Digital asset products outflows reached a staggering $2 billion in a single week, marking the culmination of a brutal three-week selloff that has drained $3.2 billion from institutional investment vehicles. This massive exodus from digital asset products represents one of the most significant capital flights in the history of crypto-based investment instruments, sending shockwaves through an already volatile market. Investors who once flocked to Bitcoin ETFs, Ethereum funds, and blockchain-focused investment products are now rushing for the exits, raising critical questions about the future of institutional cryptocurrency adoption. The current market turmoil reflects broader concerns about regulatory uncertainty, macroeconomic headwinds, and shifting risk sentiment among professional investors. As digital asset products continue to hemorrhage capital, understanding the underlying causes and potential implications becomes essential for anyone with exposure to cryptocurrency markets or considering future investments in this rapidly evolving asset class.

Scale of Digital Asset Products Outflows

The magnitude of recent digital asset product outflows cannot be understated. When investment vehicles designed to provide exposure to cryptocurrencies experience $2 billion in withdrawals within seven days, it signals a fundamental shift in investor confidence. These products, which include spot Bitcoin ETFs, crypto exchange-traded notes, and blockchain equity funds, have become the primary gateway for institutional and sophisticated retail investors seeking cryptocurrency exposure without directly holding digital coins.

Breaking Down the $3.2 Billion Three-Week Exodus

The three-week period that culminated in the $2 billion single-week outflow represents the longest sustained period of negative flows since the approval of spot Bitcoin ETFs in January 2024. Week one saw approximately $700 million leave digital asset products, followed by $500 million in week two, before accelerating to the devastating $2 billion figure in the third week. This progressive intensification suggests growing panic rather than calculated portfolio rebalancing.

What makes these digital asset products’ outflows particularly concerning is their breadth across different product categories. Bitcoin-focused funds bore the brunt of redemptions, accounting for roughly 65% of total outflows, while Ethereum products contributed another 25%. The remaining 10% came from diversified crypto funds and blockchain equity products, indicating that the selloff wasn’t limited to a single cryptocurrency but reflected broader scepticism about the entire digital asset ecosystem.

Historical Context: How Do These Outflows Compare?

To fully appreciate the severity of current digital asset products outflows, we must examine historical patterns. The previous record for weekly outflows occurred during the May 2022 Terra/LUNA collapse, when approximately $1.4 billion exited crypto investment products. The FTX bankruptcy in November 2022 triggered $900 million in weekly outflows. The current $2 billion figure exceeds both these crisis-driven events, suggesting that present concerns may be even more fundamental than exchange failures or individual project implosions.

Interestingly, the digital asset products industry had experienced remarkable inflows during the first eight months of 2024, with cumulative net inflows exceeding $28 billion, primarily driven by the launch of spot Bitcoin ETFs in the United States. This makes the sudden reversal even more dramatic, wiping out nearly 11% of year-to-date gains in just three weeks.

