Bitcoin market rallies, and altcoins dominate headlines across the financial world. Bitcoin has smashed through resistance levels to hit an impressive $87,000, while alternative cryptocurrencies are posting their most significant gains in months. This remarkable upward momentum has reignited investor confidence and sparked intense discussion about the future trajectory of digital assets. As Bitcoin continues its ascent, altcoins are not just following—they’re leading with explosive percentage gains that are capturing the attention of both retail and institutional investors. The current market rally represents a pivotal moment for the cryptocurrency ecosystem, signaling potential new all-time highs and a broader acceptance of digital currencies.

Bitcoin Market Rally and Altcoin Explosion

The recent Bitcoin market rally and the altcoins phenomenon aren’t happening in isolation. Multiple factors have converged to create the perfect storm for cryptocurrency appreciation. Bitcoin’s climb to $87,000 marks a significant psychological and technical milestone, breaking through previous resistance zones that had kept the digital asset range-bound for weeks.

What’s Driving Bitcoin to $87K?

Several catalysts have propelled Bitcoin to these new heights. Institutional adoption continues to accelerate, with major financial institutions increasing their cryptocurrency holdings. The approval of spot Bitcoin ETFs has opened floodgates for traditional investors who were previously hesitant to enter the crypto space. These regulated investment vehicles have attracted billions in capital, creating sustained buying pressure.

Macroeconomic conditions have also played a crucial role. With inflation concerns persisting and traditional markets showing volatility, investors are increasingly viewing Bitcoin as a hedge against currency devaluation. The digital asset’s fixed supply of 21 million coins makes it attractive during times of monetary expansion.

Technical analysis reveals that Bitcoin’s breakout above $85,000 triggered a cascade of stop-loss orders and activated numerous buy orders from traders who had been waiting for confirmation of the uptrend. This technical momentum, combined with strong fundamental support, has created the ideal environment for Bitcoin’s market rally.

The Altcoin Season: Which Cryptocurrencies Are Leading?

While Bitcoin captures headlines, altcoins are delivering even more impressive percentage gains. The altcoin market has exploded with activity, with several categories of cryptocurrencies posting double-digit and even triple-digit gains.

Ethereum (ETH) has surged alongside Bitcoin, breaking past key resistance levels and demonstrating strong momentum. The world’s second-largest cryptocurrency has benefited from successful network upgrades and growing adoption of decentralized applications. Ethereum’s transition to proof-of-stake continues to attract environmentally conscious investors and those seeking staking rewards.

Layer-1 blockchain alternatives like Solana, Cardano, and Avalanche have posted remarkable gains ranging from 25% to 45% during this market rally. These platforms are attracting developers and users with their faster transaction speeds and lower fees compared to Ethereum’s mainnet.

DeFi tokens have experienced a renaissance, with protocols like Uniswap, Aave, and Compound seeing renewed interest. Total value locked in DeFi applications has increased substantially, indicating that users are actively deploying capital into these yield-generating platforms.

