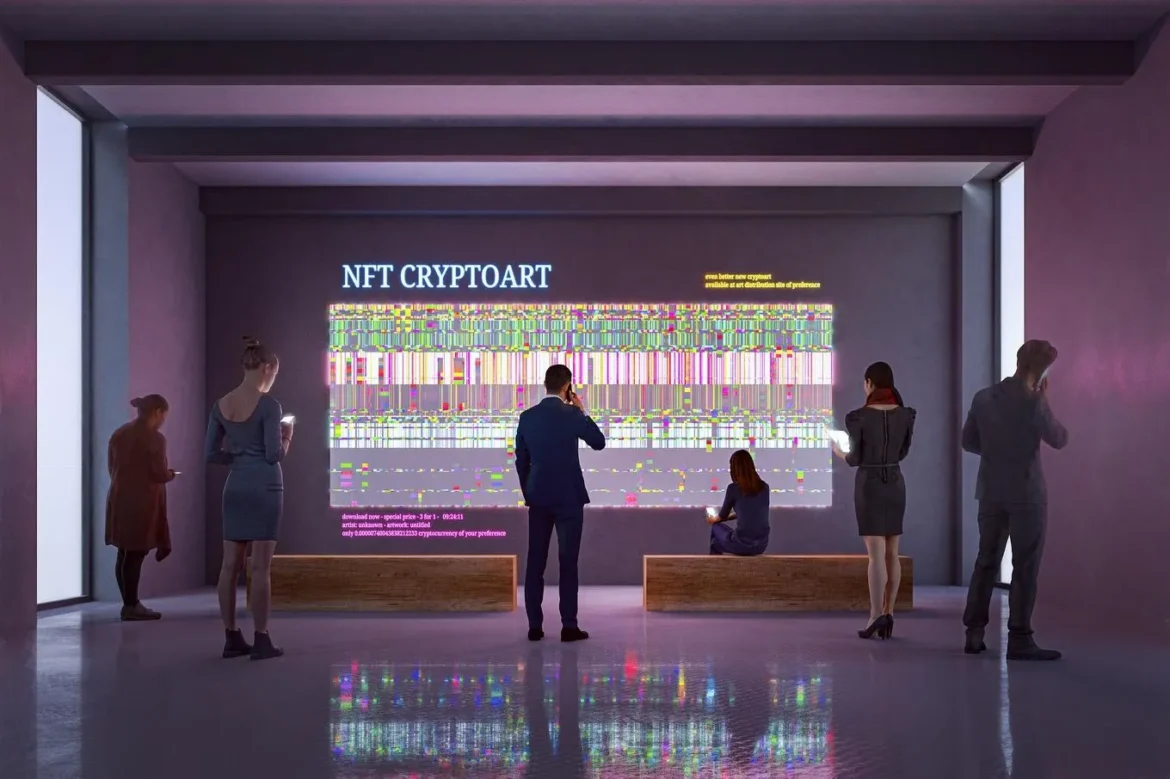

Due to the market’s dramatic drop in non-fungible tokens (NFTs), an art museum contends that NFT holders cannot sue it, a landmark case that could transform how digital asset legal issues are addressed. Consumers complain their NFTs from an art gallery with rare artworks have lost value. The gallery claims the NFT market’s general collapse, which has seen prices and trading volume plummet, absolves them of digital asset holders’ losses.

This court case shows the growing link between traditional art, digital assets, and ownership disputes. Investors, collectors, and artists have increasingly used NFTs, raising questions about their legality and sellers’ responsibilities. This lawsuit may change legal frameworks for producers, galleries, buyers, and the fast-changing world of blockchain-based art, affecting NFT transactions.

Case Background and Arguments

The avant-garde digital art gallery released a restricted selection of NFTs of prominent artists’ works, causing the problem. With these NFTs, customers received exclusive digital artwork ownership and promises of exclusive showings and fresh digital releases. Digital asset prices were at record highs when NFTs were purchased. Many assets lost value when the NFT market fell in subsequent months.

NFT buyers at the gallery, who bought these assets at peak pricing, allege they were misled about their investments’ long-term value. They bought because of the gallery’s NFT exclusivity and expansion promotion. As NFT prices fell, several buyers sued to recover their losses.

The gallery petitioned to dismiss the complaint, claiming that a market fall caused the buyers’ financial losses, not the gallery’s misleading conduct. The gallery’s legal team contends that NFTs, like other speculative assets, fluctuate in value and buyers shouldn’t blame them for the drop. The gallery denies guaranteeing a return on investment or promising NFT appreciation, a common disclaimer in speculative markets.

Legal Implications of NFTs

The lawsuit highlights the legal complications of NFTs, which are often sold as exclusive digital assets related to real-world or virtual artwork. NFTs use blockchain technology to verify digital things’ ownership and authenticity. great-profile collectors and celebrities have bought this unique item because of its great ROI potential.

NFTs are speculative, thus their prices fluctuate. The market has seen tremendous growth and severe losses, raising questions about how much producers, sellers, and galleries are responsible for these assets. Unlike traditional art markets, NFTs operate in a gray area with shifting restrictions and few precedents.

The current lawsuit hinges on whether the art gallery guaranteed the future value of the NFTs it sold. The gallery might face deception or fraud charges if it represented that NFTs would appreciate over time. If the gallery sold the NFTs as part of a digital art collection without a financial return, it could be argued that customers assumed market risk.

Market Decline and Buyer Expectations

The gallery’s claim that the market downturn caused the value drop highlights the NFT market’s speculative nature. Buyers looking to profit from digital asset price increases have viewed NFTs as high-risk investments. The volatility of the NFT market has revealed the risks of such investments. NFTs were used to obtain unique digital content, cutting-edge technology, and potentially high returns during market booms. After the market cooled, many NFTs lost value.

This has raised concerns among investors who believed their NFTs would only rise in value. Some have questioned whether they can sue for their losses. However, the gallery’s response raises crucial considerations regarding personal responsibility and speculative investment risks. NFTs, like stocks, real estate, and traditional art, are subject to market forces beyond sellers’ control. Galeries and creators may be accountable for misrepresenting their work but not for market changes.

Future of NFT Regulations

NFTs have necessitated clearer digital asset restrictions as the legal battle continues. Traditional art marketplaces had restrictions to protect buyers from fraud, deception, and wrongdoing. Even though the NFT market is young, many of these protections have yet to be properly established online. This case suggests the need for new legal frameworks to manage NFTs, their resale, and the obligations of individuals who make, sell, and buy them. Whether the art gallery’s defense holds up in court, this case could direct future NFT-related legal conflicts, determining whether producers and sellers can be liable for price changes.

Read More: Jeju Island Launches NFT Visitor Cards to Boost Tourism

Conclusion

The art gallery’s contention that NFT holders cannot sue due to the market decline changed NFT litigation. NFT buyers and sellers need legal clarity as the digital asset market evolves. This lawsuit may set a precedent for future NFT disputes, and new digital asset ownership, sale, and resale legislation may be needed. NFT holders and innovators must carefully examine the hazards of this fast-changing industry.