Bitcoin bulls defend key level positions that could determine whether the leading digital asset maintains its current trajectory or faces a significant correction. Market analysts are closely monitoring critical support zones, warning that failure to hold these positions could send Bitcoin tumbling toward $76,000. This pivotal moment in Bitcoin’s price action has traders and investors alike questioning whether the bulls have enough strength to maintain control or if bears are preparing for a decisive strike.

As December 2025 unfolds, the Bitcoin defense of the key level battle has become the focal point of cryptocurrency discourse. With billions of dollars hanging in the balance, understanding these critical price zones and the factors influencing them has never been more important for market participants. The current market structure suggests that the coming days could define Bitcoin’s trajectory for weeks or even months to come.

Critical Support Level Bitcoin Bulls Must Defend

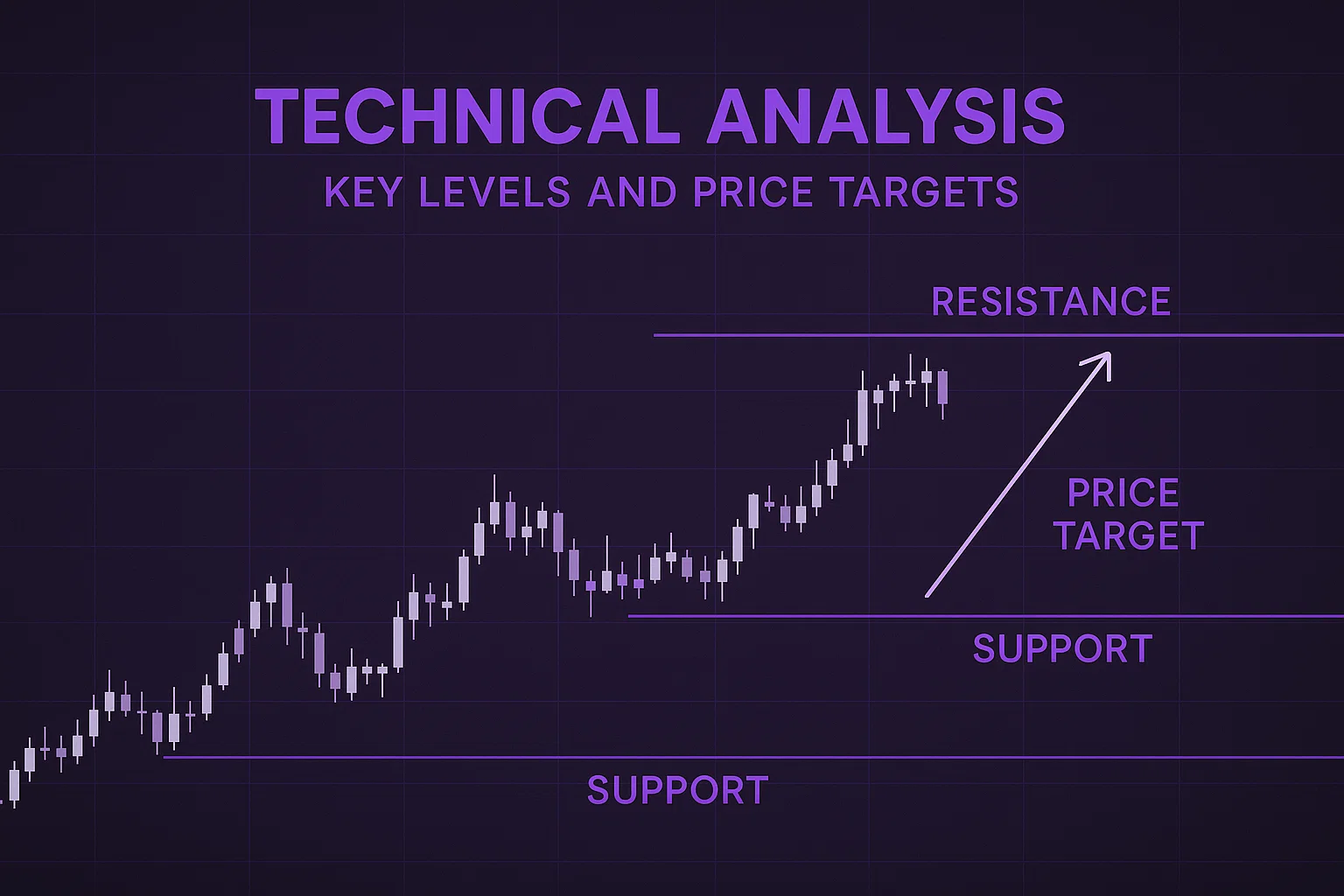

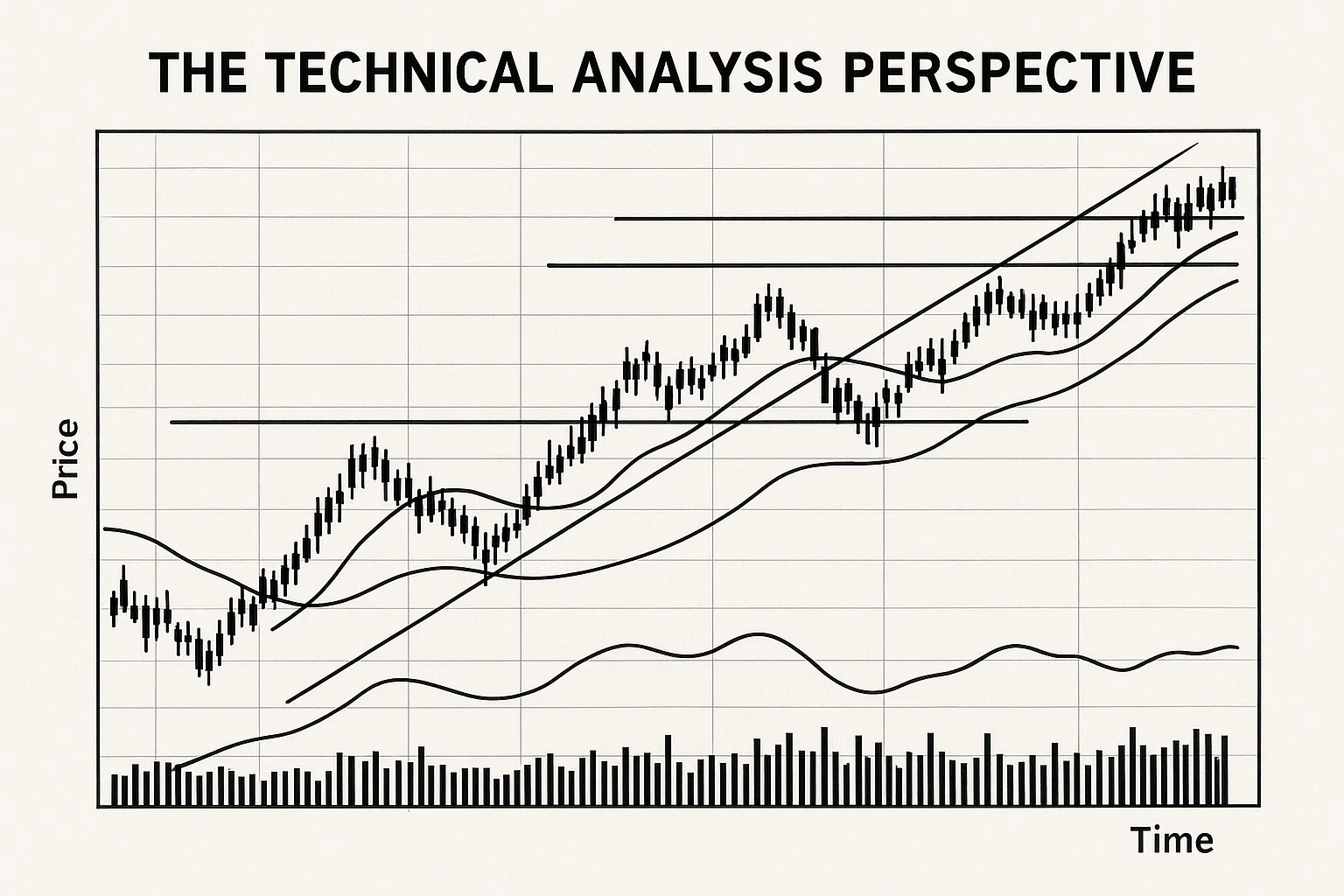

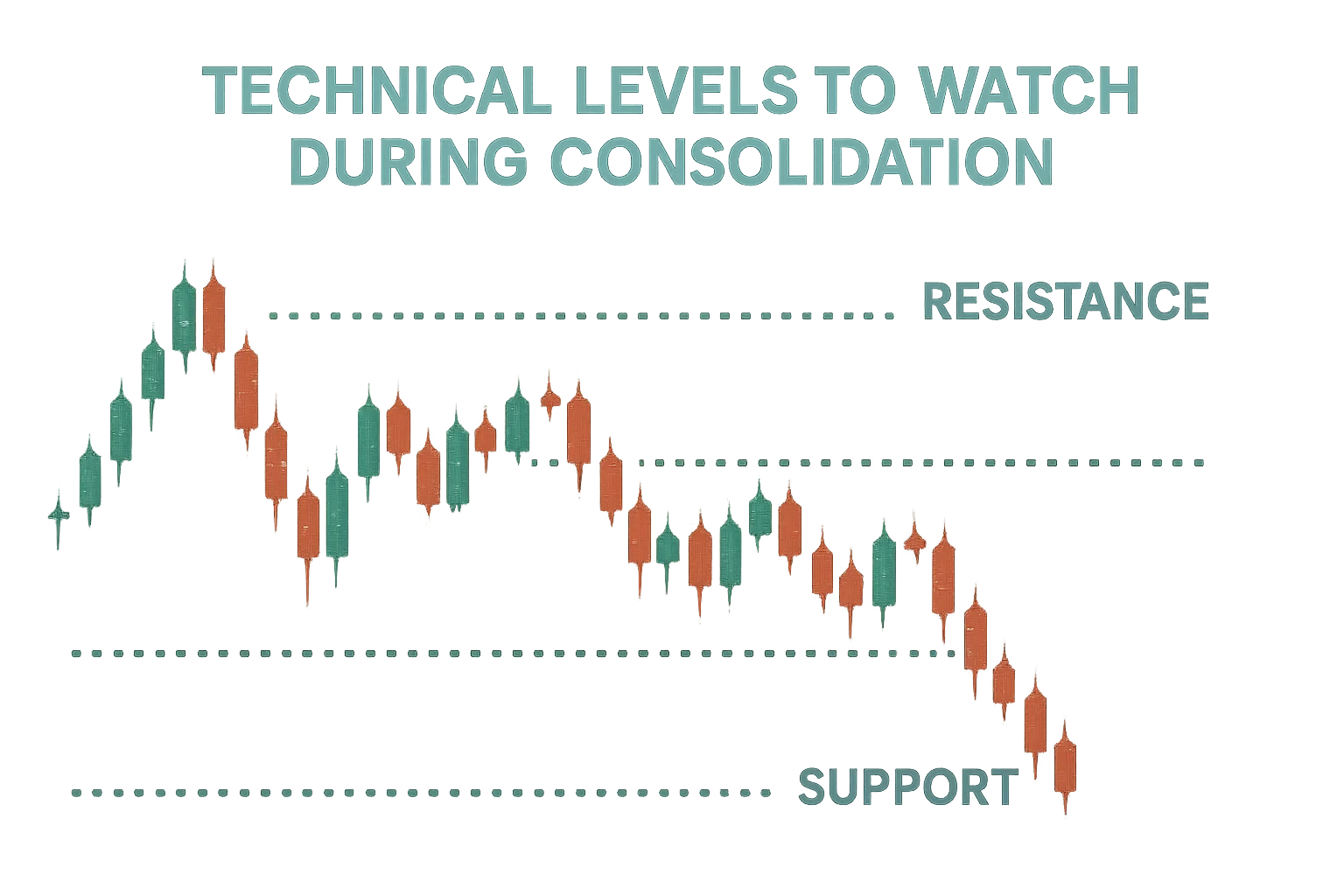

The current market situation places enormous pressure on Bitcoin bulls to defend key level strategies as technical analysts identify a crucial support zone that must hold. This level, positioned strategically within Bitcoin’s recent trading range, represents more than just a psychological barrier—it’s a technical fortress that separates continued bullish momentum from a potential bearish takeover.

The $88,000 Support Zone: A Line in the Sand