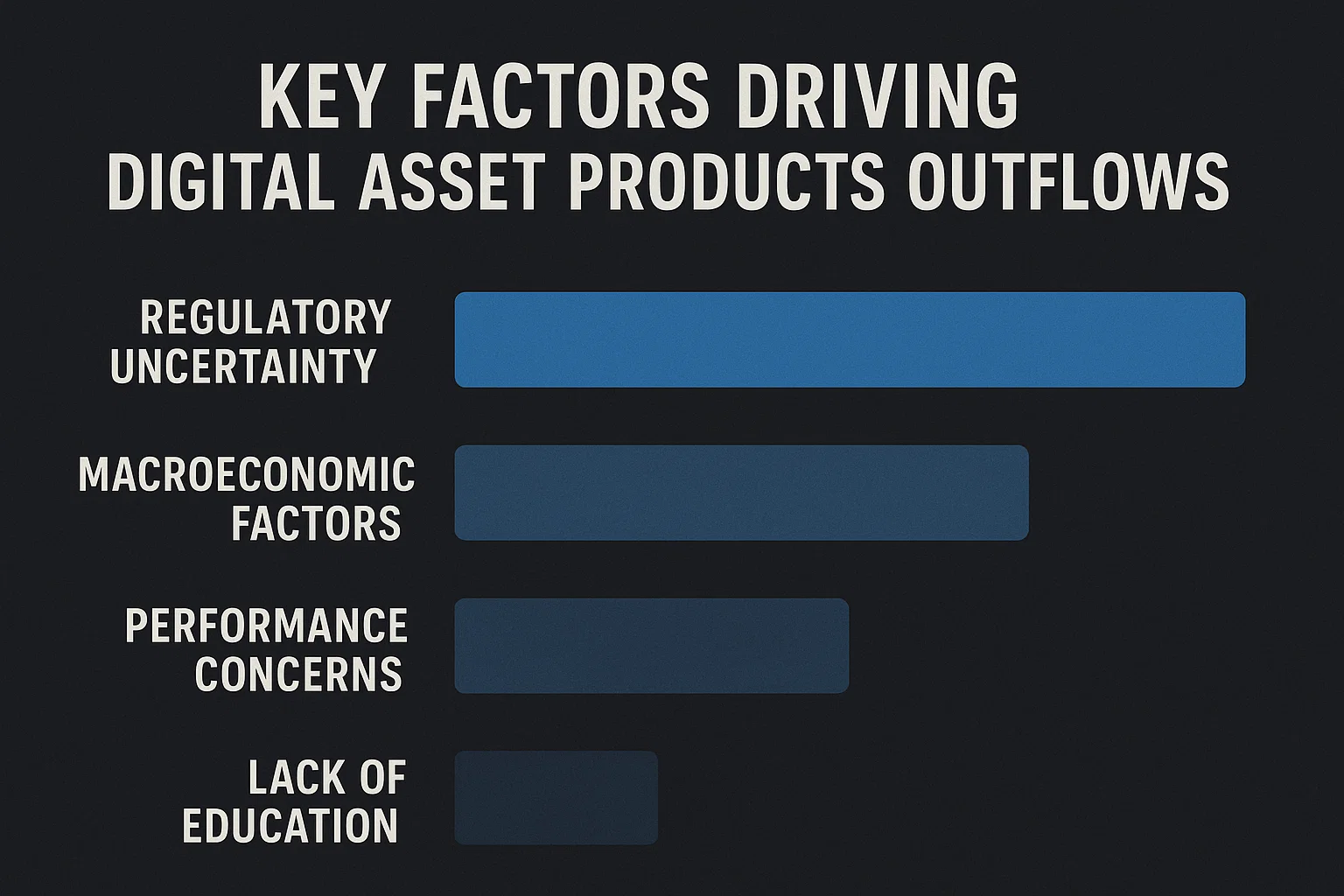

Key Factors Driving Digital Asset Products Outflows

Multiple converging factors have created the perfect storm, driving digital asset products’ outflows to record levels. Understanding these catalysts provides insight into both current market dynamics and potential future trajectories for cryptocurrency investments.

Macroeconomic Pressures and Risk-Off Sentiment

The broader macroeconomic environment has turned decidedly hostile to risk assets, and digital asset products have not been spared. Rising long-term treasury yields, persistent inflation concerns, and uncertainty surrounding Federal Reserve monetary policy have prompted investors to reduce exposure to volatile asset classes. When institutional portfolios undergo risk reduction, cryptocurrency investments are often among the first casualties due to their historical volatility and relative newness compared to traditional assets.

The correlation between digital asset products’ performance and broader equity markets has strengthened significantly over the past two years. As stock markets experience volatility, particularly in technology sectors, crypto investments have moved in tandem, eliminating the diversification benefits that initially attracted some institutional investors. This increased correlation has led portfolio managers to question whether crypto deserves a dedicated allocation when it essentially amplifies equity risk rather than diversifying it.

Regulatory Uncertainty and Policy Headwinds

Regulatory developments have cast a long shadow over digital asset products’ outflows. Recent enforcement actions by the Securities and Exchange Commission against major cryptocurrency exchanges have raised concerns about the legal framework surrounding digital asset custody, trading, and investment products. When regulatory uncertainty increases, institutional investors—who must answer to compliance departments and risk committees—often reduce exposure preemptively rather than navigate potentially murky legal waters.

The debate over cryptocurrency regulation extends beyond U.S. borders. The European Union’s Markets in Crypto-Assets (MiCA) regulation, while providing clarity in some areas, has also introduced compliance costs and operational requirements that affect digital asset products operating in European markets. Global regulatory fragmentation creates additional complexity for multinational investment firms, potentially driving them to reduce cryptocurrency allocations until a more coherent international framework emerges.

