Strategy scoops up Bitcoin in what has become a relentless accumulation campaign. In its latest acquisition, the company added 397 Bitcoin to its treasury, signalling unwavering confidence in the digital asset’s long-term value proposition. This purchase represents more than just another transaction—it’s a statement about corporate Bitcoin adoption and the evolving relationship between traditional finance and digital currencies. As institutional investors continue to recognise Bitcoin’s potential as a store of value and inflation hedge, Strategy scoops up Bitcoin repeatedly, establishing itself as one of the most aggressive corporate accumulators in the space. This buying behaviour has captured the attention of investors, analysts, and crypto enthusiasts worldwide, raising important questions about corporate treasury management and the future of Bitcoin as a reserve asset.

Strategy’s Bitcoin Accumulation Approach

The Corporate Bitcoin Investment Thesis

When Strategy scoops up Bitcoin, it’s executing a carefully calculated treasury strategy that reflects broader macroeconomic concerns. The company has positioned Bitcoin as a superior alternative to holding cash, arguing that traditional fiat currencies face long-term depreciation through monetary inflation. This perspective has transformed how corporations view their balance sheets, moving away from cash-heavy positions toward harder assets.

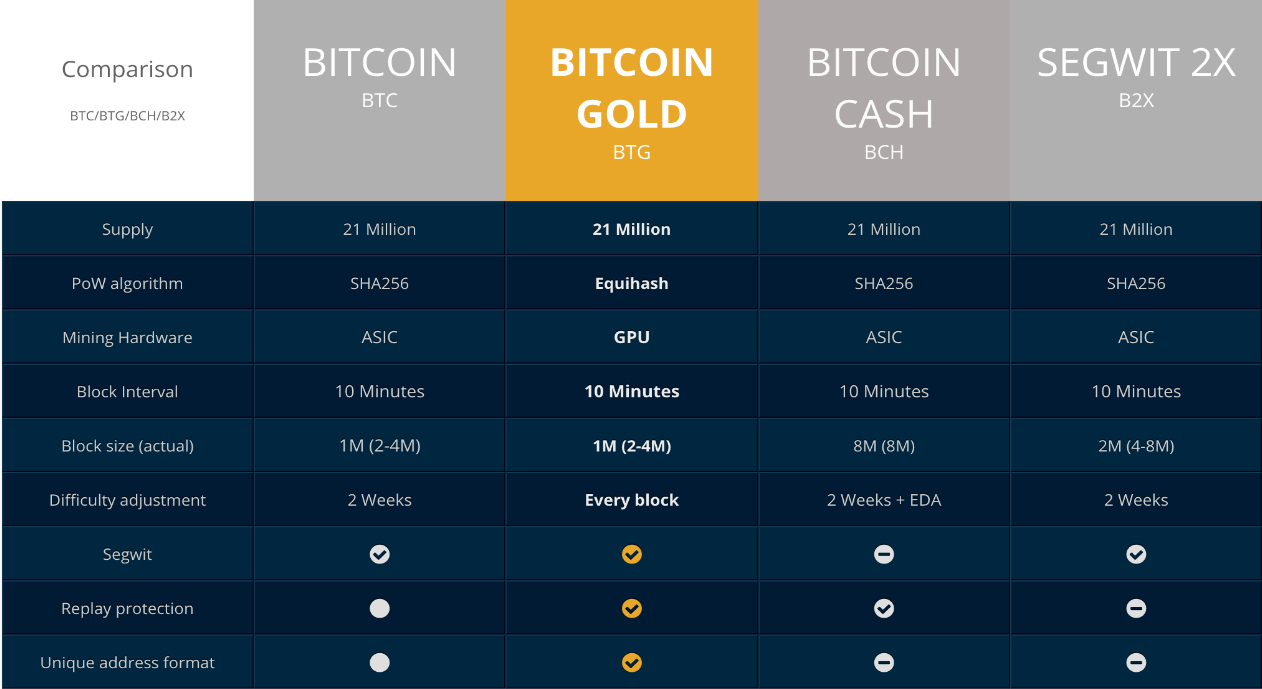

The rationale behind this approach centres on several key principles. First, Bitcoin’s fixed supply of 21 million coins creates inherent scarcity that fiat currencies lack. Second, the decentralised nature of Bitcoin removes counterparty risk associated with traditional financial institutions. Third, Bitcoin’s global liquidity and 24/7 market accessibility provide treasury management flexibility that traditional assets cannot match.