Market data indicates that the primary support level requiring defense sits around the $88,000 mark. This zone has repeatedly proven its significance over recent weeks, acting as a launching pad for bullish rallies and a safety net during minor corrections. The Bitcoin bulls defend the key level at $88,000 because it represents the convergence of multiple technical indicators, including the 50-day moving average, a previous resistance-turned-support level, and a Fibonacci retracement point.

Technical analysts emphasize that this support zone isn’t simply a single price point but rather a range spanning from $87,500 to $88,500. Within this band, significant buy orders have accumulated, creating what traders call “demand zones.” These areas attract institutional buyers and long-term holders who view any dip into this range as an attractive entry opportunity.

The volume profile analysis reveals substantial trading activity at these levels, indicating that many market participants have vested interests in defending this zone. When Bitcoin bulls defend key level positions with high volume, it typically signals strong conviction and increases the probability of successful defense.

Why $76,000 Represents the Bearish Target

The $76,000 price point didn’t emerge arbitrarily—it represents a calculated bearish target based on multiple technical analysis methodologies. If the current support fails, this level marks the next major support zone where buyers might re-enter the market with force. The distance between the current support and this bearish target represents approximately a 13-15% decline, a significant but not unprecedented move in Bitcoin’s volatile history.

Several factors make $76,000 a logical bearish destination. First, it coincides with the 200-day moving average, a widely watched indicator among institutional traders. Second, this price level represents a 38.2% Fibonacci retracement from Bitcoin’s recent rally high to its previous low. Third, historical support from earlier in 2025 exists at this level, making it a natural magnet for price action during corrections.