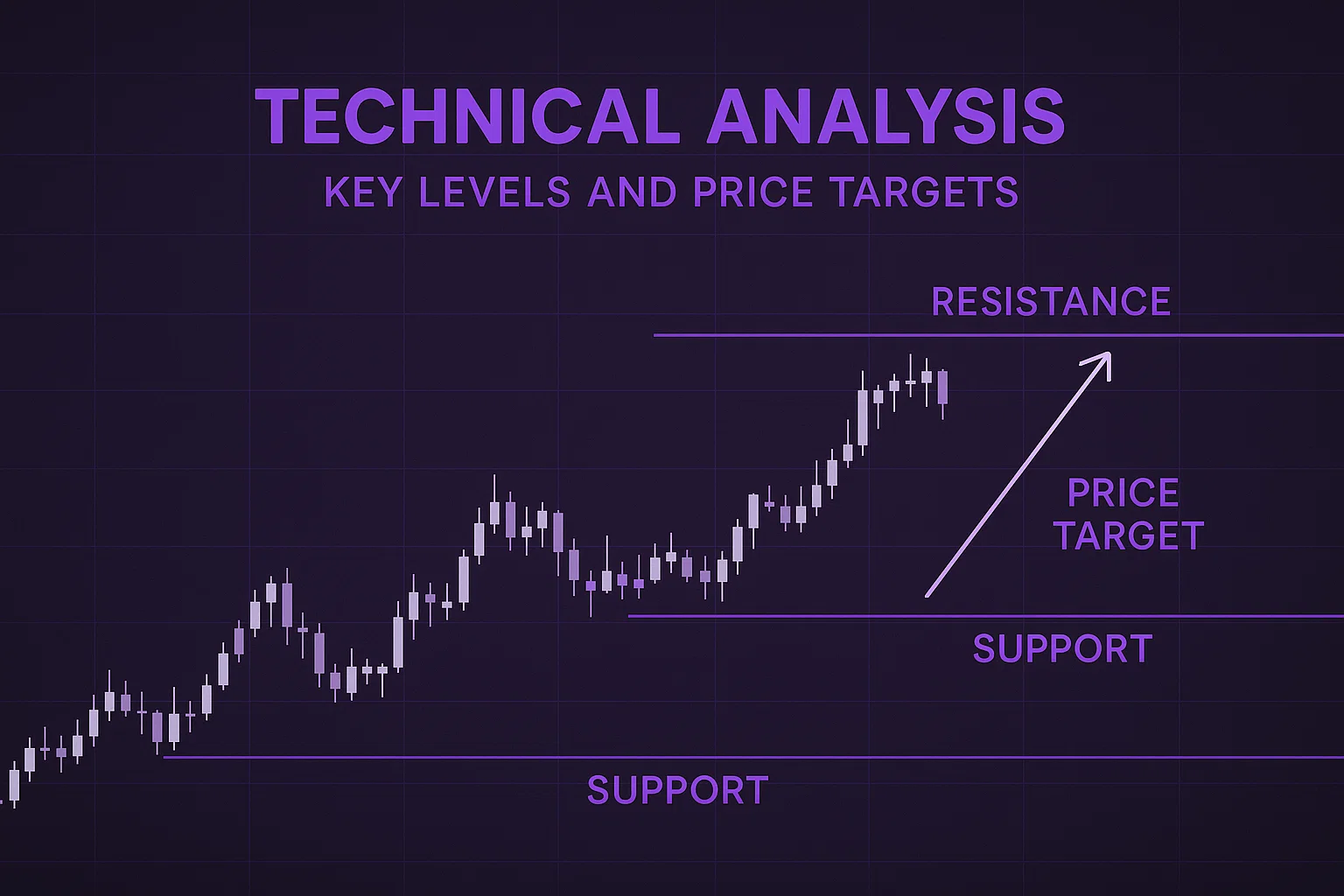

Technical Analysis: Key Levels and Price Targets

Bitcoin’s Technical Breakout Explained

The Bitcoin market rally has been accompanied by strong technical indicators that suggest continuation potential. The Relative Strength Index (RSI) shows Bitcoin is in strong bullish territory without being severely overbought, indicating room for further appreciation.

Moving averages tell a compelling story. Bitcoin is trading well above both its 50-day and 200-day moving averages, a configuration that traditionally signals a sustained uptrend. The golden cross formation—where the 50-day moving average crosses above the 200-day—occurred weeks ago and has proven to be a reliable bullish signal.

Volume analysis reveals substantial buying pressure supporting the market rally. On-chain metrics show that long-term holders are accumulating rather than selling, suggesting conviction in higher future prices. Exchange reserves of Bitcoin continue to decline, indicating that investors are moving their holdings to cold storage with no immediate plans to sell.

Fibonacci extension levels suggest potential targets for Bitcoin in the $90,000 to $95,000 range if the current momentum continues. However, traders should watch for potential resistance at psychological levels like $90,000 and $100,000, where profit-taking could temporarily pause the rally.

Altcoin Technical Patterns Worth Watching

Altcoins are displaying various technical patterns that suggest continued strength. Many major alternative cryptocurrencies have broken out of descending wedge patterns, a traditionally bullish formation that often precedes significant price appreciation.

The altcoin-to-Bitcoin ratio (measured by total altcoin market cap divided by Bitcoin market cap) has been increasing, suggesting that capital is rotating from Bitcoin into alternative cryptocurrencies. This rotation typically occurs when investors seek higher-risk, higher-reward opportunities after Bitcoin establishes a new price range.