Profit-Taking After Substantial Gains

A portion of digital asset products’ outflows can be attributed to simple profit-taking after the remarkable rally that characterised early to mid-2024. Bitcoin prices increased by over 60% during the first seven months of the year, while Ethereum gained approximately 45%. Sophisticated investors who entered digital asset products at lower price points may be systematically harvesting gains, particularly if they view current prices as unsustainably elevated relative to fundamental adoption metrics.

Tax considerations also influence redemption timing. As the year progresses, portfolio managers evaluate tax-loss harvesting opportunities and gain realisation strategies. Some digital asset products’ outflows may reflect tax-efficient portfolio management rather than fundamental bearishness on cryptocurrencies, though disentangling these motivations from price data alone proves challenging.

Impact on Bitcoin and Major Cryptocurrency Prices

The relationship between digital asset products’ outflows and cryptocurrency spot prices creates a feedback loop that can amplify market movements in both directions. When billions of dollars exit investment products, the mechanisms through which these funds maintain their exposure to underlying cryptocurrencies necessitate selling pressure on spot markets.

How ETF Redemptions Affect Spot Markets

Spot Bitcoin ETFs, which comprise a significant portion of digital asset products, maintain their price tracking accuracy through an authorised participant mechanism. When investors redeem ETF shares, authorised participants return these shares to the issuer in exchange for the underlying Bitcoin holdings. This Bitcoin then typically enters the market as selling pressure, either immediately or gradually, depending on the authorised participant’s strategy and market conditions.

The $2 billion in digital asset products outflows doesn’t translate to $2 billion in direct spot market selling—the relationship is more nuanced. However, sustained outflows create persistent downward pressure as product issuers reduce their cryptocurrency holdings proportionally. During the three weeks of heavy outflows, Bitcoin prices declined approximately 18%, while Ethereum fell roughly 22%, demonstrating the tangible price impact of sustained digital asset product redemptions.

Ethereum Faces Disproportionate Pressure

Ethereum-focused digital asset products have experienced particularly acute outflows relative to their market size. While Bitcoin products are larger in absolute terms, Ethereum vehicles have seen redemptions exceeding 8% of their total assets under management during the three weeks, compared to approximately 5% for Bitcoin products. This discrepancy reflects several Ethereum-specific concerns, including questions about the blockchain’s roadmap, competition from alternative Layer-1 networks, and uncertainty regarding Ethereum’s value proposition in a world of multiple competing smart contract platforms.

The disproportionate digital asset product outflows from Ethereum funds have contributed to Ethereum’s underperformance relative to Bitcoin during this period. The ETH/BTC ratio declined by approximately 5% during the three-week rout, indicating that investors are not uniformly reducing crypto exposure but are making asset-specific decisions that currently disfavour Ethereum.

Regional Variations in Digital Asset Products Outflows

The geography of digital asset product outflows reveals important patterns about regional investor sentiment and the global nature of cryptocurrency markets. Not all markets are experiencing outflows equally, and understanding these regional differences provides nuanced insight into the drivers of the current selloff.

North American Market Dominance in Outflows

North American digital asset products, primarily U.S.-listed Bitcoin and Ethereum ETFs, account for approximately 75% of total outflows during the three weeks. The United States alone contributed roughly $2.4 billion of the $3.2 billion total exodus. This concentration reflects both the dominance of U.S. markets in cryptocurrency investment products and potentially heightened sensitivity to U.S.-specific regulatory and macroeconomic factors.

Canadian cryptocurrency ETFs, which preceded U.S. spot Bitcoin ETFs by several years, have also experienced sustained digital asset products outflows, though on a smaller absolute scale. The Canadian market’s experience provides a longer-term perspective, showing that cryptocurrency investment products can experience extended periods of outflows followed by renewed interest when market conditions improve.

European and Asian Market Resilience

Interestingly, European digital asset products have demonstrated relative resilience during this period, with net outflows of only $400 million across the three weeks—significantly better than their proportional share of global crypto investment assets would suggest. This resilience may reflect different investor composition, with European products attracting a higher percentage of long-term strategic allocators versus tactical traders.

Asian digital asset products outflows have been minimal, totalling less than $200 million during the period. However, this figure should be interpreted cautiously, as the Asian market for regulated cryptocurrency investment products remains relatively underdeveloped compared to North American and European alternatives. Much cryptocurrency investment in Asian markets occurs through direct holdings or unregulated vehicles that don’t appear in institutional flow data.

