Bitcoin slides, leaving investors in a state of heightened concern as the world’s leading cryptocurrency experiences significant price fluctuations. Over the past few weeks, Bitcoin’s value has decreased substantially, prompting both seasoned traders and newcomers to question their investment strategies. This downturn hasn’t just affected individual portfolios—it has sent ripples across the entire digital currency ecosystem, creating uncertainty about the future trajectory of crypto markets. As Bitcoin slides, leaving investors wondering about their next move, understanding the underlying factors driving this decline becomes crucial for anyone holding or considering cryptocurrency investments.

Why Bitcoin Is Sliding

Market Sentiment and Fear Psychology

When Bitcoin slides, leaving investors nervous, market psychology plays a critical role in accelerating the decline. Fear, uncertainty, and doubt—commonly referred to as FUD in crypto communities—can create self-fulfilling prophecies where negative sentiment drives selling pressure, which in turn validates the initial fears. The cryptocurrency market is particularly susceptible to emotional trading because it operates 24/7 without circuit breakers that traditional stock markets employ to halt panic selling.

Recent market analysis reveals that investor confidence has been shaken by multiple factors converging simultaneously. Regulatory pressures from various governments, macroeconomic concerns about global recession, and technical indicators suggesting further downside potential have all contributed to the bearish sentiment. When Bitcoin price drops, retail investors often panic-sell, while institutional investors may take advantage of the lower prices or hedge their positions, creating complex market dynamics.

Regulatory Pressures and Government Actions

Governments worldwide continue to grapple with how to regulate cryptocurrencies effectively. Recent announcements from major economies regarding stricter crypto regulations have significantly impacted market confidence. The United States Securities and Exchange Commission has intensified its scrutiny of cryptocurrency exchanges and token offerings, while countries like China have maintained their hardline stance against crypto trading and mining activities.

These regulatory developments create an environment of uncertainty that directly affects Bitcoin market volatility. Investors fear that overly restrictive regulations could limit cryptocurrency adoption, reduce liquidity, or even make certain crypto activities illegal in major markets. When news breaks about potential regulatory crackdowns, Bitcoin slides, leaving investors scrambling to reassess their risk exposure and portfolio allocations.

Macroeconomic Factors Influencing Crypto Markets

The broader economic landscape plays a substantial role in cryptocurrency valuations. Central banks around the world have been adjusting monetary policies in response to inflation concerns, with interest rate hikes becoming more frequent. Higher interest rates typically strengthen traditional currencies and make yield-bearing assets more attractive compared to non-yielding assets like Bitcoin.

Additionally, global economic uncertainty stemming from geopolitical tensions, supply chain disruptions, and banking sector instability has created a risk-off environment where investors prefer safer assets. Contrary to the narrative that Bitcoin serves as “digital gold” or a hedge against economic turmoil, recent price action suggests that during acute market stress, Bitcoin behaves more like a risk asset, declining alongside technology stocks and other speculative investments.

