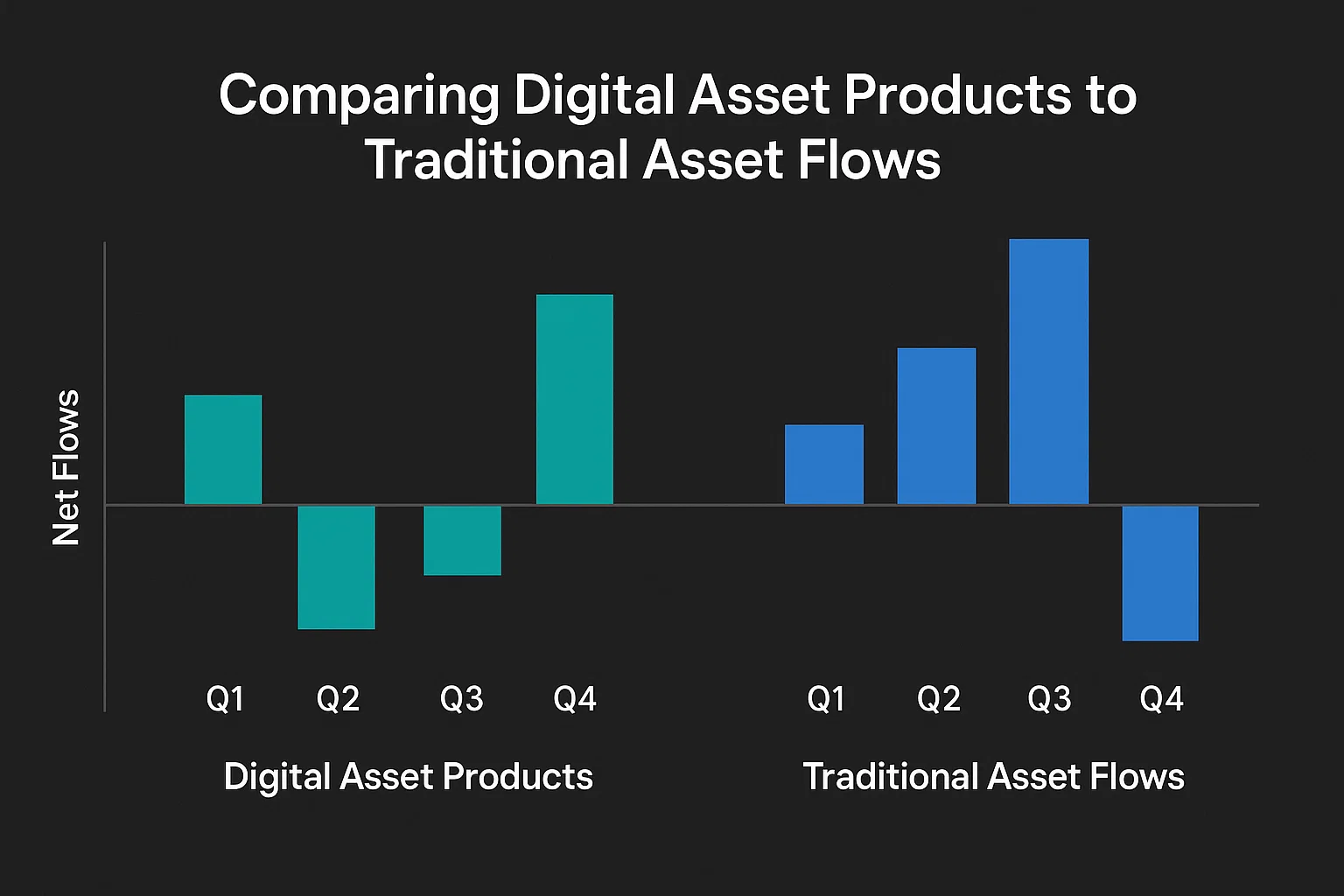

Market Implications of ARK Invest’s Crypto Positioning

When Cathie Wood allocates capital, the investment community pays attention. ARK Invest’s transparent, research-driven approach and Wood’s media presence mean her portfolio decisions influence both institutional and retail investor sentiment.