Market psychology also plays a crucial role in the $76,000 scenario. Round numbers and psychologically significant levels often act as self-fulfilling prophecies in cryptocurrency markets. As more traders position themselves around these levels, they become increasingly important to the market structure.

Technical Analysis: Indicators Supporting Bitcoin Bulls Defend Key Level Strategy

Understanding the technical landscape is essential for comprehending how Bitcoin bulls defend key level positions effectively. Multiple indicators currently provide insight into market strength and potential vulnerabilities.

Moving Averages and Trend Analysis

The relationship between Bitcoin’s price and its moving averages tells a compelling story about market momentum. Currently, Bitcoin trades above its 50-day exponential moving average (EMA), a bullish signal suggesting short-term momentum remains positive. However, the narrowing gap between the 50-day and 200-day EMAs indicates potential trend exhaustion.

When Bitcoin bulls defend key level positions near moving averages, the success rate historically increases. The 50-day EMA has acted as dynamic support during the recent uptrend, with each test resulting in a bounce. This pattern reinforces the importance of maintaining positions above these technical benchmarks.

The moving average convergence divergence (MACD) indicator shows signs of weakening bullish momentum, though it hasn’t yet crossed into bearish territory. This divergence between price action and momentum indicators often precedes significant market moves, making current price levels even more critical for the Bitcoin bulls to defend the key level narrative.