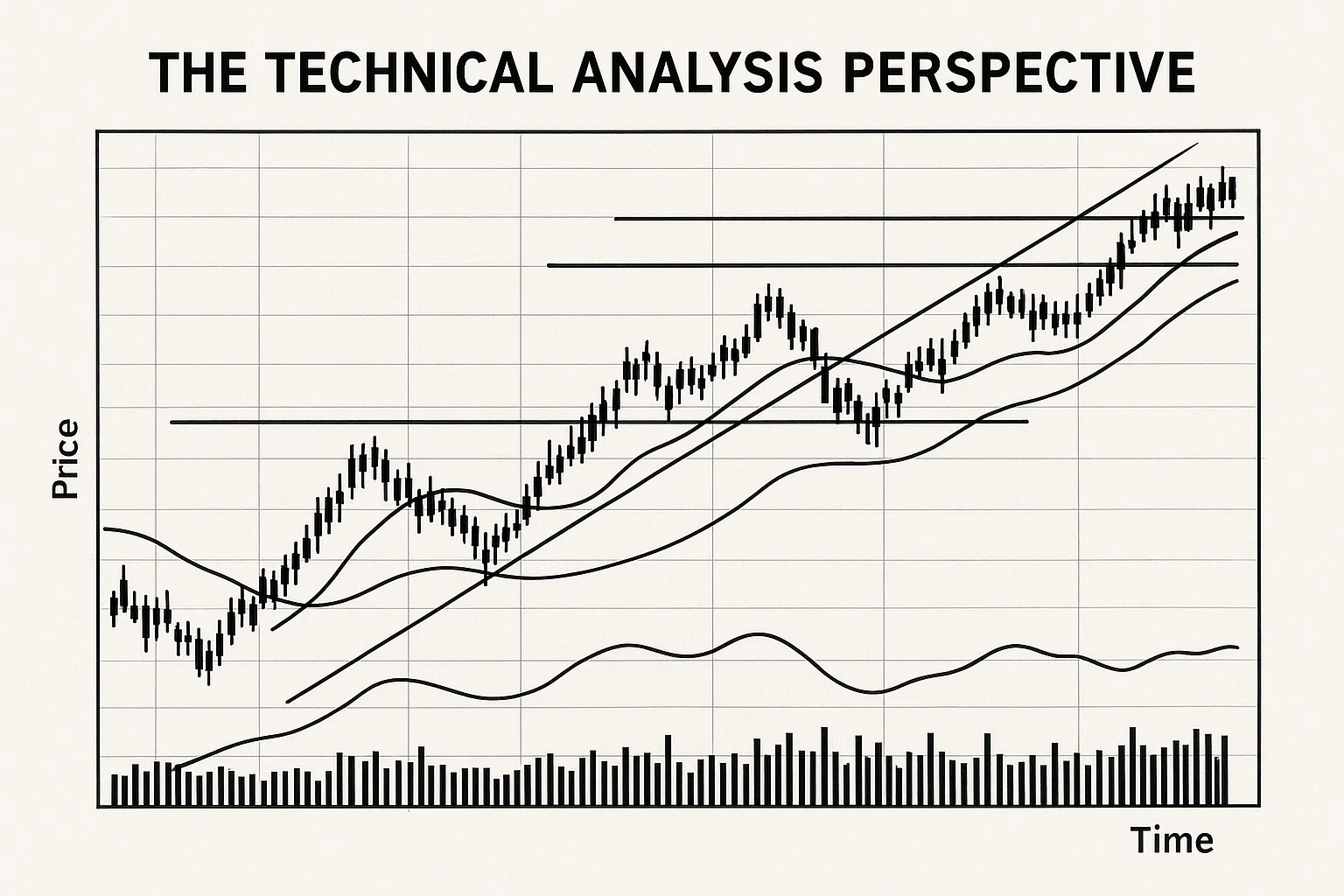

The Technical Analysis Perspective

Key Support and Resistance Levels

Technical analysts closely monitor specific price levels that historically have acted as support or resistance for Bitcoin. When Bitcoin slides, leaving investors uncertain about the bottom, these technical levels become psychological battlegrounds between bulls and bears. Recent price action has seen Bitcoin break through several key support levels that previously held during minor corrections.

The breakdown of these support levels often triggers automated trading algorithms and stop-loss orders, creating cascading sell-offs that accelerate the decline. Chart patterns such as head and shoulders formations, descending triangles, and death crosses—where short-term moving averages cross below long-term moving averages—have all appeared in recent Bitcoin price charts, signaling potential further downside to technical traders.

Trading Volume and Market Liquidity

Volume analysis provides crucial insights into the strength of price movements. When Bitcoin price declines on high volume, it indicates strong selling conviction and suggests the downtrend may continue. Conversely, low-volume declines might represent temporary weakness that could reverse quickly when buying interest returns.

Recent trading data shows that certain Bitcoin sell-offs occurred on exceptionally high volume, suggesting institutional involvement rather than just retail panic. Large holders, often called “whales” in crypto terminology, can significantly impact prices when they liquidate substantial positions. The transparency of blockchain technology allows analysts to track these large transactions, and when major wallet addresses begin moving Bitcoin to exchanges—typically a precursor to selling—it often precedes further price declines.

Impact on Different Types of Investors

Retail Investors Facing Portfolio Losses

For individual investors who entered the cryptocurrency market during the previous bull run, the current situation is particularly challenging. Many retail participants purchased Bitcoin at higher price points, and the subsequent decline has eroded their portfolio values significantly. The psychological impact of watching investments lose 30%, 40%, or even 50% of their value cannot be understated.

