Bitcoin price nears $113,700, marking one of the most significant rallies in digital asset history. After briefly touching the $114,000 threshold, Bitcoin has captured global attention as investors respond to a stunning 98% probability of Federal Reserve interest rate cuts. This remarkable convergence of monetary policy expectations and cryptocurrency market dynamics has propelled Bitcoin to new heights, reinforcing its position as a leading alternative asset class in an evolving financial landscape.

The Bitcoin price surge coincides with growing institutional adoption, macroeconomic uncertainty, and shifting Federal Reserve policies that collectively create a perfect storm for cryptocurrency appreciation. As traditional markets grapple with inflation concerns and economic headwinds, digital assets continue demonstrating resilience and attractiveness to both retail and institutional investors seeking portfolio diversification and inflation hedges.

Bitcoin Price Rally to $113,700

What’s Driving Bitcoin’s Historic Climb?

The recent movement where Bitcoin price nears $113,700 represents more than just another bullish cycle—it signals a fundamental shift in how global markets perceive cryptocurrency value propositions. Several interconnected factors contribute to this extraordinary price action:

Monetary Policy Expectations: The Federal Reserve’s anticipated rate cuts have historically correlated with Bitcoin appreciation. When interest rates decline, traditional savings vehicles offer diminished returns, prompting investors to explore alternative assets. The current 98% probability of rate cuts—the highest in recent memory—has accelerated capital rotation into cryptocurrency markets, with Bitcoin serving as the primary beneficiary.

Institutional Investment Flows: Major financial institutions have dramatically increased their Bitcoin exposure through spot ETFs, treasury allocations, and derivative positions. This institutional validation provides price support and reduces volatility compared to previous cycles. The BTC price surge reflects sustained institutional accumulation rather than speculative retail frenzy.

Macroeconomic Uncertainty: Global economic challenges, including persistent inflation concerns, geopolitical tensions, and currency devaluation fears, have enhanced Bitcoin’s appeal as “digital gold.” Investors increasingly view Bitcoin as a store of value that transcends traditional financial system vulnerabilities.

Technical Analysis: Bitcoin’s Path to $114K

From a technical perspective, the Bitcoin price movement demonstrates strong bullish momentum across multiple timeframes. Key resistance levels have been systematically overcome, with the $114,000 level representing a psychological barrier rather than significant technical resistance.

Trading volume has increased substantially during this rally, indicating genuine market participation rather than thin, manipulated price action. The volume-to-price relationship suggests a healthy market structure capable of supporting continued appreciation. On-chain metrics reveal decreased exchange balances, signaling that holders prefer long-term accumulation over short-term profit-taking.

The relative strength index (RSI) across daily and weekly charts shows strong momentum without reaching extreme overbought conditions that typically precede corrections. This measured approach suggests the Bitcoin price rally possesses sustainable characteristics rather than parabolic, unsustainable growth patterns.

Federal Reserve Rate-Cut Implications for Bitcoin

How Fed Policy Shapes Cryptocurrency Markets

The extraordinary 98% probability of Federal Reserve rate cuts represents a pivotal moment for financial markets broadly and cryptocurrency specifically. Understanding this relationship illuminates why the Bitcoin price nears $113,700 at precisely this juncture.

Liquidity Environment: Interest rate reductions inject liquidity into financial systems, increasing money supply and reducing borrowing costs. This expanded liquidity historically flows into risk assets, with Bitcoin increasingly classified as a legitimate portfolio allocation rather than purely speculative investment. Lower rates diminish opportunity costs associated with holding non-yielding assets like Bitcoin.

Dollar Weakening Dynamics: Fed rate cuts typically weaken the U.S. dollar relative to other currencies and alternative stores of value. Bitcoin’s fixed supply and decentralized nature position it as a natural beneficiary of dollar depreciation. International investors seeking dollar-hedging strategies frequently turn to cryptocurrency assets, particularly Bitcoin, given its global accessibility and liquidity.

Inflation Hedge Narrative: Rate cuts often accompany concerns about economic growth, potentially triggering inflationary monetary policies. Bitcoin’s programmatic supply schedule—with only 21 million coins ever to exist—creates scarcity dynamics that contrast sharply with fiat currency expansion. This inflation-hedge narrative gains credibility as central banks pursue accommodative policies.