Institutional vs. Retail Investor Behaviour

The composition of investors exiting digital asset products provides crucial context for interpreting the significance of current outflows and predicting potential market trajectories. Institutional and retail investors often exhibit different behaviour patterns, time horizons, and sensitivity to various market factors.

Institutional Caution Drives Primary Outflows

Analysis of redemption patterns suggests that institutional investors—including hedge funds, family offices, and registered investment advisors—are driving the bulk of digital asset products outflows. These sophisticated investors typically operate with formal risk management frameworks, compliance requirements, and fiduciary responsibilities that mandate action when volatility exceeds predetermined thresholds or when asset correlations shift unfavourably.

Institutional digital asset product redemptions often reflect portfolio rebalancing rather than panic selling. As cryptocurrency prices decline and allocations fall below target percentages, some institutions might actually be buyers. However, when prices rise rapidly and crypto allocations exceed policy maximums, institutions must reduce exposure regardless of their long-term outlook. The recent price volatility has triggered these mechanical rebalancing requirements across numerous institutional portfolios simultaneously, contributing to concentrated outflow periods.

Retail Investor Resilience and Divergent Behaviour

Retail investors accessing digital asset products through brokerage accounts and retirement plans have demonstrated somewhat different behaviour. While retail participation in outflows is certainly present, the data suggests retail investors are less likely to redeem during short-term volatility compared to institutional counterparts. This pattern mirrors historical behaviour across asset classes, where retail investors often exhibit greater inertia—for better or worse—in their investment decisions.

The retail segment of digital asset products investors may be benefiting from behavioural inertia in this instance, avoiding the crystallisation of losses that redemption would entail. However, if the downturn extends significantly or accelerates, retail panic selling could materialise, potentially adding another wave to digital asset products outflows and intensifying downward price pressure on underlying cryptocurrencies.