Relative Strength Index and Momentum Indicators

The Relative Strength Index (RSI) currently hovers in neutral territory between 45-55, suggesting neither overbought nor oversold conditions. This positioning provides flexibility for movement in either direction, meaning the battle between Bitcoin bulls defending key level positions could swing either way based on market catalysts.

Historical analysis shows that when Bitcoin’s RSI remains above 50 while defending key support levels, the probability of continued upside increases significantly. Conversely, RSI readings below 45 at support levels often precede breakdowns. Current readings suggest a balanced market where neither bulls nor bears have definitive control.

Additional momentum indicators, including the Stochastic Oscillator and Rate of Change (ROC), paint a picture of consolidation rather than trending behavior. This consolidation phase represents the calm before the storm, where the outcome of the Bitcoin defended key level battle will determine the next major market direction.

Volume Analysis and Market Participation

Volume analysis reveals crucial insights into the strength behind price movements. Recent trading sessions show declining volume during price advances and increasing volume during retracements—a potentially bearish divergence that challenges the Bitcoin bulls ‘ defense key level thesis.

However, on-balance volume (OBV), which combines price and volume data, remains in an uptrend. This suggests that despite short-term volume concerns, accumulation continues to outpace distribution. When institutional players and smart money Bitcoin bulls defend key level positions, OBV typically maintains positive momentum even during consolidation phases.

The volume profile visible range (VPVR) shows the highest trading activity clusters around current price levels, confirming this zone as a critical battleground. High-volume nodes act as strong support because many market participants have positions at these levels and are incentivized to defend them.

Fundamental Factors Influencing Bitcoin Bulls Defend Key Level Efforts

Beyond technical analysis, fundamental factors play an equally important role in the ability of Bitcoin bulls to defend key level positions successfully. These macroeconomic and crypto-specific elements provide context for price movements and investor sentiment.

