November has historically been a bullish month for cryptocurrency markets, with traders and investors coining the term “Moonvember” to describe Bitcoin’s tendency to surge during this period. However, 2025 might tell a different story. Multiple analysts are now suggesting that Bitcoin trading sideways could be the dominant theme this month, rather than the explosive price movements many had anticipated.

As the world’s leading cryptocurrency hovers around key resistance levels, market participants are recalibrating their expectations. The speculation surrounding Bitcoin trading sideways has gained traction among professional traders, technical analysts, and institutional investors who are closely monitoring on-chain metrics, macroeconomic indicators, and historical patterns. This shift in sentiment represents a significant departure from the euphoric predictions that typically characterise November in the crypto space.

Understanding why experts believe Bitcoin might consolidate rather than rally requires examining multiple factors: technical analysis, market structure, macroeconomic conditions, and investor sentiment. Let’s dive deep into the reasons behind this prediction and what it means for your portfolio.

Why Analysts Predict Bitcoin Trading Sideways in November

Technical Analysis Suggests Consolidation Phase

Technical analysts examining Bitcoin’s price action have identified several key indicators suggesting that Bitcoin trading sideways is the most probable scenario for November 2025. The cryptocurrency has been trading within a defined range for several weeks, bouncing between crucial support and resistance levels without establishing a clear directional bias.

The Relative Strength Index (RSI) on multiple timeframes shows Bitcoin sitting in neutral territory, neither overbought nor oversold. This technical positioning typically precedes extended consolidation periods rather than explosive breakouts. Additionally, trading volume has declined significantly compared to previous months, indicating reduced conviction among both buyers and sellers.

Veteran crypto trader Michael van de Poppe recently noted that Bitcoin’s current market structure resembles previous consolidation phases that lasted between 30 to 60 days. “When we see these tight ranges with declining volume, it usually means the market is building energy for the next major move,” he explained. “But that move doesn’t necessarily happen immediately.”

Historical November Performance Doesn’t Guarantee Rallies

While the term “Moonvember” has become popular in crypto circles, historical data presents a more nuanced picture. Analysis of Bitcoin’s performance across previous Novembers reveals that while some years delivered impressive returns, others saw minimal price movement or even declines.

In November 2020, Bitcoin gained approximately 42%, fueling the narrative of November as a consistently bullish month. However, November 2019 saw Bitcoin decline by nearly 18%, and November 2018 witnessed a catastrophic 37% drop during the bear market. These historical precedents support the argument for Bitcoin trading sideways rather than assuming automatic upward momentum.

Market analyst Benjamin Cowen emphasised this point in his recent market commentary: “Survivorship bias causes people to remember only the good Novembers. The reality is that November’s performance depends heavily on where Bitcoin sits in its four-year cycle and broader macroeconomic conditions.”

Macroeconomic Factors Supporting Sideways Movement

Federal Reserve Policy and Interest Rates

The macroeconomic environment plays a crucial role in cryptocurrency price action, and current conditions favour consolidation over explosive growth. The Federal Reserve’s monetary policy stance remains a critical factor influencing Bitcoin trading sideways expectations for November.

With interest rates still elevated compared to the previous decade, risk assets like Bitcoin face headwinds. The Fed has signalled a cautious approach to further rate adjustments, creating uncertainty in financial markets. This uncertainty typically manifests as sideways trading in volatile assets as investors wait for clearer directional signals.

Furthermore, the strength of the US dollar has implications for Bitcoin’s price trajectory. A robust dollar often correlates with subdued Bitcoin performance, as the cryptocurrency becomes relatively more expensive for international investors. Current dollar index levels suggest continued strength, potentially limiting Bitcoin’s upside potential in the near term.

Global Economic Uncertainty

Beyond domestic US policy, global economic factors contribute to predictions of Bitcoin trading sideways throughout November. Geopolitical tensions, concerns about economic growth in major economies, and ongoing debates about regulatory frameworks for cryptocurrencies all create an environment of caution among investors.

China’s economic recovery trajectory, European Union economic challenges, and emerging market currency volatility all influence global risk appetite. When institutional investors perceive heightened uncertainty, they often reduce position sizes and wait for clarity before making significant allocational changes. This wait-and-see approach typically results in consolidation rather than trending markets.

On-Chain Metrics Indicate Market Indecision

Exchange Flow Analysis

On-chain data provides valuable insights into market dynamics, and current metrics support the thesis of Bitcoin trading sideways in November. Exchange flow analysis reveals a relative balance between Bitcoin deposits and withdrawals, suggesting neither strong accumulation nor aggressive distribution.

When Bitcoin flows heavily from exchanges to private wallets, it typically indicates long-term holders accumulating and reducing available supply. Conversely, large flows to exchanges often precede selling pressure. The current equilibrium in these flows suggests market participants are largely sitting on the sidelines, waiting for catalysts before taking decisive action.