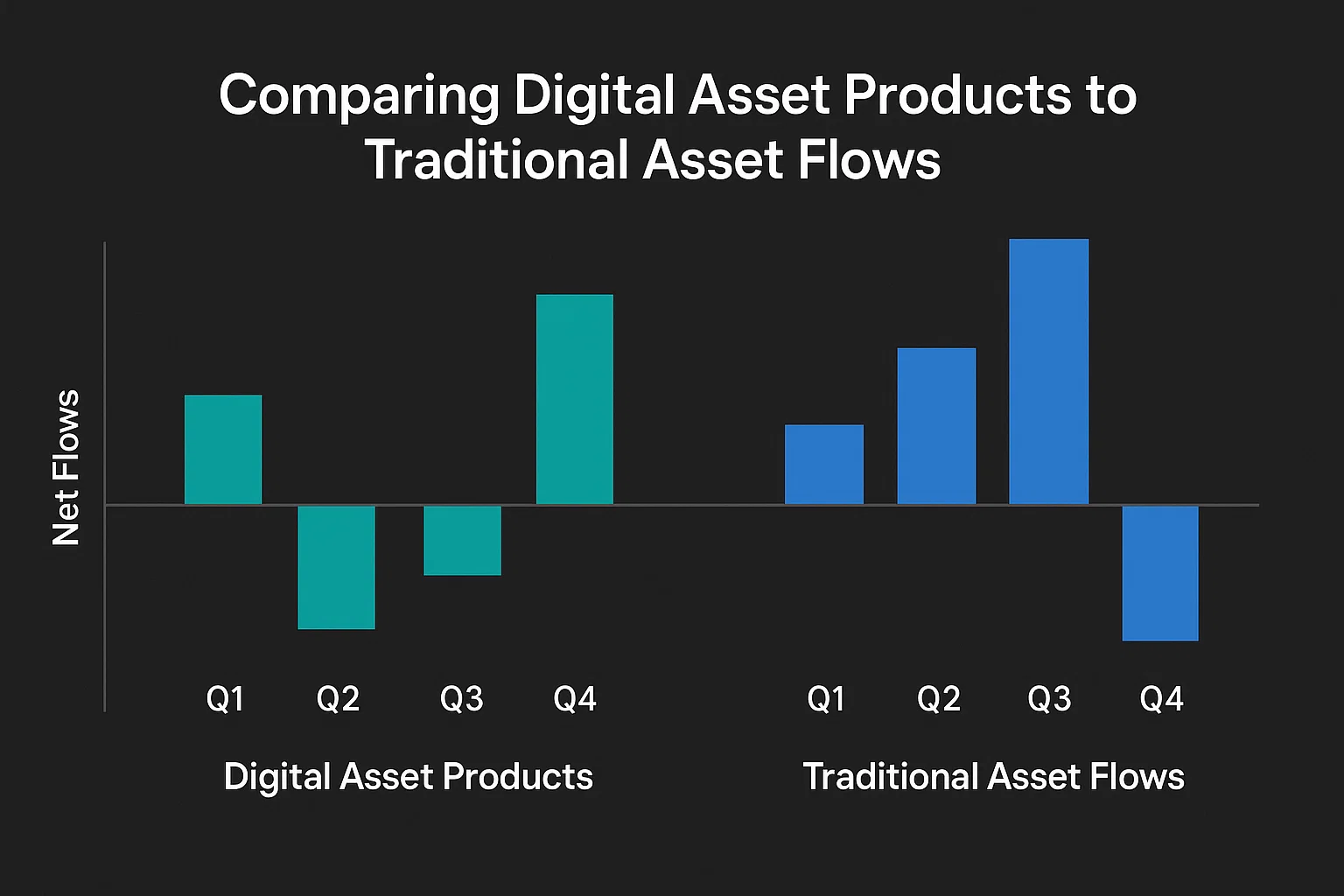

Comparing Digital Asset Products to Traditional Asset Flows

Contextualising digital asset products’ outflows within the broader investment landscape helps determine whether cryptocurrency is experiencing unique distress or participating in a more general risk-asset selloff. Examining flows across various asset classes illuminates the specific versus systemic nature of crypto’s current challenges.

Equity ETF Flows Provide Context

During the same three-week period that saw $3.2 billion exit digital asset products, U.S. equity ETFs experienced net inflows of approximately $12 billion, with the majority flowing into large-cap and value-oriented funds. Technology-focused equity ETFs, which share some investor overlap with cryptocurrency products, saw modest inflows of $800 million. This divergence suggests that the digital asset products outflows reflect crypto-specific concerns rather than broad risk-off positioning across all asset classes.

However, small-cap and growth equity ETFs did experience outflows totalling approximately $4 billion during this period, indicating that investors are indeed reducing exposure to higher-risk, higher-volatility segments of equity markets. The digital asset products outflows thus occur within a broader context of risk reduction focused on speculative growth assets rather than wholesale abandonment of invested positions.

Fixed Income Sees Record Inflows

The contrast between digital asset products outflows and fixed-income flows is particularly stark. U.S. bond ETFs attracted approximately $28 billion during the three weeks, with the majority flowing into intermediate-term treasury and investment-grade corporate bond funds. This pattern clearly indicates a shift in investor preference toward safer, income-generating assets and away from speculative growth vehicles.

The magnitude of bond inflows relative to digital asset products outflows suggests that much of the capital exiting cryptocurrency investments is seeking refuge in traditional safe-haven assets rather than rotating within risk assets. This dynamic poses challenges for cryptocurrency bulls who argue that digital assets serve as portfolio diversifiers, as current behaviour shows investors treating crypto as a risk asset to be reduced when seeking safety rather than an alternative store of value.

Expert Perspectives on Digital Asset Products Outflows

Industry analysts, portfolio managers, and cryptocurrency thought leaders have offered varied interpretations of the digital asset products outflows phenomenon, reflecting the complexity of cryptocurrency markets and the diversity of perspectives within the investment community.

Bearish Interpretations and Warning Signs

Some analysts view the sustained digital asset products outflows as evidence that institutional adoption of cryptocurrency has reached a temporary ceiling. They argue that the initial wave of institutional interest, catalysed by spot ETF approvals and cryptocurrency’s perceived maturation, has now been fully absorbed by the market. According to this perspective, further significant institutional adoption requires either substantially lower prices that offer compelling value or fundamental developments in cryptocurrency utility and regulation that expand the addressable institutional market.

Critics of cryptocurrency investment have seized upon the digital asset products’ outflows as validation of their scepticism about digital assets’ institutional staying power. They contend that cryptocurrencies lack the fundamental characteristics necessary for permanent institutional portfolio inclusion and that current outflows represent the beginning of a longer-term deallocation trend as institutions recognise the limitations of digital assets as investment vehicles.