Institutional Validation Through Public Equity Exposure

For investors unable or unwilling to hold cryptocurrency directly, Cathie Wood crypto stocks provide indirect exposure through regulated, publicly traded companies. This structure addresses concerns about custody, taxation, and regulatory uncertainty while still capturing upside from blockchain adoption.

ARK’s investment approach also validates cryptocurrency-related companies as legitimate long-term holdings rather than speculative trades. When a respected institutional investor with a track record in technology investing commits nearly $100 million to these names, it signals conviction based on fundamental analysis rather than momentum chasing.

The timing of ARK’s purchases often proves as significant as the selections themselves. Wood has demonstrated willingness to buy during periods of pessimism and fear, a contrarian approach that has generated substantial returns when markets eventually recover. Her recent accumulation during crypto market uncertainty could indicate she perceives current valuations as attractive relative to long-term potential.

Portfolio Construction and Risk Management

ARK’s approach to cryptocurrency exposure through equity positions rather than direct token ownership reflects a sophisticated risk management strategy. While cryptocurrencies themselves can experience dramatic volatility, the companies providing infrastructure tend to exhibit somewhat more stable fundamentals with diverse revenue streams.

This structure also provides governance rights and financial transparency unavailable with direct cryptocurrency holdings. As shareholders in these companies, ARK can influence corporate strategy, access detailed financial information, and benefit from management teams’ capital allocation decisions—tools unavailable to cryptocurrency holders.

The diversification across four distinct companies with different business models further reduces concentration risk. Circle’s stablecoin focus, Coinbase’s exchange dominance, Block’s consumer integration, and Bullish’s institutional targeting create exposure to multiple adoption pathways for blockchain technology.

Broader Trends Driving Crypto Stock Investments

Wood’s investments don’t occur in isolation but reflect broader trends reshaping finance and technology. Understanding these macro forces provides context for why Cathie Wood crypto stocks represent more than tactical trades.

Monetary Innovation and Digital Currency Adoption

Central banks worldwide are exploring and piloting central bank digital currencies (CBDCs), validating blockchain technology’s potential to modernize money itself. While CBDCs may compete with private cryptocurrencies in some ways, their development creates infrastructure, regulatory frameworks, and public familiarity that benefit the entire digital asset ecosystem.

The companies in Wood’s portfolio are positioning themselves as essential service providers regardless of whether the future of digital money centers on cryptocurrencies, stablecoins, or CBDCs. Circle’s stablecoin expertise, Coinbase’s regulatory relationships, Block’s payment integration, and Bullish’s trading infrastructure all remain valuable across multiple digital currency scenarios.

International remittances represent another compelling use case driving adoption. Traditional remittance services charge high fees and require days for settlement, particularly for developing world corridors. Blockchain-based alternatives can settle instantly at a fraction of the cost, potentially disrupting a market worth hundreds of billions annually in fees. Companies facilitating these transactions capture value as volume migrates to blockchain rails.

Generational Wealth Transfer and Digital Native Investors

The ongoing transfer of wealth to millennial and Gen Z investors—demographics with higher cryptocurrency adoption rates—creates a tailwind for digital asset companies. Younger investors demonstrate greater comfort with digital-native financial products and often view cryptocurrency as a natural portfolio component rather than an exotic speculation.

This demographic shift influences not just retail adoption but institutional strategies as well. As younger professionals advance into decision-making roles at family offices, endowments, and pension funds, their familiarity with and openness to cryptocurrency will likely increase institutional allocation to the space.

Financial advisors are also adapting their practices to meet client demand for cryptocurrency exposure. Many advisors who previously dismissed digital assets now face persistent client questions about allocation strategies. The companies in Wood’s portfolio provide accessible, regulated vehicles for advisors to recommend, potentially capturing this latent demand as it translates into actual allocations.