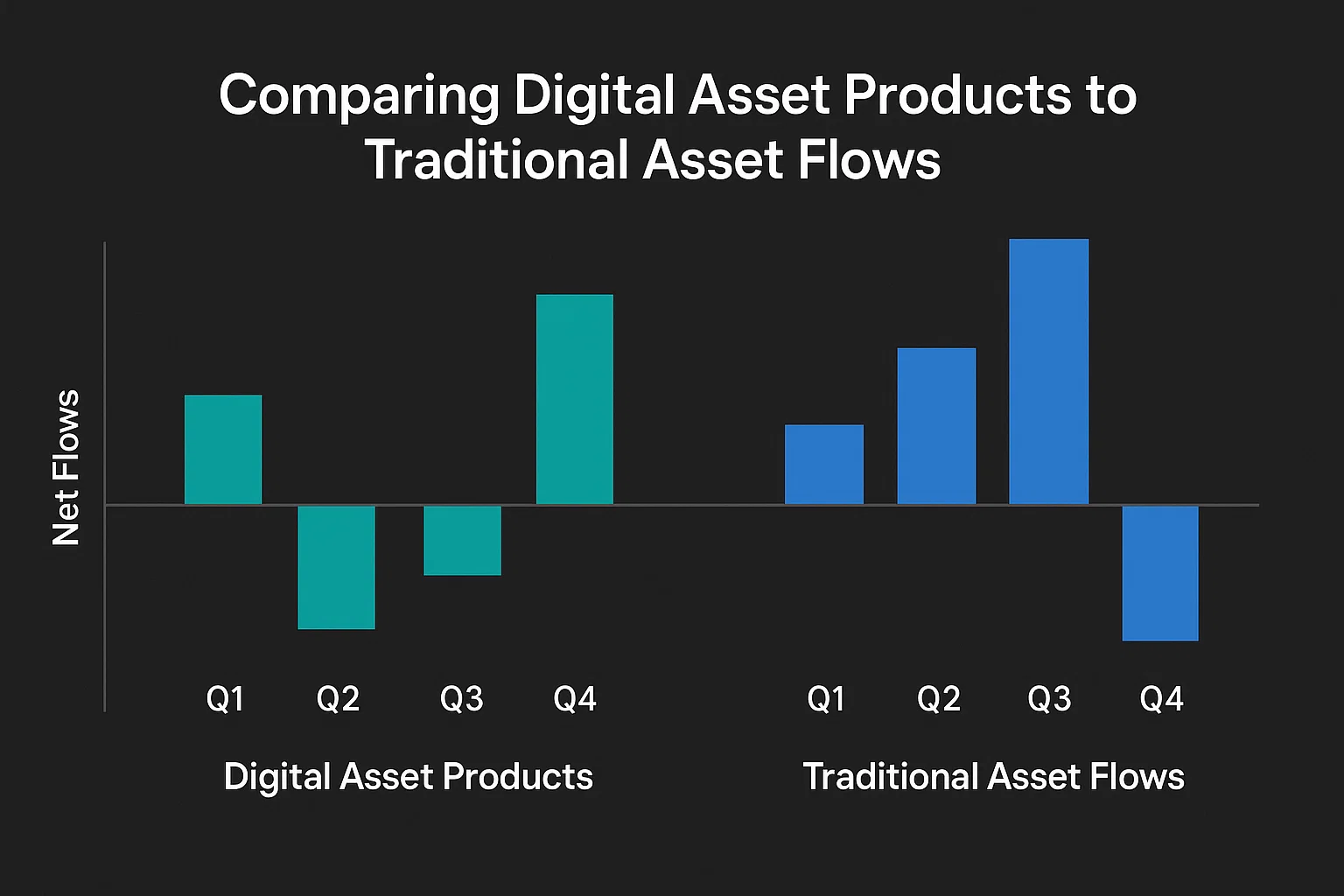

Institutional Investment and Adoption Trends

Institutional participation in Bitcoin markets has reached unprecedented levels in 2025. Major financial institutions, hedge funds, and corporate treasuries continue accumulating Bitcoin, providing a fundamental floor beneath prices. This institutional presence strengthens the Bitcoin bulls’ defense key level narrative by introducing large-scale buyers willing to step in during corrections.

Bitcoin ETF flows remain positive, with billions of dollars entering these investment vehicles monthly. These sustained inflows indicate growing mainstream acceptance and provide consistent buying pressure. When Bitcoin bulls defend key level positions, ETF purchases often provide crucial support, absorbing selling pressure from leveraged traders and short-term speculators.

Corporate adoption continues expanding, with several Fortune 500 companies exploring Bitcoin treasury strategies. This trend toward corporate Bitcoin holdings creates long-term demand dynamics that support higher price levels. The more corporations adopt Bitcoin as a treasury asset, the stronger the foundation for bulls to defend critical support zones.

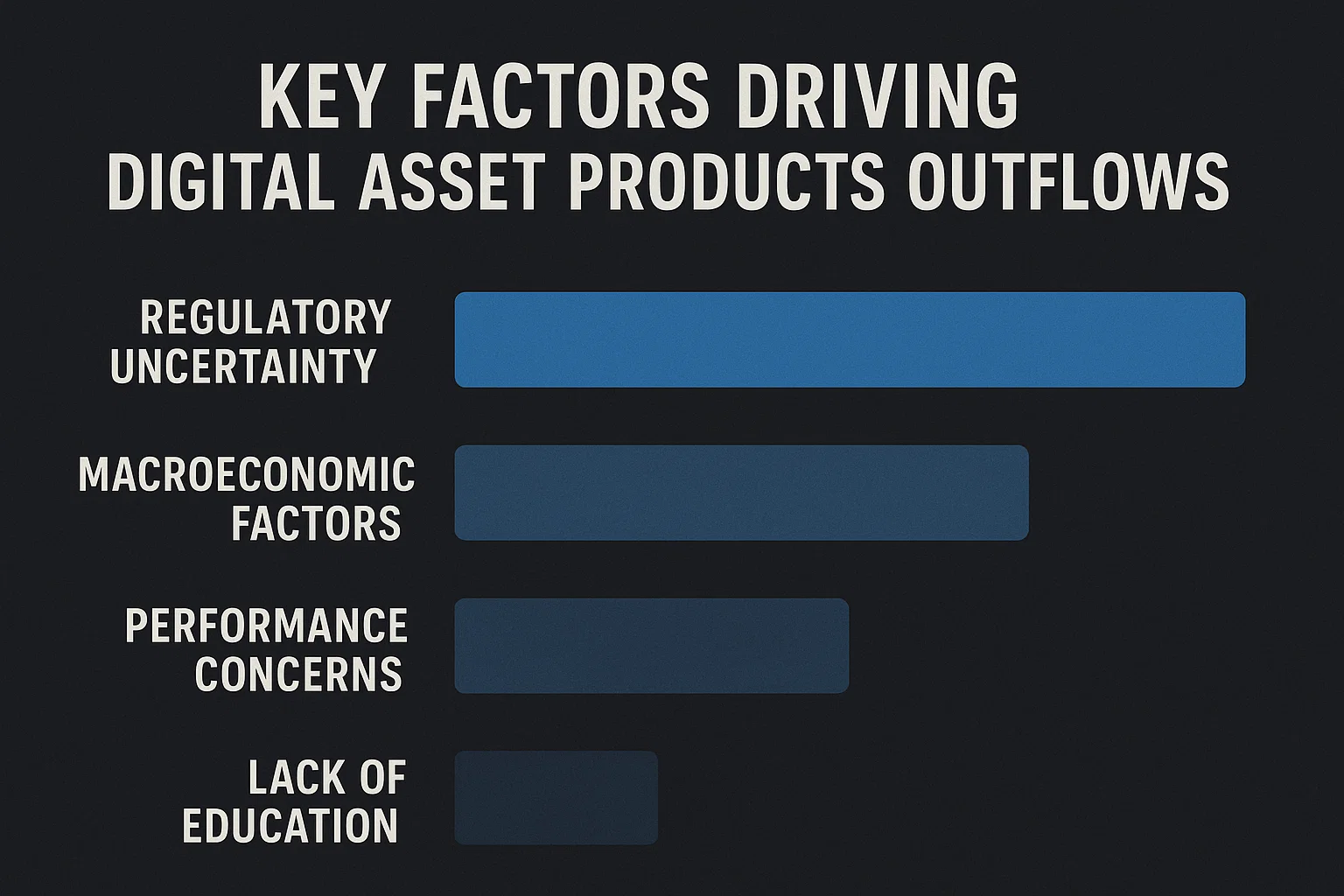

Regulatory Developments and Market Sentiment

Regulatory clarity has improved significantly in 2025, with major jurisdictions establishing clearer frameworks for cryptocurrency operations. This regulatory progress reduces uncertainty and attracts traditional investors previously hesitant about crypto exposure. Positive regulatory developments strengthen market confidence, helping Bitcoin bulls defend key level positions during periods of volatility.