Historical Correlation Between Rate Cuts and BTC Performance

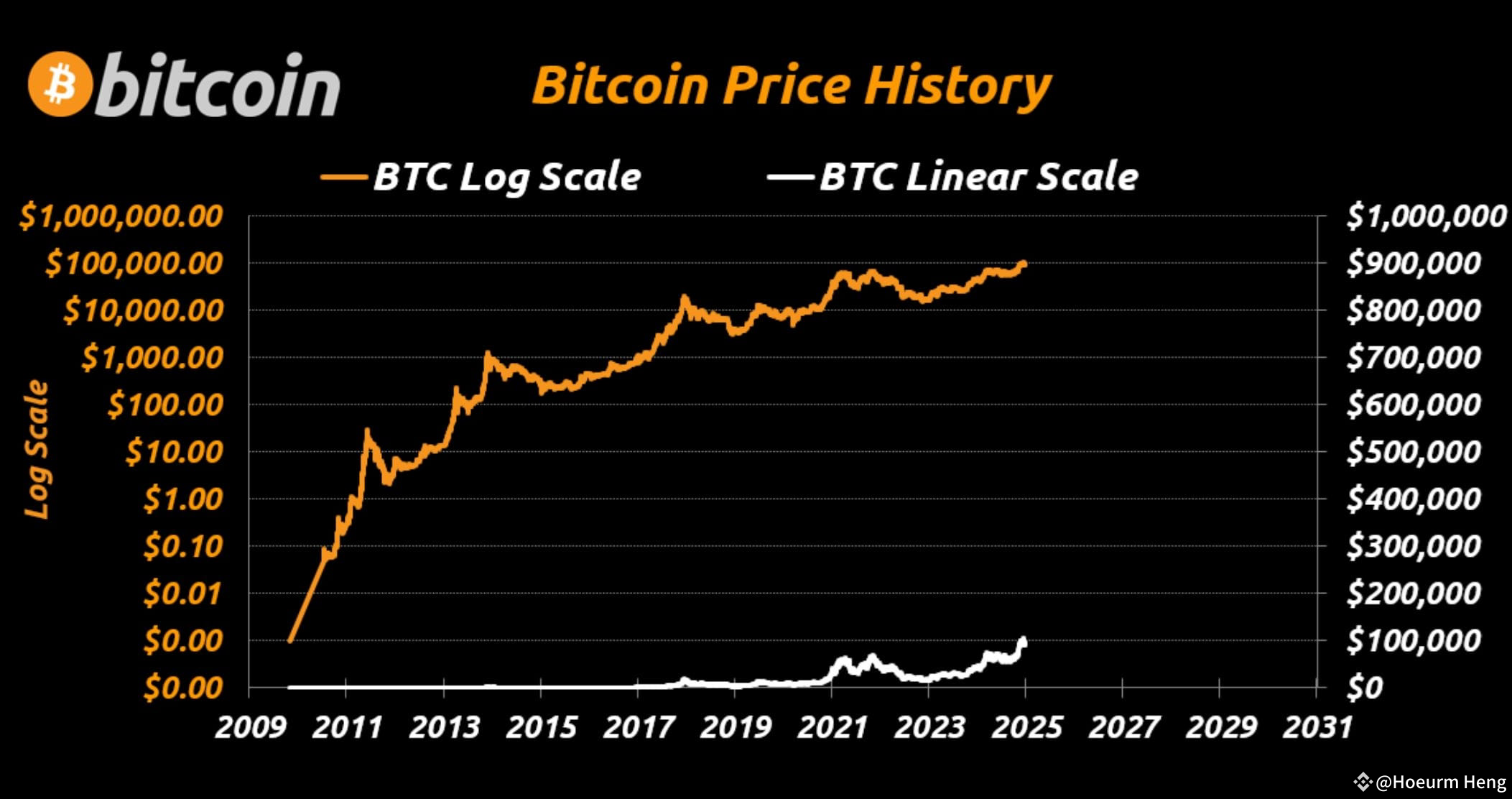

Examining previous rate-cut cycles provides valuable context for understanding the current Bitcoin price surge. During the 2019 rate-cut cycle, Bitcoin appreciated by over 200% as the Federal Reserve pivoted from tightening to easing. Similarly, the unprecedented 2020 rate cuts coincided with Bitcoin’s remarkable rally from $5,000 to eventual all-time highs above $60,000.