Breaking Down the 397 Bitcoin Purchase

The latest acquisition, where Strategy scoops up Bitcoin—specifically 397 BTC—demonstrates consistent execution of the company’s long-term accumulation plan. At current market valuations, this purchase represents a multi-million dollar investment that further strengthens the company’s position as a Bitcoin treasury holder.

This purchase pattern reveals disciplined buying behaviour rather than emotional market timing. By making regular acquisitions regardless of short-term price movements, the company employs a dollar-cost averaging strategy that mitigates volatility risk while building substantial holdings over time.

The Historical Context of Strategy’s Bitcoin Holdings

From Initial Purchase to Massive Accumulation

The journey that led to Strategy scoops up Bitcoin, becoming a regular headline, began with a revolutionary decision to allocate treasury reserves to cryptocurrency. What started as a controversial move has evolved into a comprehensive Bitcoin acquisition strategy that has fundamentally altered the company’s balance sheet composition.

Early purchases faced scepticism from traditional investors who questioned the wisdom of holding volatile digital assets on corporate balance sheets. However, as Bitcoin demonstrated resilience through multiple market cycles, the strategy gained credibility and inspired other companies to consider similar approaches.

The Cumulative Impact on Holdings

Each time Strategy scoops up Bitcoin, the cumulative effect strengthens the company’s position as one of the largest corporate Bitcoin holders globally. The aggregated holdings now represent a significant portion of the company’s total assets, creating a direct correlation between the company’s financial performance and Bitcoin’s market price.

This concentration creates both opportunities and risks. On one hand, successful Bitcoin appreciation could dramatically enhance shareholder value. On the other hand, significant downturns in Bitcoin’s price would impact the company’s balance sheet, potentially affecting stock performance and investor sentiment.

Market Implications When Strategy Scoops Up Bitcoin

Institutional Validation and Market Sentiment

Every announcement where Strategy scoops up Bitcoin serves as a powerful signal to both institutional and retail investors. These purchases validate Bitcoin’s legitimacy as a treasury asset and demonstrate that sophisticated financial entities are willing to commit substantial capital to cryptocurrency exposure.

The psychological impact on markets extends beyond immediate price movements. When a publicly traded company consistently allocates resources to Bitcoin, it normalises cryptocurrency investment for conservative investors who previously viewed digital assets with suspicion. This normalisation effect contributes to broader mainstream adoption and acceptance.

Supply Dynamics and Price Pressure

When Strategy scoops up Bitcoin in quantities like 397 BTC, it removes supply from circulating markets. Given Bitcoin’s fixed supply schedule, consistent institutional buying creates upward price pressure, particularly when combined with other large-scale accumulation efforts from corporations, nation-states, and high-net-worth individuals.

The supply dynamics become especially pronounced around Bitcoin halving events, when new supply issuance decreases by 50%. Institutional purchases during these periods can amplify scarcity effects, potentially driving significant price appreciation as demand meets constrained supply.

The Financial Mechanics Behind Bitcoin Purchases

Funding Strategies for Large-Scale Acquisitions

Understanding how Strategy scoops up Bitcoin requires examining the financial engineering behind these purchases. The company has employed various funding mechanisms, including equity offerings, convertible debt instruments, and capital raised specifically for Bitcoin acquisition purposes.

These funding strategies often involve sophisticated financial instruments that allow the company to raise capital at favourable terms while maintaining operational flexibility. Convertible notes, for example, provide investors with potential upside through conversion to equity while giving the company immediate capital for Bitcoin purchases.

Balance Sheet Considerations

Each time Strategy scoops up Bitcoin, accounting treatment becomes a critical consideration. Under current accounting standards, companies must treat Bitcoin as an intangible asset subject to impairment testing. This means that while companies must recognise decreases in Bitcoin’s value, they cannot record increases until assets are sold.