However, regulatory risks haven’t disappeared entirely. Ongoing debates about taxation, reporting requirements, and cross-border transactions continue to create occasional headwinds. When regulatory uncertainty increases, it can undermine the Bitcoin bulls’ defense key level efforts by triggering risk-off sentiment among institutional participants.

Market sentiment indicators, including the Crypto Fear and Greed Index, currently sit in neutral territory. This balanced sentiment suggests markets are neither euphoric nor panicked—a condition that often precedes significant directional moves. The outcome of the current Bitcoin defense of the key level battle could shift sentiment dramatically in either direction.

Macroeconomic Conditions and Bitcoin’s Role

Global macroeconomic conditions significantly influence Bitcoin’s price dynamics and the ability of bulls to maintain support levels. Current monetary policy, with central banks maintaining cautious stances, creates an environment where Bitcoin’s value proposition as an alternative asset remains compelling.

Inflation concerns, though moderating from previous peaks, continue supporting Bitcoin’s narrative as a hedge against currencdebasementon. When inflation expectations rise, Bitcoin bulls defend key level positions more aggressively, viewing Bitcoin as protection against purchasing power erosion.

Interest rate policies also impact Bitcoin markets. As traditional fixed-income yields fluctuate, Bitcoin’s attractiveness as a return-generating asset shifts accordingly. The relationship between interest rates and Bitcoin prices influences whether institutional investors, Bitcoin bulls, end key level positions, or rotate capital into other asset classes.