These historical precedents suggest rate-cut environments create favorable conditions for Bitcoin investment, though correlation doesn’t guarantee causation. Multiple factors influence cryptocurrency prices, and Fed policy represents one significant variable among many.

The current 98% probability represents exceptional certainty compared to previous cycles, where rate-cut expectations emerged more gradually. This definitive market consensus has allowed investors to position portfolios proactively, contributing to Bitcoin’s preemptive appreciation as the BTC price nears record territories.

Market Sentiment and Investor Psychology

Institutional vs. Retail Participation

The composition of market participants significantly differs in the current cycle compared to previous Bitcoin rallies. Institutional investors now comprise a substantially larger percentage of trading volume and holdings, fundamentally altering market dynamics.

Corporate treasuries, hedge funds, pension funds, and insurance companies have allocated billions toward Bitcoin exposure. This institutional participation provides price stability, reduces manipulation susceptibility, and enhances mainstream credibility. Unlike retail-dominated rallies characterized by high volatility and emotional trading, institutional involvement creates more measured, sustainable price appreciation.

However, retail investors remain essential market participants, bringing enthusiasm, adoption, and network effects that strengthen Bitcoin’s ecosystem. The balanced participation between institutional and retail segments creates a healthy market structure supporting the Bitcoin price at elevated levels.

Fear and Greed Index Insights

Cryptocurrency market sentiment indicators, particularly the Fear and Greed Index, provide psychological context for understanding current price action. As the Bitcoin price nears $113,700, sentiment metrics show elevated optimism without reaching extreme euphoria levels that typically signal market tops.

This measured optimism suggests room for continued appreciation before exhaustion signals emerge. Sophisticated investors recognize that sustainable bull markets build gradually rather than exploding parabolically, and current sentiment readings align with ongoing bullish trends rather than imminent reversals.

Social media engagement, search volume trends, and media coverage have increased proportionally with price appreciation but remain below previous cycle peaks. This suggests broader awareness growth potential as mainstream audiences discover Bitcoin’s value proposition amid favorable macroeconomic conditions.

Bitcoin’s Role in Diversified Investment Portfolios

Modern Portfolio Theory and Cryptocurrency Allocation

Financial advisors increasingly recommend modest Bitcoin allocation within diversified portfolios, recognizing cryptocurrency’s low correlation with traditional assets. Academic research demonstrates that small Bitcoin positions—typically 1-5% of portfolio value—can enhance risk-adjusted returns without dramatically increasing overall portfolio volatility.

As the Bitcoin price reaches unprecedented levels, allocation strategies require careful consideration. Dollar-cost averaging remains the preferred approach for most investors, systematically accumulating positions over time rather than attempting market timing. This disciplined methodology reduces emotional decision-making and smooths entry prices across market cycles.

Rebalancing protocols become crucial as Bitcoin appreciates, preventing cryptocurrency positions from dominating portfolios beyond intended allocation percentages. Professional wealth managers implement regular rebalancing schedules, capturing gains during appreciation while maintaining strategic asset allocation frameworks.

Risk Management Considerations

Despite Bitcoin’s impressive performance, prudent investors acknowledge inherent volatility and implement appropriate risk management strategies. Position sizing represents the foundational risk management element—never allocating more capital than comfortable losing entirely, recognizing cryptocurrency’s speculative characteristics.

Stop-loss strategies, though controversial in cryptocurrency communities, provide downside protection for risk-averse investors. However, Bitcoin’s volatility can trigger premature stop-loss executions, so careful consideration of placement levels and timeframes proves essential.

Diversification within cryptocurrency holdings—allocating across Bitcoin, Ethereum, and select alternative coins—can reduce single-asset risk while maintaining crypto market exposure. However, Bitcoin typically constitutes the majority of serious investors’ cryptocurrency allocations given its liquidity, security, and established network effects.