Risks and Challenges Facing Crypto Stocks

Despite Wood’s conviction, Cathie Wood’s crypto stock investments face meaningful risks that investors should understand before following her lead into this sector.

Regulatory Uncertainty and Potential Restrictions

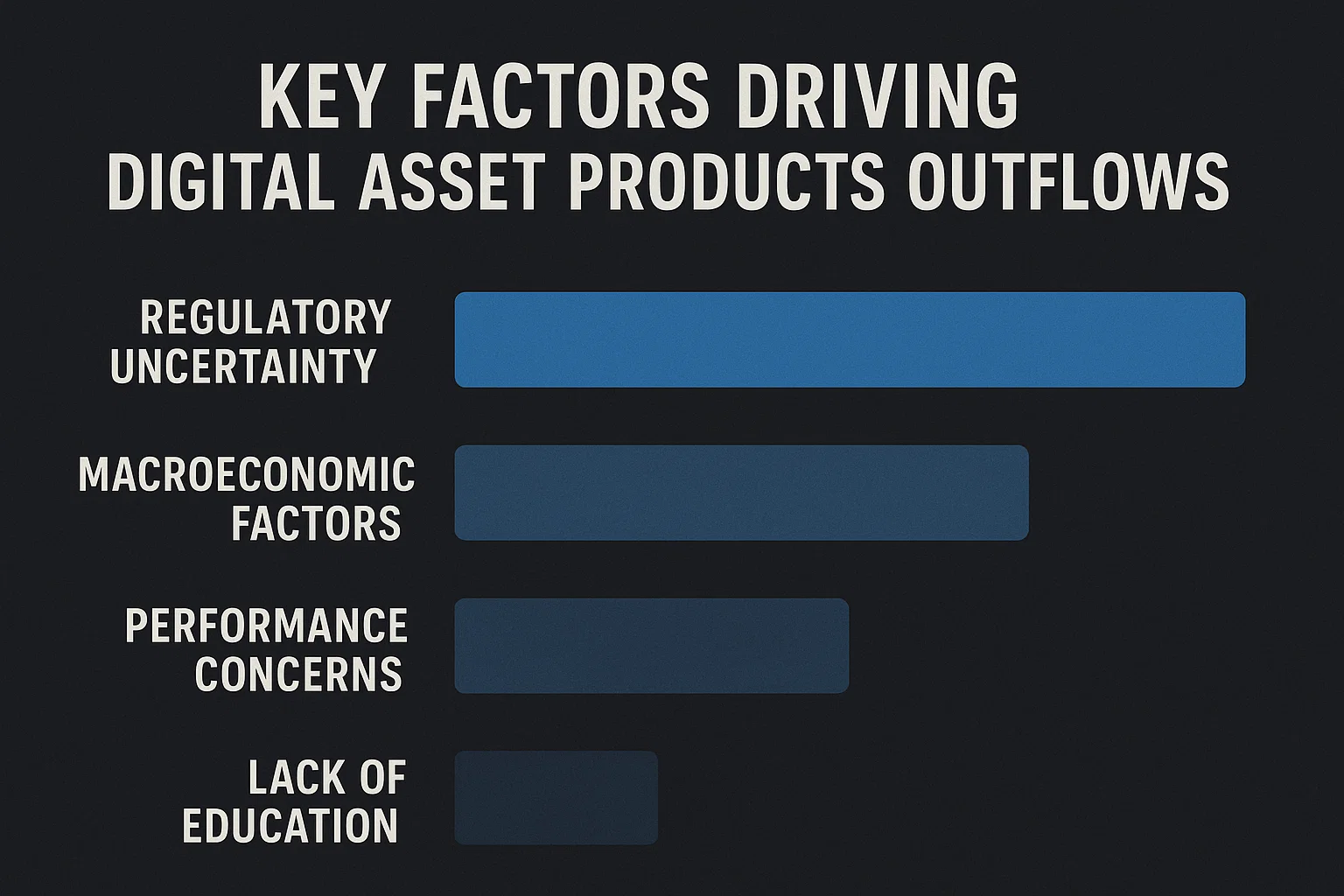

While regulatory clarity would likely benefit these companies long-term, the path to that clarity remains uncertain and could involve painful interim steps. Potential regulations might restrict business models, impose costly compliance requirements, or even prohibit certain activities entirely.