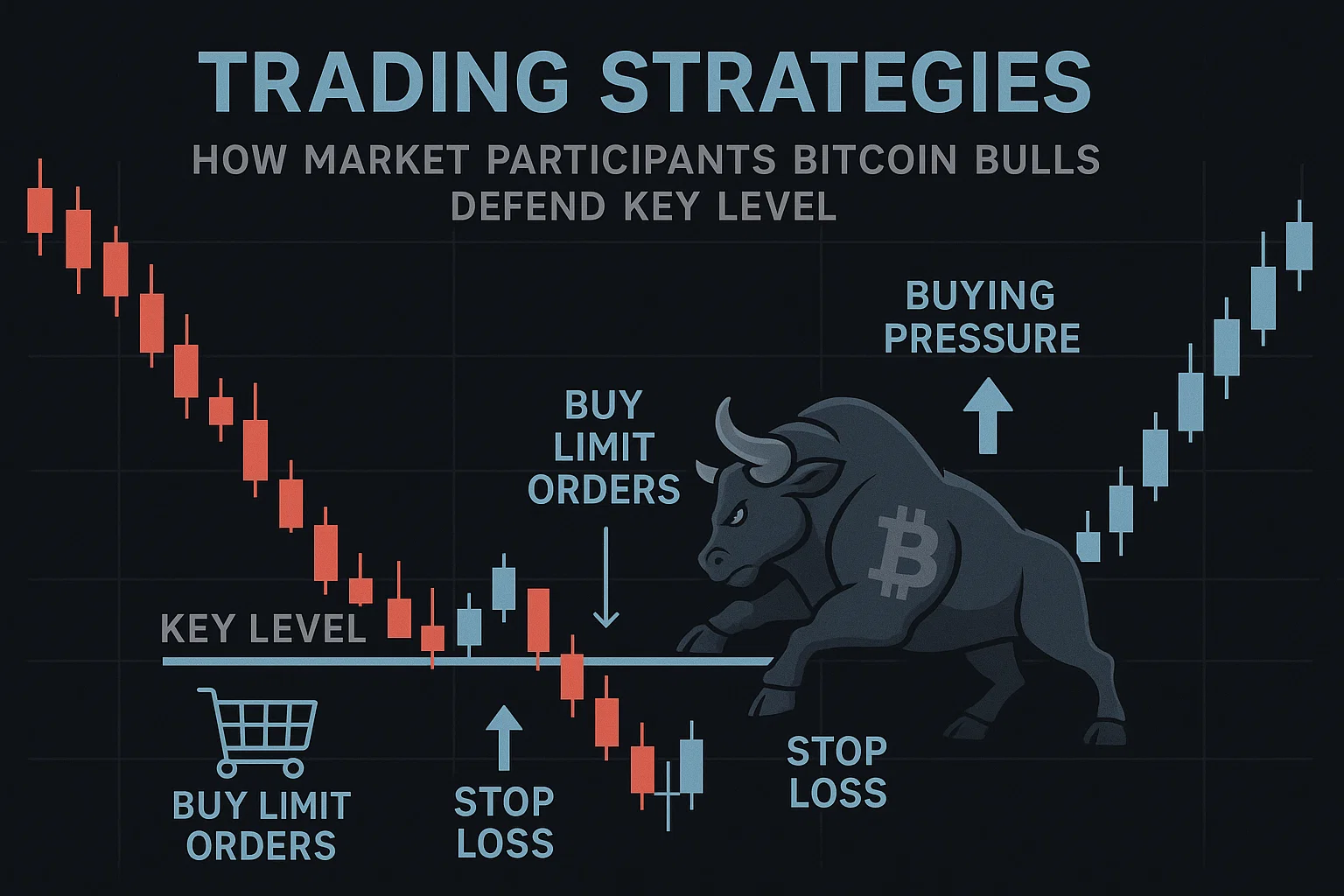

Trading Strategies: How Market Participants Bitcoin Bulls Defend Key Level

Professional traders employ various strategies when participating in the Bitcoin defense key level battle. Understanding these approaches provides insight into market dynamics and potential future movements.

Long Position Management and Risk Control

Experienced traders managing long positions implement strict risk management protocols during periods when Bitcoin bulls defend key level positions that face pressure. Stop-loss orders typically sit just below key support zones, protecting capital while allowing for normal price fluctuation.

Position sizing becomes critical during uncertain periods. Rather than concentrating risk in single large positions, sophisticated traders scale into positions gradually, adding to winners while cutting losers quickly. This approach allows Bitcoin bulls to defend key levels effectively without exposing themselves to catastrophic losses if support breaks.

Hedging strategies also play important roles. Some long-term Bitcoin holders purchase put options or short futures contracts to protect portfolio value during potential corrections. These hedges allow them to maintain core positions while limiting downside risk if the Bitcoin bulls’ defense of the key level effort fails.

Short-Term Trading Tactics and Scalping Opportunities

Short-term traders and scalpers view the Bitcoin bulls’defensed key level battle as opportunity-rich territory. The increased volatility around key support zones creates numerous intraday trading opportunities for those with quick reflexes and disciplined strategies.

Range-trading strategies become particularly effective when Bitcoin consolidates around critical levels. Traders buy near support and sell near resistance, profiting from the back-and-forth price action while Bitcoin bulls defend key level positions. This approach requires precise entry and exit execution but can generate consistent returns during consolidation phases.

Breakout traders position themselves differently, waiting for definitive breaks above resistance or below support before entering positions. If Bitcoin bulls defend the key level successfully and price breaks higher, these traders pile into long positions, amplifying bullish momentum. Conversely, support breaks trigger short entries, accelerating downward moves toward $76,000.

Long-Term Investment Perspectives

Long-term investors approach the Bitcoin defense of key level situation with different mindsets than active traders. Many view any significant correction as an accumulation opportunity, deploying capital gradually through dollar-cost averaging strategies.

These investors focus less on short-term price fluctuations and more on Bitcoin’s fundamental value proposition and long-term adoption trends. For them, whether Bitcoin bulls defend key level positions today matters less than Bitcoin’s position in the financial system five or ten years forward.

However, even long-term holders monitor key support levels to gauge market health and potential entry opportunities. If current support fails and Bitcoin drops toward $76,000, many would view this as an attractive buying opportunity rather than a cause for concern, ultimately supporting the Bitcoin bull defense of key levels through patient accumulation.

Historical Context: Previous Instances When Bitcoin Bulls Defend Key Level

Examining historical precedents provides a valuable perspective on current market conditions and the likelihood of successful defense at critical support levels.

The 2024 Mid-Year Correction

In mid-2024, Bitcoin faced similar circumstances when bulls needed to defend the $62,000 level after a rapid rally to $73,000. The initial tests of support showed weakness, with Bitcoin briefly dropping to $58,000 before bulls regained control. This successful defense led to a subsequent rally that established new, higher lows and eventually pushed Bitcoin toward six-figure territory.

The lesson from this period demonstrates that temporary support breaks don’t necessarily invalidate bullish structures. Even when Bitcoin bulls defend key level efforts initially falter, strong recoveries can occur if fundamental conditions remain supportive. The 2024 experience showed that patient accumulation during corrections often proves profitable.

The 2023 Bear Market Bottom

Looking further back, the 2023 bear market bottom occurred around $16,000 after a prolonged decline from the 2021 all-time high. The defense of the $15,000-$17,000 range proved crucial for establishing the foundation for 2024-2025’s bull market. Institutional accumulation during this period created strong support that bulls successfully defended multiple times.

This historical example illustrates that when Bitcoin bulls defend key level positions during extreme bearish sentiment, the potential rewards for patient investors can be substantial. The successful defense at these levels marked a generational buying opportunity that many investors wish they had capitalized on more aggressively.

Expert Analyst Perspectives on Bitcoin Bulls Defend Key Level Scenario

Leading cryptocurrency analysts have shared diverse perspectives on the current market situation and the importance of defending key support levels.

Bullish Analyst Viewpoints

Prominent bullish analysts argue that current support levels remain strong and that Bitcoin bulls defending key levels will likely succeed. They point to improving fundamentals, including ETF inflows, institutional adoption, and improving regulatory clarity, as factors supporting higher prices.

These analysts emphasize that any correction toward $76,000 would represent a healthy pullback rather than the beginning of a bear market. They view such moves as opportunities for accumulation, expecting Bitcoin to ultimately establish new all-time highs in 2025. The technical structure, they argue, supports the Bitcoin defended key level thesis despite short-term uncertainty.