Technical Factors Supporting Bitcoin’s Price Level

On-Chain Metrics and Network Fundamentals

Beyond price charts, on-chain analytics provide deep insights into Bitcoin’s fundamental strength. As BTC price nears $113,700, key on-chain metrics reveal robust network health supporting elevated valuations.

Hash Rate Security: Bitcoin’s network hash rate—the computational power securing the blockchain—has reached all-time highs, demonstrating miner confidence and network security. Higher hash rates increase attack costs, enhancing Bitcoin’s value proposition as a secure, censorship-resistant monetary network.

Active Addresses and Transaction Volume: Network activity metrics show sustained growth in daily active addresses and transaction volumes, indicating genuine utility rather than purely speculative interest. Real economic activity occurring on Bitcoin’s blockchain validates its monetary network thesis.

HODL Waves and Long-Term Holder Behavior: Significant percentages of Bitcoin supply remain dormant for extended periods, demonstrating strong conviction among long-term holders. These “HODLers” reduce circulating supply available for trading, creating supply constraints that support price appreciation during demand surges.

Mining Economics and Production Costs

Bitcoin mining economics provide price support levels based on production costs. The most recent halving event reduced block rewards, increasing per-coin production costs for miners. Current Bitcoin prices substantially exceed most miners’ break-even thresholds, ensuring profitable operations and continued network security investment.

Mining difficulty adjustments maintain approximately ten-minute block intervals regardless of hash rate fluctuations, demonstrating Bitcoin’s elegant economic design. As the price appreciates, mining becomes more profitable, attracting additional computational resources that increase difficulty, which subsequently raises production costs—creating a natural price support mechanism.

The geographic distribution of mining operations has diversified following regulatory changes in various jurisdictions, enhancing network decentralization and resilience. This geographic diversity reduces single-point-of-failure risks and demonstrates Bitcoin’s antifragile characteristics.

Global Economic Context and Bitcoin Adoption

International Monetary Developments

The Bitcoin price rally occurs against a backdrop of significant international monetary developments. Central banks worldwide face similar challenges—balancing economic growth objectives against inflation concerns while navigating geopolitical complexities.

Countries experiencing currency crises or high inflation increasingly view Bitcoin as a viable alternative or complement to traditional monetary systems. This emerging market adoption, while representing a small percentage of total Bitcoin volume, demonstrates real-world utility beyond speculative investment.

Cross-border payment applications showcase Bitcoin’s practical advantages over traditional banking infrastructure, particularly for international remittances. Though transaction costs sometimes challenge small-value transfers, Lightning Network and other second-layer solutions address scalability limitations while preserving Bitcoin’s base-layer security.

Regulatory Landscape Evolution

Regulatory clarity continues improving across major jurisdictions, reducing uncertainty that historically dampened institutional participation. The United States, European Union, and Asian financial centers have developed increasingly sophisticated frameworks governing cryptocurrency trading, custody, and taxation.

This regulatory maturation legitimizes Bitcoin investment for institutions previously constrained by compliance concerns. Clear rules enable proper risk assessment and control implementation, removing barriers to institutional adoption. While regulatory approaches vary internationally, the trend toward recognition and accommodation rather than prohibition strengthens Bitcoin’s long-term prospects.

Spot Bitcoin ETF approvals in major markets represent watershed moments in cryptocurrency legitimization. These investment vehicles provide traditional investors with familiar, regulated access to Bitcoin exposure without direct custody requirements, dramatically expanding potential investor bases.

Price Predictions and Future Outlook

Analyst Projections for Bitcoin’s Trajectory

Financial analysts and cryptocurrency experts offer varied Bitcoin price predictions extending across broad ranges, reflecting inherent uncertainty in emerging asset classes. Conservative analysts anticipate consolidation around current levels before potential further appreciation, while optimistic projections target substantially higher valuations.

Several prominent analysts cite stock-to-flow models, adoption curves, and macroeconomic tailwinds supporting continued Bitcoin appreciation. These models, while controversial, provide frameworks for understanding Bitcoin’s supply scarcity relative to demand growth. Critics rightfully note that past performance doesn’t guarantee future results, and model limitations shouldn’t be ignored.