The SEC’s aggressive stance toward cryptocurrency regulation has created particular uncertainty for U.S.-based companies. If regulators ultimately conclude that many tokens constitute securities, exchanges like Coinbase could face limitations on which assets they can list and how they can operate. While the companies are building compliance infrastructure to adapt, regulatory costs could significantly impact profitability.

International regulatory divergence also creates challenges. A fragmented global regulatory landscape where different jurisdictions impose conflicting requirements increases operational complexity and costs. Companies may need to restrict services in certain markets or maintain parallel infrastructure to serve different regulatory regimes, reducing efficiency and economies of scale.

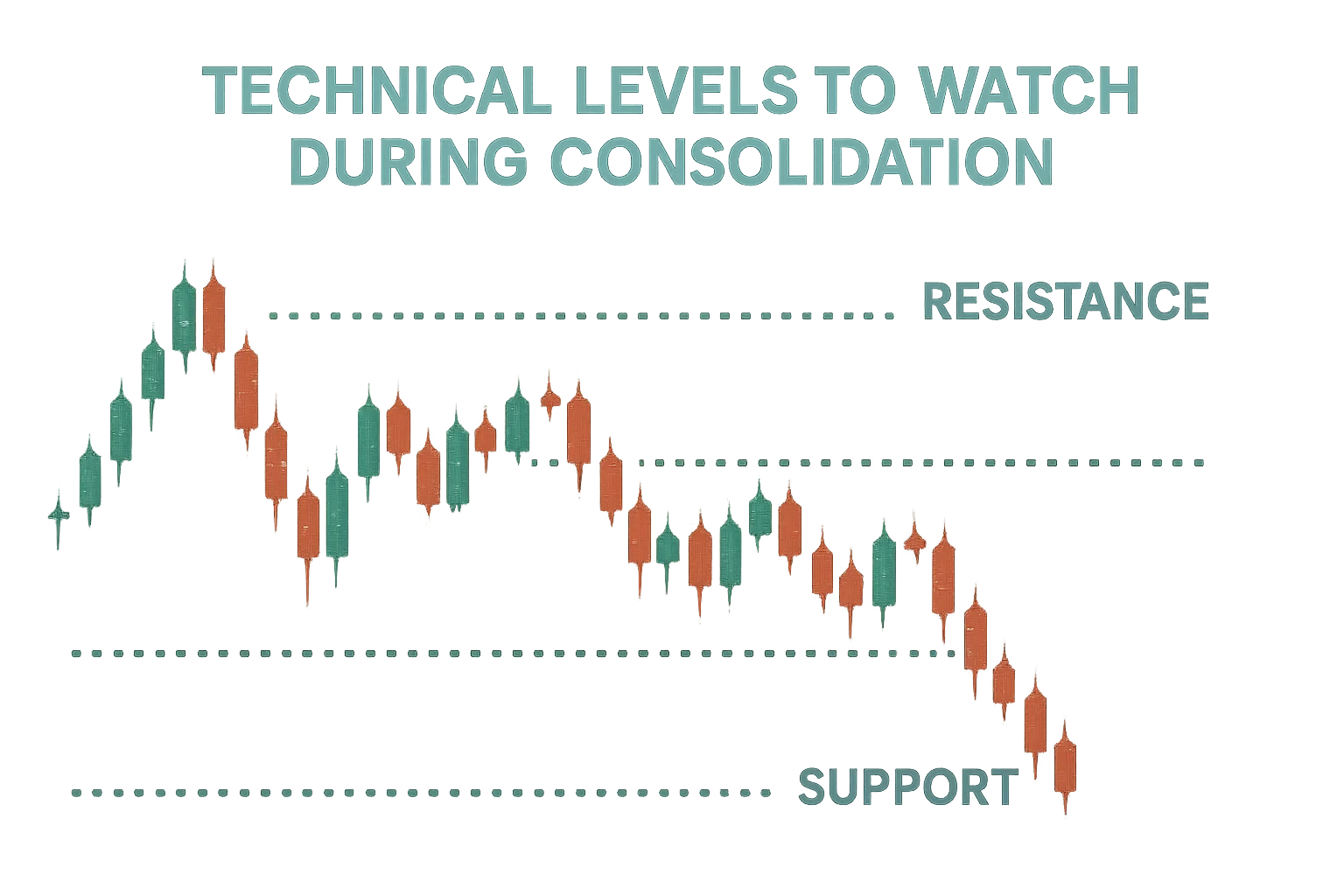

Market Volatility and Revenue Cyclicality

Cryptocurrency markets remain highly volatile, and the revenue of companies serving this ecosystem often correlates with market conditions. During bear markets, trading volumes decline, new user acquisition slows, and engagement decreases—all negatively impacting company performance.

While companies are diversifying revenue streams to reduce this cyclicality, trading and transaction fees remain substantial portions of revenue for most cryptocurrency businesses. A prolonged crypto winter could pressure profitability and require cost-cutting measures that might limit long-term growth initiatives.

The competitive landscape also intensifies during difficult markets. Larger, better-capitalized competitors may use downturns to gain market share through aggressive pricing or marketing, while smaller players struggle or exit entirely. The ultimate winners from this competitive dynamic remain uncertain despite current market positions.

Technological Disruption and Platform Risk

The pace of innovation in blockchain technology means today’s leading platforms could become obsolete if superior alternatives emerge. New blockchain protocols with better performance characteristics, alternative consensus mechanisms with improved security or efficiency, or entirely novel approaches to decentralized systems could disrupt current market leaders.

Companies must continuously invest in research, development, and platform improvement to avoid obsolescence—investments that weigh on profitability and create execution risk. A missed technological transition or failed product launch could permanently damage competitive positioning in a fast-moving industry where user loyalty remains relatively low.