This asymmetric accounting treatment creates challenges for companies holding significant Bitcoin positions, as temporary market downturns can force balance sheet write-downs that don’t reflect the asset’s recoverable value. Many corporate treasurers advocate for accounting standard updates that would better reflect Bitcoin’s liquid nature and market value.

Strategic Advantages of Corporate Bitcoin Holdings

Inflation Protection and Store of Value

The core reason Strategy scoops up Bitcoin relates to protecting purchasing power against monetary inflation. With central banks globally maintaining expansionary monetary policies, traditional cash holdings face a steady erosion of real value. Bitcoin’s programmatic scarcity offers an alternative that theoretically preserves value over long time horizons.

This inflation hedge thesis has gained traction as inflation rates in major economies have exceeded central bank targets. Companies holding significant cash reserves face a choice: accept gradual devaluation or seek alternative stores of value that maintain purchasing power.

Portfolio Diversification Benefits

When Strategy scoops up Bitcoin, it diversifies away from traditional asset correlations. Bitcoin has historically demonstrated low correlation with traditional equity and bond markets, providing portfolio diversification benefits that can reduce overall risk-adjusted volatility.

This diversification advantage has attracted institutional investors seeking to optimise portfolio construction. By including uncorrelated assets like Bitcoin, treasurers can potentially enhance returns while managing downside risk through broader asset allocation.

Challenges and Criticisms of the Strategy

Volatility Concerns and Risk Management

Despite the strategic rationale, critics question whether Strategy scoops up Bitcoin prudently, given cryptocurrency’s notorious price volatility. Bitcoin has experienced multiple 50%+ drawdowns throughout its history, raising concerns about exposing shareholder capital to such dramatic fluctuations.

Risk management in this context requires careful position sizing, clear communication with stakeholders, and robust governance frameworks that ensure Bitcoin holdings align with overall corporate strategy. Companies must balance potential upside with fiduciary responsibilities to shareholders, employees, and other stakeholders.

Regulatory Uncertainty

As Strategy scoops up Bitcoin, regulatory considerations loom large. Cryptocurrency regulation remains in flux globally, with different jurisdictions taking varying approaches to digital asset oversight. Future regulatory changes could impact the viability of corporate Bitcoin holdings, potentially requiring adjustments to strategy or even forced liquidation under adverse scenarios.

The regulatory landscape includes questions about securities classification, tax treatment, reporting requirements, and custodial standards. Companies holding significant Bitcoin must navigate this uncertainty while maintaining compliance across multiple jurisdictions.

Comparison with Other Corporate Bitcoin Adopters

The Growing Trend of Corporate Accumulation

Strategy scoops up Bitcoin as part of a broader trend that includes various corporations, mining companies, and financial service providers. Each entity brings different motivations and strategies to Bitcoin accumulation, creating a diverse ecosystem of institutional holders.

Some companies view Bitcoin primarily as a treasury asset, while others integrate cryptocurrency into their core business models. Mining companies naturally accumulate Bitcoin through operations, while financial institutions may hold Bitcoin to facilitate customer services or trading operations.

Differentiation in Approach and Scale

What distinguishes situations where Strategy scoops up Bitcoin from other corporate adopters is the scale, consistency, and public commitment to the strategy. While some companies make opportunistic Bitcoin purchases, this approach represents systematic accumulation as a core element of corporate strategy.

The transparent communication about purchases, holdings, and strategic rationale has made Strategy a case study in corporate Bitcoin adoption. This visibility provides valuable data for researchers, investors, and other companies considering similar strategies.

Future Outlook for Corporate Bitcoin Investment

Potential Continuation of the Buying Spree

Given established patterns, observers expect Strategy scoops up Bitcoin to remain a recurring headline. The company has articulated a long-term vision where Bitcoin holdings grow substantially, potentially reaching levels that make it one of the world’s largest non-government Bitcoin holders.

Future purchases will likely depend on several factors, including Bitcoin market conditions, capital availability, shareholder sentiment, and macroeconomic developments. The company has demonstrated willingness to raise capital specifically for Bitcoin acquisition, suggesting purchases will continue as long as the strategic thesis remains intact.