Retail investors often lack the sophisticated risk management tools available to institutional players. They may not have properly diversified their portfolios, set appropriate stop-losses, or maintained adequate cash reserves to weather downturns. When Bitcoin slides, leaving investors with mounting losses, emotional decision-making often replaces rational analysis, leading to poorly timed sales that lock in losses at the worst possible moment.

Institutional Investors and Corporate Treasuries

Large institutional investors approach the Bitcoin market volatility with different strategies and risk tolerances than retail participants. Many institutions have predetermined entry and exit strategies, sophisticated hedging mechanisms, and professional risk management teams. However, they’re not immune to the challenges presented by significant price declines.

Companies that added Bitcoin to their corporate treasuries—a trend popularized by firms like MicroStrategy and Tesla—face scrutiny from shareholders and boards of directors when these assets decline in value. These paper losses affect balance sheets and can influence stock prices, creating additional pressure on corporate decision-makers to justify their cryptocurrency allocations. Some institutions view current prices as buying opportunities, implementing dollar-cost averaging strategies to accumulate Bitcoin at lower levels, while others may reduce exposure to manage overall portfolio risk.

Miners Dealing with Profitability Challenges

Bitcoin miners face unique challenges when prices decline. Mining operations involve significant fixed costs, including electricity, equipment, and facility maintenance. When Bitcoin price drops, mining becomes less profitable, and smaller operations may be forced to shut down if revenues no longer cover operational expenses.

This dynamic creates a self-reinforcing cycle where declining prices reduce mining profitability, which may decrease overall network hash rate as unprofitable miners cease operations. However, Bitcoin’s difficulty adjustment mechanism eventually compensates for reduced mining activity, and historically, these periods of miner capitulation have often preceded price bottoms as the weakest players exit the market.

Historical Context: Previous Bitcoin Declines

Lessons from Past Bear Markets

Bitcoin slides, leaving investors concerned, isn’t a new phenomenon—the cryptocurrency has experienced multiple severe bear markets throughout its history. In 2018, Bitcoin declined approximately 83% from its peak, falling from nearly $20,000 to around $3,200. Similarly, in 2013-2014, Bitcoin experienced an 87% drawdown after reaching highs near $1,100.

Each previous bear market shared common characteristics: excessive speculation during the bull run, leverage-driven price increases, regulatory uncertainties, and eventual capitulation selling. However, each cycle also saw Bitcoin eventually recover and reach new all-time highs, demonstrating the cryptocurrency’s resilience and growing adoption over time.

Understanding these historical patterns provides perspective for current investors. While past performance doesn’t guarantee future results, recognizing that significant volatility is inherent to Bitcoin’s nature helps investors maintain realistic expectations and avoid panic-driven decisions.

Recovery Patterns and Timeframes

Historical analysis reveals that Bitcoin recoveries typically unfold over extended periods. After major declines, Bitcoin often enters accumulation phases where prices consolidate within a range as weak hands exit and strong hands accumulate. These periods can last months or even years before the next bull market emerges.

The recovery process usually begins when negative sentiment reaches extreme levels, measured by indicators like the Fear & Greed Index showing maximum fear. At these points, sellers become exhausted, and prices stabilize. Gradually, positive developments such as technological improvements, increased adoption, or favorable regulatory changes rebuild confidence, attracting new investment and eventually driving prices higher.

Strategies for Navigating Market Volatility

Risk Management Fundamentals

When Bitcoin slides, leaving investors with losses, proper risk management becomes the difference between surviving and thriving in cryptocurrency markets. The fundamental principle is never investing more than you can afford to lose. This applies especially to highly volatile assets like cryptocurrencies, where substantial price swings are normal rather than exceptional.

Diversification represents another crucial risk management tool. Rather than concentrating all capital in Bitcoin, investors should maintain exposure to various asset classes, including traditional stocks, bonds, real estate, and potentially other cryptocurrencies. This approach ensures that a single asset’s poor performance doesn’t devastate the entire portfolio.