Volume profiles for leading altcoins show accumulation zones at lower prices, with substantial buying interest that has absorbed selling pressure. This volume support suggests that recent gains may have staying power rather than being purely speculative pumps.

Fundamental Factors Fueling the Cryptocurrency Market Rally

Institutional Investment and ETF Impact

The institutional embrace of cryptocurrency has been a game-changer for the Bitcoin market rally and the altcoins trend. Spot Bitcoin ETFs have accumulated billions of dollars in assets under management since their approval, representing unprecedented mainstream financial adoption.

Major corporations continue to add Bitcoin to their treasury reserves, viewing it as a strategic asset that provides diversification and potential appreciation. Companies ranging from technology firms to traditional enterprises are allocating portions of their cash reserves to cryptocurrency.

Pension funds and endowments are cautiously entering the space, conducting due diligence and establishing positions in Bitcoin and select altcoins. This institutional capital represents long-term, stable demand that supports higher price levels.

Investment banks and asset managers are launching cryptocurrency-focused products, making it easier for their clients to gain exposure. This infrastructure development legitimizes the asset class and reduces barriers to entry for traditional investors.

Regulatory Clarity and Global Adoption

Regulatory developments have provided much-needed clarity that’s supporting the market rally. Several jurisdictions have established clear frameworks for cryptocurrency taxation, trading, and custody, reducing uncertainty that previously deterred institutional participation.

Countries are competing to become cryptocurrency-friendly hubs, offering favorable regulations and tax incentives. This regulatory competition is accelerating adoption and creating environments where blockchain businesses can thrive.

Central bank digital currencies (CBDCs) are being developed globally, which paradoxically validates the underlying blockchain technology that powers Bitcoin and altcoins. As governments explore digital currencies, public awareness and acceptance of cryptocurrency concepts increase.

International payment companies are integrating cryptocurrency functionality, enabling consumers to use Bitcoin and other digital assets for everyday transactions. This utility expansion supports the fundamental value proposition of cryptocurrencies beyond mere speculation.

Top Performing Altcoins in the Current Market Rally

Layer-1 Blockchain Tokens

Solana (SOL) has emerged as one of the strongest performers during this Bitcoin market rally altcoins surge. The high-performance blockchain has recovered from previous network issues and is attracting developers with its fast transaction speeds and growing ecosystem. Solana’s price has appreciated by over 40% during the current rally, driven by increased NFT activity and DeFi applications.

Cardano (ADA) has posted impressive gains as the network continues rolling out smart contract capabilities and establishing partnerships in developing markets. The academic approach to blockchain development is resonating with investors seeking fundamentally sound projects.

Avalanche (AVAX) has surged on the back of subnet developments and institutional partnerships. The platform’s focus on enterprise blockchain solutions and its compatibility with Ethereum applications have positioned it as a serious competitor in the layer-1 space.

DeFi and Utility Tokens

Decentralized finance tokens are experiencing renewed interest as users return to yield farming and liquidity provision. Uniswap (UNI), the largest decentralized exchange, has seen its token appreciate alongside increased trading volumes on the platform.

Chainlink (LINK), the leading blockchain oracle network, continues to secure partnerships with major enterprises and blockchain projects. As smart contracts require reliable real-world data feeds, Chainlink’s utility drives sustained demand.

Polygon (MATIC) has benefited from Ethereum’s scaling challenges, offering a layer-2 solution that provides fast, low-cost transactions. Major brands and applications choosing Polygon for their blockchain infrastructure have supported the token’s appreciation.

Emerging Sectors and Narrative-Driven Gains

Artificial intelligence and blockchain integration projects have captured speculative interest, with tokens in this category posting substantial gains. The intersection of two transformative technologies appeals to forward-thinking investors.

Real-world asset tokenization projects are gaining traction as the technology matures. Platforms enabling tokenized real estate, commodities, and securities are attracting attention from both crypto-native and traditional finance participants.

Gaming and metaverse tokens experienced a surge as virtual world platforms announced updates and partnerships. The play-to-earn model continues to evolve, with new projects addressing sustainability concerns that plagued earlier iterations.