Glassnode, a leading on-chain analytics provider, reported that Bitcoin’s exchange netflow has remained near zero for several consecutive weeks. This neutral positioning aligns with sideways price action expectations and indicates a market in temporary equilibrium.

Whale Activity and Accumulation Patterns

Large holders, commonly referred to as “whales,” significantly influence Bitcoin’s price movements. Recent whale activity patterns suggest a pause in aggressive accumulation, supporting predictions of Bitcoin trading sideways this month.

Analysis of addresses holding more than 1,000 BTC shows that these entities have largely maintained their positions without significant changes. This contrasts with previous accumulation phases, where whale addresses showed consistent growth. The lack of strong directional conviction among major holders often precedes consolidation periods as the market searches for equilibrium pricing.

Market Sentiment and Investor Psychology

The Contrarian Perspective

Interestingly, the widespread expectation of “Moonvember” rallies might actually contribute to Bitcoin trading sideways behaviour. Markets often move in ways that frustrate the majority of participants, and when bullish expectations become consensus, the probability of disappointment increases.

Funding rates in perpetual futures markets have remained elevated, indicating that many traders are positioned long (betting on price increases). When positioning becomes one-sided, markets often consolidate or move against the crowd until leverage is flushed out and sentiment resets.

Crypto analyst Nic Carter noted: “When everyone expects Bitcoin to pump, that’s often when it does the opposite or simply trades sideways. Markets need skeptics and sellers to create sustainable upward momentum.”

Retail vs. Institutional Divergence

The divergence between retail sentiment and institutional positioning provides additional context for Bitcoin trading sideways predictions. While retail investors on social media platforms express strong bullish conviction, institutional order flow data suggests more cautious positioning.

Institutional investors typically operate with longer time horizons and more sophisticated risk management frameworks. Their current reduced activity levels indicate a preference to wait for clearer market signals before deploying significant capital. This institutional caution acts as a dampener on price volatility and supports range-bound trading.

What Sideways Trading Means for Bitcoin Investors

Short-Term Trading Strategies

For traders, Bitcoin trading sideways creates specific opportunities and challenges. Range-bound markets favour different strategies compared to trending markets. Successful range traders identify support and resistance levels and execute trades near these boundaries, buying support and selling resistance.

Options strategies become particularly relevant during sideways markets. Selling covered calls or cash-secured puts can generate income while Bitcoin consolidates. These strategies benefit from time decay and reduced volatility, which typically characterise sideways trading periods.

However, traders must remain vigilant for potential breakouts. Consolidation phases inevitably end, and the subsequent move can be explosive. Setting alerts at key technical levels ensures traders don’t miss significant moves when Bitcoin eventually breaks from its range.

Long-Term Holder Perspective

Long-term Bitcoin holders often view sideways trading periods positively, as they provide opportunities to accumulate at relatively stable prices. If Bitcoin trading sideways characterises November, it offers patient investors the chance to dollar-cost average without chasing rapid price appreciation.

Historically, Bitcoin’s most significant returns have come from positions accumulated during consolidation phases rather than during explosive rallies. Investors who bought during the 2018-2019 sideways market or the mid-2023 consolidation period enjoyed substantial gains when Bitcoin eventually broke higher.

Additionally, sideways markets reduce the stress associated with high volatility. For investors with long time horizons, temporary price consolidation is merely noise in Bitcoin’s broader adoption trajectory.