Bearish Analyst Warnings

Conversely, bearish analysts warn that weakening momentum indicators and declining volume suggest the Bitcoin bulls’ key level may fail. They point to overextended technical indicators, potential regulatory challenges, and macroeconomic headwinds as risks undermining bullish sentiment.

These analysts anticipate that a break below current support would trigger cascading stop-loss orders and leveraged position liquidations, accelerating the move toward $76,000 or potentially lower. They advise caution and recommend waiting for clearer bullish signals before aggressively accumulating positions.

Neutral Analyst Assessments

Many analysts adopt neutral stances, acknowledging valid arguments on both sides. They recognize that whether Bitcoin bulls defend key level positions successfully depends on numerous factors, many of which remain uncertain. These analysts recommend balanced approaches, maintaining some exposure while keeping dry powder for potential buying opportunities.

The neutral perspective emphasizes flexibility and adaptability rather than strong directional bets. As market conditions evolve, reassessing positions and adjusting strategies becomes essential for navigating periods when Bitcoin bulls defend key level battles that remain unresolved.

On-Chain Metrics and Their Impact on Bitcoin Bulls Defend Key Level

On-chain data provides unique insights into Bitcoin holder behavior and network fundamentals that influence price action and support levels.

Exchange Balances and Supply Dynamics

Exchange balance metrics show Bitcoin supply on exchanges has been declining steadily throughout 2025, indicating accumulation by long-term holders. When supply leaves exchanges, it reduces available Bitcoin for selling, strengthening the foundation for Bitcoin bulls to defend key level efforts.

This supply squeeze creates favorable conditions for price appreciation, as reduced selling pressure meets consistent demand from new buyers. The more Bitcoin that moves into cold storage and long-term holding patterns, the stronger the support at key levels becomes.

Whale Accumulation Patterns

Whale wallet addresses holding significant Bitcoin quantities have shown accumulation patterns during recent price consolidation. When large holders of Bitcoin bulls defend key levels through strategic buying, it often signals confidence in future price appreciation and provides substantial support.

Whale accumulation typically precedes major price moves, as these sophisticated investors often have superior information and analysis capabilities. Their willingness to accumulate around current levels suggests they view the risk-reward profile as favorable despite short-term uncertainty.

Network Activity and User Growth

Bitcoin network activity, measured by active addresses and transaction counts, remains robust. Consistent network usage indicates genuine adoption and utility beyond speculative trading. When network fundamentals remain strong, it supports the Bitcoin bulls’ defense key level narrative by demonstrating underlying value.

New address growth continues trending positively, bringing fresh participants into the Bitcoin ecosystem. This expanding user base creates additional demand and broader distribution of Bitcoin holdings, both factors that strengthen support at key price levels.

Potential Catalysts That Could Help Bitcoin Bulls Defend Key Level

Several potential catalysts could emerge to strengthen bullish defenses and prevent the feared decline toward $76,000.

Positive Regulatory Announcements

Favorable regulatory developments could provide the catalyst needed for Bitcoin bulls to defend key levels successfully. Announcements about Bitcoin ETF approvals in new jurisdictions, clearer tax treatment, or supportive legislative frameworks would likely trigger buying interest and strengthen support.

Regulatory clarity reduces uncertainty premium priced into Bitcoin, potentially unlocking institutional capital currently sitting on the sidelines. Major regulatory wins could shift market sentiment decisively in the bulls’ favor.

Institutional Adoption Milestones

Significant institutional adoption announcements, such as major corporations adding Bitcoin to treasuries or prominent financial institutions launching Bitcoin services, would support the Bitcoin bulls’ defense key level. These developments validate Bitcoin’s mainstream acceptance and attract follow-on institutional interest.

The psychological impact of major adoption milestones often exceeds their immediate financial impact, as they signal shifting attitudes toward Bitcoin among traditional finance professionals and corporate decision-makers.

Macroeconomic Shifts

Changes in broader macroeconomic conditions could also influence whether Bitcoin bulls defend key level positions successfully. Increased inflation concerns, currency devaluation fears, or geopolitical tensions often drive investors toward Bitcoin as a hedge, providing buying pressure at key levels.

Conversely, positive macroeconomic developments reducing Bitcoin’s appeal as a haven could undermine support. The complex interplay between macro conditions and Bitcoin prices means bulls must monitor developments beyond cryptocurrency markets when defending key levels.

Conclusion

The current market juncture represents a pivotal moment for Bitcoin’s near-term trajectory. Whether Bitcoin bulls defend key level positions successfully will determine if Bitcoin maintains its upward trajectory or faces a significant correction toward $76,000. The technical, fundamental, and psychological factors discussed throughout this analysis highlight the complexity of the current market environment.

For traders and investors, understanding the dynamics of how Bitcoin bulls defend key level positions provides essential context for decision-making. Those maintaining long positions should implement appropriate risk management, including stop-losses and position sizing appropriate to their risk tolerance. Conversely, those waiting on the sidelines should prepare for potential opportunities, whether bulls successfully defend current support or the market corrects toward lower levels.

Read More: Best Bitcoin Exchange News Updates Platform Rankings