Bullish Counterarguments and Historical Parallels

Cryptocurrency advocates offer more optimistic interpretations of digital asset products outflows, viewing them as a healthy consolidation following the tremendous inflows of early 2024. They draw parallels to previous cryptocurrency cycles, noting that periods of heavy outflows have historically created attractive entry points for long-term investors. According to this view, the digital asset products that remain after the current shakeout will be held by stronger hands with longer time horizons, creating a more stable foundation for the next upward price movement.

Some analysts argue that the digital asset products outflows actually represent a maturation of cryptocurrency markets rather than a fundamental rejection. As these products become more established, they naturally experience the full cycle of investor sentiment that characterises all asset classes, including periods of redemptions and negative sentiment. The ability to experience major outflows without systemic collapse demonstrates the growing resilience and infrastructure development within cryptocurrency markets.

Potential Catalysts for Reversing Digital Asset Products Outflows

While current data paints a challenging picture for digital asset products, various developments could potentially reverse the outflow trend and restore investor confidence in cryptocurrency investment vehicles. Understanding these potential catalysts helps investors and market participants anticipate possible turning points.

Regulatory Clarity as a Game-Changer

Perhaps the most significant potential catalyst for reversing digital asset products outflows would be comprehensive regulatory clarity from major jurisdictions, particularly the United States. Clear regulatory frameworks that define cryptocurrency classifications, establish custody requirements, and provide legal certainty for investment products would likely reassure institutional investors currently sitting on the sidelines or reducing exposure.

Legislative developments such as comprehensive stablecoin regulation or formal recognition of cryptocurrency as a distinct asset class could substantially improve the operating environment for digital asset products. When institutions can confidently navigate regulatory requirements without fear of sudden enforcement actions or legal reinterpretation, capital allocation to cryptocurrency investments becomes more straightforward and defensible to fiduciary committees and compliance departments.

Macroeconomic Shifts and Inflation Concerns

Changes in the macroeconomic environment could reverse digital asset products’ outflows if conditions align with cryptocurrency’s value propositions. Renewed inflation concerns, currency devaluation fears, or financial system instability have historically driven interest in Bitcoin as digital gold and cryptocurrencies as alternative financial infrastructure. Should macroeconomic conditions shift in these directions, digital asset products could experience renewed inflows from investors seeking portfolio protection.

Additionally, changes in monetary policy—particularly if central banks pivot toward more accommodative stances or interest rates decline significantly—could improve the relative attractiveness of non-yielding assets like cryptocurrencies. The reduction in competition from high-yielding safe assets would make the risk-reward profile of digital asset products more appealing to yield-seeking investors.

Technological Developments and Real-World Adoption

Meaningful advances in blockchain technology, cryptocurrency usability, or real-world adoption could provide fundamental support for reversing digital asset products’ outflows. Developments such as the successful implementation of Bitcoin’s Lightning Network at scale, breakthrough applications of Ethereum’s smart contract capabilities, or the adoption of blockchain technology by major corporations or governments would validate cryptocurrency’s utility beyond speculative trading.

The integration of digital asset products into traditional financial infrastructure—such as inclusion in target-date retirement funds, model portfolios from major wealth management firms, or adoption by sovereign wealth funds—would represent a structural shift in cryptocurrency’s role within institutional portfolios. Such developments would likely trigger sustained inflows that dwarf current outflow figures.

Investment Strategies During Digital Asset Products Outflows

For investors navigating the current period of digital asset products outflows, various strategic approaches merit consideration depending on individual circumstances, risk tolerance, and investment objectives. The optimal strategy varies significantly based on whether one is currently invested in cryptocurrency, considering initial investment, or managing an existing allocation.

Dollar-Cost Averaging for Long-Term Believers

Investors with conviction in cryptocurrency’s long-term potential might view digital asset products’ outflows and associated price declines as accumulation opportunities. Dollar-cost averaging—investing fixed amounts at regular intervals regardless of price—can be an effective strategy during periods of volatility and negative sentiment. This approach removes the pressure of attempting to time the market bottom while building positions at generally depressed prices.

When implementing dollar-cost averaging into digital asset products during outflow periods, investors should ensure their investment horizon extends well beyond the current volatility. Historical cryptocurrency cycles suggest that major drawdowns can extend for 12-18 months before sustainable recoveries begin, requiring patience and discipline to maintain systematic investment through extended downturns.