Risk Factors and Market Considerations

Volatility and Market Corrections

While the Bitcoin market rally and altcoin trend are exciting, investors must recognize the inherent volatility in cryptocurrency markets. Sharp corrections are common even within broader uptrends. Bitcoin’s history includes numerous 20-30% pullbacks during bull markets.

Overleveraged positions in derivatives markets can amplify price movements in both directions. Liquidation cascades can cause rapid price drops even when fundamental conditions remain strong. Prudent investors should use appropriate position sizing and avoid excessive leverage.

Sentiment-driven price action can disconnect from fundamental value, creating bubbles that eventually deflate. While current momentum is supported by tangible adoption metrics, portions of the market rally may be speculative and subject to reversal.

Regulatory and Macroeconomic Risks

Sudden regulatory announcements can impact cryptocurrency prices significantly. While the overall regulatory trend has been toward clarity and acceptance, unexpected restrictive measures from major economies could dampen the Bitcoin rally.

Macroeconomic conditions, including interest rate decisions, inflation data, and traditional market performance, affect cryptocurrency prices. If risk appetite decreases globally, cryptocurrencies may experience capital outflows despite their long-term potential.

Security breaches, exchange failures, or major protocol vulnerabilities could undermine confidence and trigger selling pressure. While the cryptocurrency industry has matured substantially, these risks haven’t been eliminated.

Investment Strategies for the Current Market Environment

Position Management in a Bull Market

During a Bitcoin market rally, altcoins surge, and disciplined position management becomes crucial. Taking partial profits at predetermined levels helps lock in gains while maintaining exposure to further upside. Dollar-cost averaging out of positions mirrors the strategy that built them, reducing timing risk.

Portfolio rebalancing ensures that any single position doesn’t become disproportionately large due to appreciation. When altcoins significantly outperform, rebalancing can mean taking profits from the strongest performers and redistributing to maintain target allocations.

Stop-loss orders protect against unexpected reversals, though they should be placed thoughtfully to avoid being triggered by normal volatility. Trailing stops can be particularly effective during trending markets, automatically adjusting upward as prices increase.

Diversification Across Cryptocurrency Categories

Smart investors don’t concentrate exclusively on Bitcoin or any single altcoin during a market rally. Diversification across different cryptocurrency categories reduces specific risk while maintaining exposure to the sector’s growth.

A balanced cryptocurrency portfolio might include large-cap assets like Bitcoin and Ethereum for stability, mid-cap layer-1 platforms for growth, and smaller positions in DeFi and utility tokens for higher-risk, higher-reward potential.

Correlation analysis helps identify cryptocurrencies that don’t move in lockstep, providing genuine diversification benefits. While most cryptocurrencies trend together during major moves, their degrees of volatility and specific catalysts differ.

Long-Term Perspective vs. Trading Opportunities

The Bitcoin market rally and the altcoins phenomenon create opportunities for both long-term holders and active traders. Long-term investors focus on fundamental value, accumulating during corrections and holding through volatility with conviction in cryptocurrency’s transformative potential.

Active traders capitalize on shorter-term price movements, using technical analysis and momentum indicators to time entries and exits. This approach requires more time, skill, and risk tolerance but can generate returns that exceed buy-and-hold strategies during trending markets.

Hybrid approaches combine both philosophies: maintaining a core long-term position while allocating a smaller portion to active trading. This strategy provides the peace of mind of holding for fundamental appreciation while allowing participation in shorter-term opportunities.

On-Chain Metrics and Market Health Indicators

Network Activity and Adoption Metrics

On-chain data provides invaluable insights into the health of the Bitcoin market rally. Active addresses have increased substantially, indicating genuine user growth rather than mere price speculation. Transaction counts and fees demonstrate network utilization and demand for block space.

Hash rate—the computational power securing the Bitcoin network—has reached all-time highs, reflecting miner confidence in future profitability and the network’s security robustness. Rising hash rate during price appreciation confirms the health of the market rally.

Altcoin networks show similar positive trends. Ethereum’s daily active users continue growing, with decentralized applications processing billions in daily transaction volume. Layer-1 competitors are establishing growing user bases and developer communities.