Position sizing also matters significantly. Professional traders typically risk only 1-2% of their portfolio on any single trade or investment. While this may seem conservative, it allows investors to weather multiple losing positions without depleting their capital, preserving resources for eventual market recoveries.

Dollar-Cost Averaging During Downturns

Dollar-cost averaging (DCA) involves investing fixed amounts at regular intervals regardless of price. This strategy can be particularly effective during periods of Bitcoin market volatility because it removes emotional decision-making from the investment process. Instead of trying to time the perfect entry point—a notoriously difficult task—investors systematically accumulate Bitcoin over time.

When implemented during declining markets, DCA allows investors to purchase more Bitcoin as prices fall, lowering their average cost basis. If markets eventually recover, these lower entry points generate higher returns. The psychological benefit is equally important: DCA provides a structured approach that prevents paralysis during market uncertainty and reduces the sting of watching prices decline after making a large lump-sum investment.

Long-Term Perspective vs. Short-Term Trading

Investors must clearly define their investment horizon and strategy. Long-term holders, often called “HODLers” in crypto culture, believe in Bitcoin’s fundamental value proposition and view price declines as temporary noise. These investors focus on Bitcoin’s scarcity (21 million total supply), growing adoption, technological improvements, and potential as an alternative to traditional financial systems.

Conversely, short-term traders attempt to profit from price volatility through active buying and selling. This approach requires substantial time, expertise, and emotional discipline. Most retail investors lack the skills, tools, and time commitment necessary for successful short-term trading, often generating worse results than simply holding long-term.

When Bitcoin slides, leaving investors questioning their strategy, revisiting the original investment thesis helps clarify the appropriate course of action. If fundamental beliefs about Bitcoin’s long-term potential remain intact, short-term price declines represent noise rather than signals to sell.

What Industry Experts Are Saying

Analyst Predictions and Market Forecasts

Cryptocurrency analysts offer varying perspectives on Bitcoin’s current situation and future trajectory. Some analysts point to technical indicators suggesting further downside potential, identifying specific price levels where additional support might emerge. Others emphasize macroeconomic factors, arguing that Bitcoin’s price remains closely correlated with traditional risk assets and will likely follow broader market trends.

Notably, long-term Bitcoin advocates maintain their bullish stance despite current weakness. They argue that Bitcoin’s fundamental properties—decentralization, limited supply, and censorship resistance—remain unchanged regardless of short-term price action. These experts often recommend viewing current prices as accumulation opportunities rather than reasons for panic.

However, more cautious voices warn about potential systemic risks in the cryptocurrency ecosystem, including exchange solvency concerns, regulatory crackdowns, and the possibility that Bitcoin may not fulfill its promised role as an inflation hedge or alternative monetary system.

Institutional Sentiment and Investment Flows

Monitoring institutional investment flows provides insights into sophisticated investors’ market views. Recent data shows mixed signals: some institutions continue accumulating Bitcoin through vehicles like spot ETFs, while others reduce exposure or implement hedging strategies to protect against further downside.

The launch of Bitcoin spot ETFs in major markets represented a significant milestone for cryptocurrency legitimization, providing traditional investors with regulated, easily accessible Bitcoin exposure. However, when Bitcoin price declines, ETF flows often turn negative as risk-averse investors exit these positions, creating additional selling pressure on the underlying asset.

The Broader Cryptocurrency Ecosystem Impact

Altcoins and Market Correlation

When Bitcoin slides, leaving investors concerned, alternative cryptocurrencies (altcoins) typically experience even more severe declines. Bitcoin dominance—the percentage of total cryptocurrency market capitalization represented by Bitcoin—often increases during market downturns as investors flee riskier altcoins for the relative safety of the most established cryptocurrency.

This correlation exists because Bitcoin serves as the primary trading pair for most altcoins and represents the gateway through which most capital enters the cryptocurrency market. Additionally, many altcoins lack Bitcoin’s network effects, security, and established track record, making them more vulnerable during risk-off periods.

Some altcoins with strong fundamentals and real-world utility may eventually outperform Bitcoin during recovery phases, but during initial declines, few cryptocurrencies successfully decouple from Bitcoin’s price action.