Security risks also loom large. Despite best efforts, cryptocurrency businesses remain attractive targets for hackers given the irreversible nature of blockchain transactions. A major security breach resulting in customer fund losses could devastate reputation and trigger regulatory intervention, even for companies with otherwise strong security practices.

How Retail Investors Can Approach Crypto Stock Investing

For investors interested in following Wood’s lead into cryptocurrency-related equities, several considerations can inform more thoughtful investment approaches.

Portfolio Allocation and Risk Tolerance

Cathie Wood crypto stocks represent high-growth, high-volatility investments appropriate for only the risk-capital portion of diversified portfolios. Financial advisors typically recommend limiting exposure to any single thematic investment to a small percentage of overall holdings, particularly for themes as volatile as cryptocurrency.

Investors should honestly assess their risk tolerance and investment timeline. These companies may experience drawdowns of 50% or more during market downturns, and recovery could require years. Only capital that investors can afford to lose without impacting financial goals or emotional well-being should be allocated to these positions.

Dollar-cost averaging—investing fixed amounts at regular intervals—can help manage timing risk in volatile markets. Rather than attempting to time the perfect entry point, consistent accumulation over time averages out volatility and removes emotional decision-making from the investment process.

Due Diligence Beyond Following Notable Investors

While Wood’s investment decisions provide valuable signals, blindly copying portfolio moves without independent analysis represents poor investment practice. Each investor’s financial situation, goals, and risk tolerance differ, making personalized analysis essential.

Researching company fundamentals—revenue models, competitive positioning, management quality, balance sheet strength, and growth trajectories—provides a foundation for informed decisions. Reading quarterly earnings reports, listening to management presentations, and understanding regulatory developments affecting specific companies enables more confident long-term holding during inevitable volatility.

Understanding valuation also matters, even for growth stocks. While high-growth technology companies often trade at elevated multiples, understanding what growth rates and competitive outcomes are already priced into current valuations helps assess risk-reward ratios and appropriate position sizes.