Exchange Flow Analysis

Monitoring Bitcoin flows to and from exchanges provides sentiment indicators. Large outflows suggest investors are moving coins to cold storage with no immediate plans to sell, a bullish signal. Currently, exchange reserves are declining, supporting the continuation of the Bitcoin market rally and the altcoins trend.

Whale wallet activity—movements by large holders—can provide early warnings of potential selling pressure or confirmation of accumulation. Current data shows whales accumulating rather than distributing, reinforcing the bullish thesis.

Stablecoin supply on exchanges indicates dry powder available for purchasing cryptocurrencies. When stablecoin reserves are high and Bitcoin prices are rising, it suggests that continued buying power exists to support further appreciation.

Historical Context: Comparing Past Market Cycles

Lessons from Previous Bull Markets

The current Bitcoin market rally shares characteristics with previous bull cycles while exhibiting unique features. The 2017 bull run was driven primarily by retail speculation and ICO mania, leading to an unsustainable bubble. The 2020-2021 cycle incorporated institutional adoption, providing a more stable foundation.

The present rally combines institutional infrastructure, regulatory clarity, and genuine utility expansion—factors absent in earlier cycles. This foundation suggests potentially greater sustainability, though historical patterns remind us that corrections remain inevitable.

Market cycles in cryptocurrency have historically followed Bitcoin halving events, which reduce the rate of new Bitcoin supply. The most recent halving occurred in April 2024, and historical patterns suggest bull markets peak 12-18 months post-halving, placing us potentially in the middle of this cycle.

Altcoin Season Patterns and Timing

Altcoin seasons—periods when alternative cryptocurrencies significantly outperform Bitcoin—typically occur after Bitcoin establishes a new price range and consolidates. Current market dynamics suggest we’re entering this phase, with altcoins posting larger percentage gains than Bitcoin.

Historical data shows altcoin seasons can last several months, with capital rotating through different sectors. Early movers are often large-cap alternatives, followed by mid-caps, and finally small-cap speculative plays as the cycle matures.

Recognizing where we are in the cycle helps inform position management. If we’re in the early-to-middle stages of an altcoin season, substantial opportunities may remain. However, late-stage altcoin rallies often include low-quality projects and unsustainable valuations.

Future Outlook: Where the Market Goes From Here

Price Predictions and Analyst Expectations

Market analysts are increasingly bullish on the Bitcoin market rally and altcoins ‘ continuation. Conservative estimates place Bitcoin’s near-term target at $95,000, while more optimistic projections suggest $100,000-$120,000 is achievable within the current cycle.

Altcoin projections vary widely by project category and market cap. Large-cap alternatives like Ethereum may see 50-100% gains from current levels, while mid-cap projects with strong fundamentals could deliver multiples of that performance.

However, these projections assume continued favorable macroeconomic conditions, sustained institutional interest, and the absence of major negative regulatory developments. Market dynamics can change rapidly, making rigid price predictions unreliable.

Catalysts That Could Extend the Rally

Several potential catalysts could propel the market rally to new heights. Additional countries adopting Bitcoin as legal tender would validate the digital currency’s monetary properties and create new demand sources.

Major technology companies integrating cryptocurrency functionality into their platforms would exponentially increase user exposure and adoption. If social media giants or payment processors expand their crypto offerings, billions of users will gain easy access.

Ethereum’s continued scaling through layer-2 solutions and upcoming network upgrades could drive renewed interest in the ecosystem and associated altcoins. Successfully addressing scalability while maintaining decentralization would be a significant achievement.

Traditional financial system disruptions—whether through banking crises, currency devaluations, or sovereign debt concerns—often drive safe-haven demand for Bitcoin, potentially accelerating its appreciation and lifting the broader cryptocurrency market.

Conclusion

The current Bitcoin market rally and the altcoins phenomenon represent a transformative moment for the cryptocurrency ecosystem. With Bitcoin reaching $87,000 and altcoins posting their most impressive gains in months, investors are witnessing the maturation of digital assets as a legitimate investment class.

The convergence of institutional adoption, regulatory clarity, technological advancement, and macroeconomic conditions has created an environment conducive to sustained appreciation. While volatility remains inherent to cryptocurrency markets, the fundamental foundation supporting this market rally appears stronger than in previous cycles.

Read More: Bitcoin Dip Below $110K Triggers $524M Crypto Liquidations