Institutional research divisions at major financial firms increasingly publish Bitcoin analysis, applying traditional financial methodologies to cryptocurrency valuation. While diverse methodologies produce varied conclusions, growing institutional research attention validates Bitcoin as a serious asset class warranting professional analysis.

Potential Catalysts and Risk Factors

Several potential catalysts could propel the Bitcoin price beyond current levels. Sovereign wealth fund allocations, additional corporate treasury adoptions, or central bank reserve diversification into Bitcoin would represent demand shocks difficult for supply to accommodate, potentially driving significant appreciation.

Conversely, risk factors deserve equal consideration. Regulatory crackdowns, security breaches at major exchanges, or macroeconomic developments contradicting current rate-cut expectations could trigger corrections. Technical vulnerabilities, though unlikely given Bitcoin’s extensive battle-testing, represent tail risks requiring acknowledgment.

Geopolitical developments, particularly regarding Bitcoin’s role in international sanctions evasion or authoritarian government responses to cryptocurrency adoption, create unpredictable risk vectors. Bitcoin’s censorship-resistant properties generate both opportunities and challenges depending on governmental perspectives.

Trading Strategies for Current Market Conditions

Approaches for Different Investor Profiles

As the Bitcoin price nears $113,700, investors must align their strategies with risk tolerance, time horizons, and financial objectives. Long-term accumulation strategies suit investors believing in Bitcoin’s fundamental value proposition across multi-year timeframes. These investors focus less on short-term volatility, instead systematically building positions through market cycles.

Active traders might employ technical analysis, identifying support and resistance levels for tactical entries and exits. However, Bitcoin’s 24/7 trading and volatility make active trading psychologically and practically demanding. Most retail investors achieve superior results through passive strategies rather than attempting to time market movements.

Options and derivatives markets provide sophisticated investors with tools for hedging, speculation, or yield generation. However, these instruments introduce complexity and risks requiring substantial expertise. Conservative investors typically avoid leveraged products, recognizing that spot Bitcoin ownership provides sufficient exposure without liquidation risks.

Tax Implications and Record-Keeping

Bitcoin investment generates tax obligations in most jurisdictions, requiring careful record-keeping and planning. Capital gains taxation applies to profits from Bitcoin sales, with holding periods often determining long-term versus short-term rates. Sophisticated investors consult tax professionals to optimize after-tax returns through strategic timing and loss harvesting.

Cryptocurrency-specific tax software simplifies tracking across exchanges, wallets, and transactions. Given blockchain transparency, tax authorities increasingly possess capabilities to identify undeclared cryptocurrency gains, making compliance both prudent and legally required.

International investors face varied tax treatments depending on residency and citizenship, sometimes creating advantageous planning opportunities. Understanding applicable tax laws prevents costly surprises and optimizes net returns from Bitcoin appreciation.

Comparing Bitcoin to Traditional Assets

Bitcoin vs. Gold: The Digital Gold Narrative

Bitcoin’s comparison to gold—often termed “digital gold”—provides a useful framework for understanding its value proposition. Both assets share characteristics including scarcity, durability, and store-of-value functions. However, Bitcoin offers advantages in portability, divisibility, and verification, while gold maintains advantages in historical precedent and broader acceptance.

As the Bitcoin price appreciates, its market capitalization approaches significant fractions of gold’s total value, though remaining substantially smaller. Some analysts project eventual parity based on superior monetary properties, while skeptics question whether digital assets can replicate thousands of years of gold’s monetary history.

Portfolio allocations increasingly treat Bitcoin as complementary to gold rather than purely competitive. Both assets serve portfolio diversification functions while offering distinct risk-return profiles appropriate for different scenarios and investor preferences.

Bitcoin vs. Stocks: Risk-Return Profiles

Comparing Bitcoin investment to equity markets reveals dramatically different risk-return characteristics. Bitcoin’s historical volatility substantially exceeds stock market volatility, offering both higher potential returns and larger potential losses. This volatility gradually decreases as Bitcoin market capitalization grows, though remaining elevated compared to traditional assets.

Stocks provide ownership stakes in productive enterprises generating cash flows, while Bitcoin represents a monetary network without traditional cash flow generation. This fundamental difference creates distinct valuation methodologies and risk characteristics requiring different analytical frameworks.