Broader Implications for Corporate Treasury Management

As Strategy scoops up Bitcoin and demonstrates the viability of cryptocurrency treasury holdings, other corporations face increasing pressure to articulate their own positions on digital assets. This could lead to accelerated adoption as companies seek to avoid being left behind in what some view as a paradigm shift in corporate treasury management.

The evolution of accounting standards, regulatory frameworks, and market infrastructure will facilitate or constrain this adoption curve. Improvements in any of these areas could trigger broader corporate movement toward Bitcoin allocation.

Technical Considerations for Large-Scale Bitcoin Custody

Security and Custodial Solutions

When Strategy scoops up Bitcoin in significant quantities, secure custody becomes paramount. The company must implement institutional-grade security protocols, including multi-signature wallets, cold storage solutions, geographic distribution of keys, and comprehensive insurance coverage.

Custodial arrangements typically involve specialised cryptocurrency custody providers with proven track records and regulatory compliance. These providers offer security features, including segregated storage, redundant backups, and institutional controls that meet fiduciary standards for managing shareholder assets.

Transaction Execution and Market Impact

Executing purchases when Strategy scoops up Bitcoin requires sophisticated trading strategies to minimise market impact and achieve favourable pricing. Large orders can move markets if executed poorly, resulting in unfavourable execution prices that reduce the efficiency of capital deployment.

Professional execution typically involves working with multiple liquidity providers, using algorithmic trading strategies, and timing purchases to coincide with periods of high market liquidity. These techniques help companies accumulate substantial positions without significantly disrupting market prices.

The Role of Bitcoin in Modern Portfolio Theory

Risk-Return Characteristics

The decision that leads Strategy scoops up Bitcoin must be evaluated through the lens of modern portfolio theory, which examines how assets contribute to overall portfolio risk and return. Bitcoin’s historical returns have been extraordinary, but accompanied by volatility that exceeds traditional asset classes.

From a portfolio construction perspective, even small Bitcoin allocations can significantly impact expected returns due to the asset’s high historical appreciation. However, the accompanying volatility requires careful consideration of risk tolerance and investment time horizon.

Correlation Benefits in Portfolio Construction

Strategy scoops up Bitcoin partly because of low correlation with traditional assets. This characteristic provides diversification benefits that can improve risk-adjusted returns at the portfolio level, even if Bitcoin itself exhibits high standalone volatility.

The correlation structure between Bitcoin and traditional assets has evolved, occasionally increasing during market stress periods. Understanding these dynamics helps treasurers optimise allocation decisions and manage portfolio risk more effectively.

Key Metrics and Performance Indicators

Evaluating the Success of Bitcoin Holdings

To assess whether decisions where Strategy scoops up Bitcoin create shareholder value, several metrics deserve attention. These include the average cost basis of holdings, unrealised gains or losses, Bitcoin’s percentage of total assets, and how holdings perform relative to alternative treasury strategies.

Performance evaluation must consider both realised and unrealised returns, accounting treatment implications, and opportunity costs of capital allocation. The long-term nature of the strategy means short-term price movements may not reflect ultimate success or failure.

Transparency and Reporting Standards

Each time Strategy scoops up Bitcoin, transparent disclosure maintains investor confidence. Regular reporting on total holdings, average purchase price, and strategic rationale helps stakeholders understand the company’s position and evaluate management’s execution of stated strategy.

Best practices in cryptocurrency disclosure continue to evolve, with companies experimenting with different approaches to transparency. Real-time holdings disclosure, regular purchase announcements, and detailed quarterly reporting all serve to maintain accountability and investor trust.

Conclusion

The phenomenon where Strategy scoops up Bitcoin represents more than isolated corporate decisions—it signals a fundamental shift in how sophisticated entities view money, value storage, and treasury management. The recent 397 Bitcoin acquisition continues a pattern that has redefined corporate treasury strategy and inspired ongoing debate about the role of cryptocurrency in modern finance.

As Strategy scoops up Bitcoin repeatedly, it validates the thesis that digital scarcity and decentralised networks offer compelling alternatives to traditional monetary systems. Whether this strategy ultimately proves visionary or reckless will depend on Bitcoin’s long-term trajectory and the evolving regulatory and technological landscape.