Portfolio Rebalancing Considerations

For investors who maintain target allocations to digital asset products as part of diversified portfolios, current outflows and price declines create rebalancing decisions. If cryptocurrency has fallen below target allocation percentages due to price declines, mechanical rebalancing would suggest adding to positions. However, investors should carefully consider whether the factors driving digital asset products’ outflows fundamentally change their assessment of appropriate cryptocurrency allocation.

Rebalancing into digital asset products during outflow periods can be psychologically challenging, as it requires purchasing assets experiencing negative momentum and investor sentiment. However, this contrarian approach has historically generated returns when the selling pressure eventually exhausts itself and prices recover. The key question for rebalancing decisions is whether current outflows represent temporary sentiment shifts or permanent changes in the cryptocurrency’s institutional investment case.

Risk Management and Capital Preservation

Conservative investors or those with shorter time horizons might reasonably conclude that the digital asset products’ outflows signal deteriorating risk-reward profiles that justify reduced or eliminated cryptocurrency exposure. When substantial capital has already been withdrawn by institutional investors and price momentum remains negative, the probability of further downside may exceed near-term recovery prospects.

Implementing stop-loss levels or position size limits for digital asset products can protect capital during extended downturns while maintaining some exposure for potential rebounds. Alternatively, rotating from cryptocurrency exposure into more stable assets until outflow trends reverse and technical indicators improve could preserve capital for redeployment when risk-reward dynamics become more favourable.

The Future Outlook for Digital Asset Products

Looking beyond the current period of digital asset products outflows, the longer-term trajectory of cryptocurrency investment vehicles depends on numerous evolving factors. While near-term challenges are evident, the infrastructure, regulatory progress, and institutional awareness developed over recent years provide foundations that didn’t exist in previous cryptocurrency market cycles.

Structural Growth Drivers Remain Intact

Despite significant digital asset products outflows, several structural growth drivers for cryptocurrency investment vehicles remain intact. The approval of spot Bitcoin ETFs represented a watershed moment in cryptocurrency’s institutional legitimisation, and this development cannot be undone by temporary outflows. The infrastructure now exists for mainstream investors to access cryptocurrency exposure through familiar, regulated investment products—a capability that will persist regardless of current sentiment.

Additionally, the demographic shift toward younger investors who are generally more comfortable with digital assets suggests long-term tailwinds for digital asset products. As wealth transfer occurs from older to younger generations over the coming decades, the investor base naturally shifts toward demographics that view cryptocurrency as a legitimate portfolio component rather than a speculative novelty.

Lessons Learned and Market Maturation

The current digital asset product outflows provide valuable lessons for both product issuers and investors. Product providers are learning which structures, fee levels, and communication strategies effectively serve institutional investors during various market conditions. This knowledge will inform the next generation of digital asset products, potentially including options with downside protection, diversified exposures, or active management strategies that may appeal to more risk-averse institutional investors.

The experience of navigating significant digital asset product outflows without market collapse or systemic failures demonstrates the increasing maturity and resilience of cryptocurrency investment infrastructure. Unlike earlier cryptocurrency market downturns that featured exchange failures, custody disasters, or liquidity crises, current outflows are occurring within functioning, regulated products that continue operating normally despite significant redemptions. This resilience builds confidence in the long-term viability of cryptocurrency investment vehicles.

Conclusion

The $2 billion in digital asset products outflows during a single week, culminating a three-week period that drained $3.2 billion from cryptocurrency investment vehicles, represents a significant moment in the evolution of digital asset investing. This capital exodus reflects a complex interplay of macroeconomic pressures, regulatory uncertainties, profit-taking after substantial gains, and shifting risk sentiment among institutional investors. While the short-term outlook remains clouded by persistent selling pressure and negative momentum, the fundamental infrastructure and institutional pathways for cryptocurrency investment have been permanently established through products like spot Bitcoin ETFs and regulated crypto funds.

Investors navigating the current digital asset products outflows must carefully assess their individual circumstances, risk tolerance, and investment horizons. Those with long-term conviction and appropriate risk capacity might view current conditions as accumulation opportunities, while more conservative investors may reasonably choose to reduce exposure until clearer positive catalysts emerge. Regardless of individual positioning, understanding the drivers behind digital asset products and monitoring potential inflection points will be essential for making informed decisions in this rapidly evolving market.

Read More: AI-Powered Crypto Scams Protection Guide 2025