Correlation studies show Bitcoin maintaining relatively low correlation with stock markets across most time periods, though correlations increase during extreme market stress when all risk assets tend to move together. This correlation pattern emphasizes Bitcoin’s diversification benefits during normal market conditions.

Security and Custody Considerations

Self-Custody vs. Custodial Solutions

As Bitcoin holdings appreciate, security considerations become paramount. Investors must choose between self-custody—maintaining direct control of private keys—and custodial solutions where third parties secure assets. Each approach offers distinct advantages and trade-offs.

Self-custody provides maximum control and eliminates counterparty risk but requires technical competence and responsibility for security. Hardware wallets offer reasonable security for most users, storing private keys offline while enabling transaction signing. However, inheritance planning, backup procedures, and operational security require careful consideration.

Custodial solutions through regulated exchanges or specialized custody providers offer convenience and institutional-grade security infrastructure. However, custody introduces counterparty risk—the possibility of exchange failures, hacks, or fraud. Selecting reputable, insured custodians mitigates but doesn’t eliminate these risks.

Best Practices for Bitcoin Security

Regardless of custody choice, security best practices significantly reduce risk exposure. Multi-signature wallets require multiple private keys for transaction authorization, preventing single points of failure. Geographic distribution of keys across secure locations further enhances security against physical threats.

Regular security audits, strong password hygiene, two-factor authentication, and email security prevent common attack vectors. Social engineering attacks targeting cryptocurrency holders have increased alongside Bitcoin price appreciation, requiring vigilance against phishing attempts and impersonation scams.

Inheritance planning ensures beneficiaries can access Bitcoin holdings upon death or incapacitation. Without proper planning, Bitcoin can become permanently inaccessible, effectively removing it from circulation. Professional estate planners increasingly understand cryptocurrency considerations and can structure appropriate inheritance mechanisms.

The Future of Bitcoin and Cryptocurrency Markets

Technological Developments and Scaling Solutions

Bitcoin’s technical roadmap includes ongoing development to enhance functionality, privacy, and scalability. The Lightning Network enables instant, low-cost transactions by conducting them off-chain while settling periodically on Bitcoin’s base layer. This second-layer solution addresses transaction throughput limitations without compromising base-layer security.

Taproot upgrade implementation improved privacy and smart contract capabilities, demonstrating Bitcoin’s continued evolution despite its reputation as ossified technology. Conservative development philosophy prioritizes security and stability over rapid feature additions, reflecting Bitcoin’s role as foundational monetary infrastructure.

Further scaling solutions under development or discussion include additional privacy enhancements, cross-chain interoperability protocols, and continued Lightning Network refinement. These improvements position Bitcoin to support increased adoption without sacrificing security or decentralization—core properties underlying its value proposition.

Mainstream Adoption Trajectories

As the Bitcoin price nears $113,700, mainstream adoption continues accelerating across demographic segments and geographic regions. Payment processors increasingly support Bitcoin transactions, merchants expand acceptance, and user interfaces improve accessibility for non-technical users.

Generational wealth transfer from baby boomers to millennials and Generation Z—demographics showing higher cryptocurrency affinity—potentially catalyzes significant capital inflows. Younger investors demonstrate greater comfort with digital assets and skepticism toward traditional financial institutions, creating demographic tailwinds for Bitcoin adoption.

Educational initiatives by industry participants, academic institutions, and media organizations gradually improve public understanding of Bitcoin’s technology and value propositions. As comprehension increases, the stigma and mystery surrounding cryptocurrency diminish, facilitating broader acceptance and integration into mainstream finance.

Conclusion

The remarkable situation where Bitcoin price nears $113,700 represents more than a numerical milestone—it signals cryptocurrency’s maturation into a legitimate asset class commanding serious attention from global investors, institutions, and policymakers. The confluence of favorable Federal Reserve policy expectations, institutional adoption, and improving regulatory clarity creates conditions supporting continued Bitcoin appreciation.

However, prudent investors recognize that past performance doesn’t guarantee future results and maintain realistic expectations about volatility and risk. Whether Bitcoin continues its ascent or experiences corrections, the long-term trajectory appears increasingly positive as adoption expands and monetary properties gain recognition.