DeFi and NFT Market Implications

Decentralized finance (DeFi) protocols and non-fungible token (NFT) markets face unique challenges during Bitcoin market volatility. Many DeFi protocols use cryptocurrencies as collateral for loans and other financial activities. When collateral values decline rapidly, it can trigger cascading liquidations that exacerbate market downturns.

NFT markets, which experienced explosive growth during previous bull markets, typically see dramatic volume and price declines during crypto winters. The speculative nature of many NFT projects means they’re particularly sensitive to overall market sentiment and available liquidity. When cryptocurrency investors face portfolio losses, discretionary spending on digital collectibles usually decreases substantially.

Regulatory Developments and Future Outlook

Global Regulatory Landscape Evolution

Regulatory clarity remains one of the most significant factors influencing Bitcoin’s long-term trajectory. Different jurisdictions approach cryptocurrency regulation with varying philosophies—some embrace innovation while others prioritize consumer protection and financial stability concerns.

Recent developments include proposals for comprehensive cryptocurrency frameworks in major economies, increased enforcement actions against non-compliant platforms, and ongoing debates about whether cryptocurrencies should be classified as securities, commodities, or entirely new asset categories. These regulatory developments create uncertainty that directly impacts the Bitcoin price and overall market confidence.

Progressive regulatory frameworks that provide clear rules while allowing innovation could ultimately benefit Bitcoin by increasing institutional adoption and mainstream acceptance. Conversely, overly restrictive regulations might limit growth potential or drive activity to less regulated jurisdictions.

Technological Developments and Network Upgrades

Bitcoin’s underlying technology continues evolving despite price volatility. The Lightning Network, a second-layer solution designed to enable faster, cheaper transactions, continues expanding its capacity and user base. Additional technological improvements focus on privacy enhancements, smart contract capabilities, and improved user experiences.

These technological advancements don’t immediately impact Bitcoin’s price, but they strengthen the network’s fundamental value proposition over time. As Bitcoin becomes more functional, scalable, and user-friendly, it potentially attracts broader adoption—a key driver of long-term value appreciation.

Building Resilience as a Bitcoin Investor

Emotional Discipline and Psychological Preparation

Perhaps the most challenging aspect of Bitcoin market volatility is maintaining emotional equilibrium during extreme price swings. Successful long-term investors develop psychological resilience that allows them to resist panic selling during downturns and euphoric buying during peaks.

This emotional discipline comes from thorough preparation, including understanding Bitcoin’s historical volatility, accepting that substantial drawdowns are normal, and maintaining conviction in the investment thesis. Investors who entered the market with realistic expectations and appropriate position sizes are better equipped to weather storms without making reactive decisions.

Practical strategies for maintaining emotional discipline include limiting portfolio checking frequency, avoiding cryptocurrency social media during extreme volatility, and focusing on long-term goals rather than daily price movements. Many successful investors establish predetermined rules for buying and selling, removing emotional decision-making from the equation entirely.

Educational Resources and Continued Learning

The cryptocurrency space evolves rapidly, with new developments, technologies, and market dynamics emerging constantly. Investors who commit to ongoing education position themselves to make better decisions and capitalize on opportunities that others miss.

Quality educational resources include Bitcoin’s foundational literature (such as the original whitepaper), reputable cryptocurrency news sources, technical analysis courses, and blockchain technology explanations. Understanding not just Bitcoin’s price movements but its underlying technology, economics, and societal implications provides the knowledge foundation necessary for confident long-term investing.

Additionally, learning from experienced investors and analysts—while maintaining critical thinking and avoiding blind followership—helps newer investors develop frameworks for evaluating market conditions and making informed decisions when Bitcoin slides, leaving investors uncertain about their next moves.

Conclusion

The current situation, where Bitcoin slides, leaving investors anxious, represents a challenging but not unprecedented period in cryptocurrency markets. While short-term price declines create stress and portfolio losses, they also present opportunities for patient investors with appropriate risk management strategies and long-term perspectives.

Success in Bitcoin investing requires realistic expectations, emotional discipline, continuous education, and risk management fundamentals. Rather than attempting to predict short-term price movements or time the perfect entry and exit points, investors should focus on understanding Bitcoin’s fundamental value proposition and determining whether it aligns with their financial goals and risk tolerance.

Read More: Best Bitcoin Exchange News Updates Platform Rankings