Tax Implications and Portfolio Location

Cryptocurrency-related stocks held in taxable accounts generate tax implications with each sale, potentially creating tax drag that reduces returns. For long-term investors, utilizing tax-advantaged accounts like IRAs or 401(k)s where available can improve after-tax returns by deferring or eliminating capital gains taxes.

However, tax-advantaged account space is limited and valuable, so investors must weigh the benefits of using this space for high-volatility thematic investments versus more diversified holdings. Consultation with tax professionals can help optimize portfolio location decisions based on individual circumstances.

Record-keeping becomes particularly important for investors actively trading these positions. Capital gains and losses must be accurately tracked and reported, with wash sale rules potentially applying to limit loss recognition for tax purposes.

Future Outlook: Where Crypto Stocks Could Head Next

Looking forward, several potential catalysts could drive performance for Cathie Wood crypto stocks, while risks remain that could undermine the investment thesis.

Potential Positive Catalysts

Bitcoin ETF adoption continues to expand as financial advisors become more comfortable recommending cryptocurrency exposure. As these products gather assets, underlying trading activity increases, benefiting exchanges, custody providers, and market infrastructure companies throughout the ecosystem.

Traditional banks integrating blockchain technology for cross-border payments and settlements could dramatically expand stablecoin adoption. If major financial institutions choose to partner with existing stablecoin issuers rather than developing competing products, companies like Circle could experience explosive growth as they become rails for traditional banking activities.

Institutional cryptocurrency allocation increasing from current levels near 1-2% to a more substantial 5-10% of portfolios would unlock enormous capital flows into the ecosystem. As more pension funds, endowments, and sovereign wealth funds overcome operational and governance hurdles to cryptocurrency investment, the companies providing institutional infrastructure would capture significant value.

Regulatory clarity, particularly in the United States, could remove a major overhang preventing capital deployment into the sector. Clear rules about which tokens are securities, how exchanges should operate, and what compliance requirements apply would enable companies to operate with confidence and potentially unlock product innovations currently too risky under ambiguous regulations.

Potential Headwinds to Monitor

However, intensifying competition from traditional financial institutions entering the cryptocurrency space could pressure margins and market share. If established banks, payment networks, and exchanges leverage existing customer relationships and regulatory licenses to offer cryptocurrency services, current pure-play crypto companies might struggle to maintain premium valuations.

A major fraud, hack, or scandal in the cryptocurrency ecosystem—even if not directly involving these companies—could trigger regulatory crackdowns and damage public perception. The cryptocurrency industry has weathered numerous such incidents, but a sufficiently large failure could set adoption back years and impact even well-managed companies through guilt-by-association.

Macroeconomic conditions also matter. Rising interest rates and slowing economic growth have historically correlated with weakness in speculative assets, including cryptocurrency. While the companies themselves have diverse business models, their fortunes remain partially tied to overall cryptocurrency market health, which responds to broader financial conditions.

Technological disruption from unexpected innovations could undermine current business models. Just as blockchain technology is disrupting traditional finance, new technologies could disrupt current blockchain implementations. Companies must continuously evolve to avoid obsolescence in a rapidly changing technological landscape.

Conclusion

Cathie Wood’s $93 million investment in Cathie Wood crypto stock, including Circle, Coinbase, Block, and Bulli, sh represents a calculated bet on blockchain technology’s transformative potential. Rather than speculating on cryptocurrency prices directly, Wood’s strategy targets the infrastructure companies enabling digital asset adoption—an approach offering exposure to blockchain upside while potentially reducing volatility.

For investors considering similar positioning, the key lies in understanding both the compelling long-term thesis and the meaningful near-term risks. These companies operate at the intersection of technology, finance, and regulation—a space characterized by rapid change and uncertainty. Success requires patient capital willing to endure volatility in pursuit of transformational returns.

Read More: Top Altcoin News This Week, Breaking Updates, Market