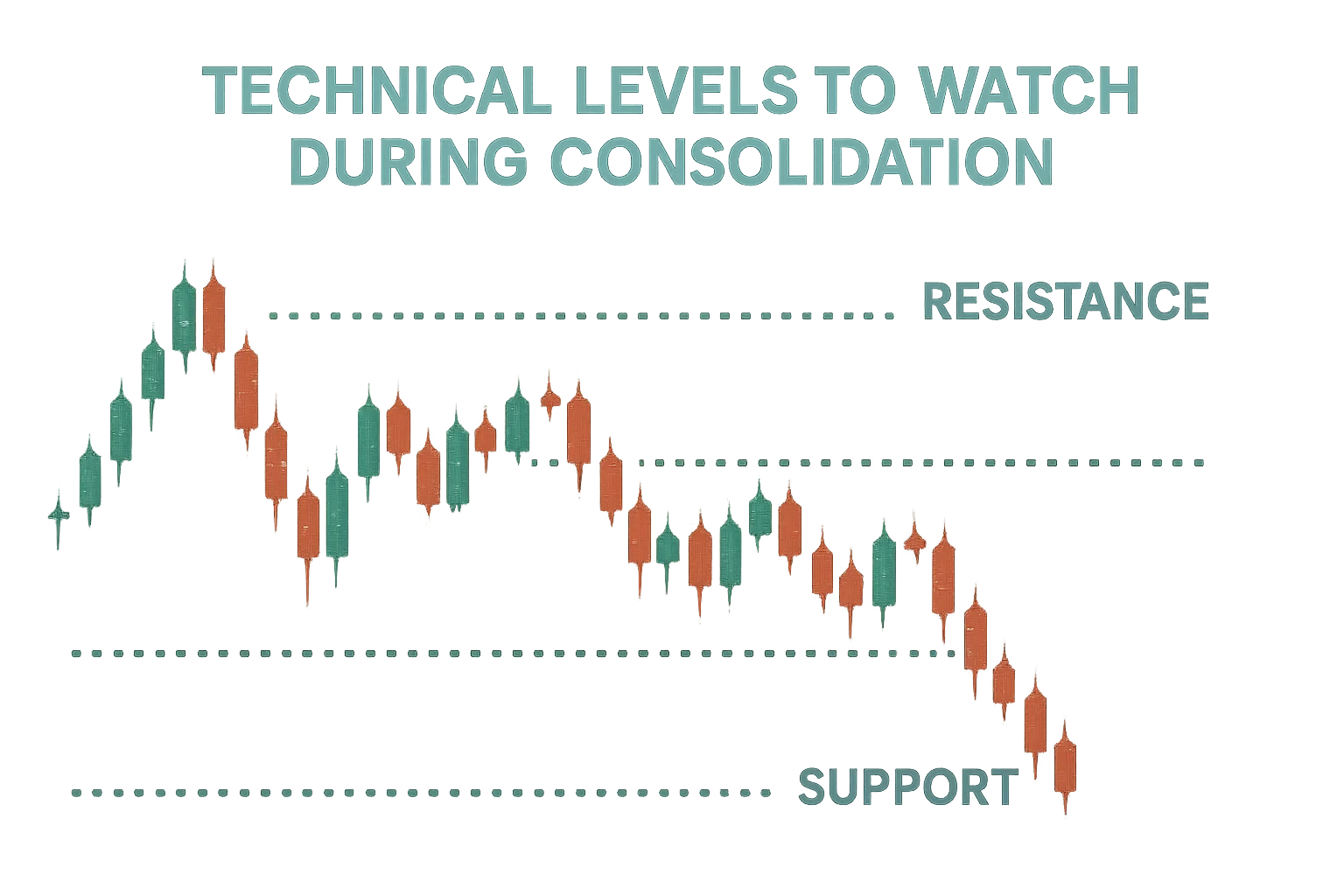

Technical Levels to Watch During Consolidation

Key Support Zones

Understanding critical support levels becomes essential when Bitcoin trading sideways defines the market environment. Multiple technical support zones have emerged that could dictate Bitcoin’s short-term price behaviour.

The primary support level sits where Bitcoin has bounced multiple times in recent weeks. This zone represents a confluence of technical factors, including previous resistance turned support, the 200-day moving average, and high-volume nodes from volume profile analysis. A sustained break below this level would invalidate the sideways trading thesis and potentially trigger deeper corrections.

Secondary support exists at lower levels, representing ultimate downside targets if the consolidation range breaks negatively. These levels align with Fibonacci retracement levels from previous rallies and represent areas where long-term holders have historically added to positions.

Resistance Barriers

Resistance levels define the upper boundary of the expected sideways trading range. Bitcoin trading sideways implies repeated tests of resistance without successful breakouts. The primary resistance zone has rejected Bitcoin’s price multiple times, creating a ceiling that bulls must overcome to invalidate the consolidation scenario.

This resistance area coincides with psychological round numbers, previous all-time high levels, and technical indicators like the 50-week moving average on certain timeframes. The concentration of sell orders at these levels creates significant supply that must be absorbed before upward continuation becomes possible.

Technical analysts employ various tools to identify resistance strength, including order book analysis, volume profile studies, and measurement of previous rejection patterns. The current resistance structure suggests that multiple attempts may be necessary before a decisive breakout occurs.

Potential Catalysts That Could End Sideways Trading

Regulatory Developments

While analysts predict Bitcoin trading sideways for November, certain catalysts could disrupt this forecast. Regulatory news represents one of the most impactful potential catalysts that could end consolidation and trigger directional movement.

Major regulatory clarity from significant jurisdictions like the United States, the European Union, or Asian financial centres could provide the catalyst needed for Bitcoin to break from its range. Positive regulatory developments tend to reduce uncertainty premiums and attract institutional capital, potentially driving prices higher.

Conversely, unexpectedly restrictive regulatory measures could trigger downside breaks from consolidation ranges. The crypto market remains highly sensitive to regulatory headlines, making such developments critical to monitor during sideways trading periods.

Institutional Adoption Announcements

Corporate treasury adoption, exchange-traded fund inflows, or major payment processor integrations represent potential catalysts that could end Bitcoin’s trading sideways behaviour. These developments signal increasing mainstream acceptance and can attract substantial new capital to the cryptocurrency.

The approval and subsequent trading of spot Bitcoin ETFs have created new pathways for institutional and retail investment. Significant inflow announcements into these products could provide the buying pressure needed to break Bitcoin from consolidation and resume upward trends.

Macroeconomic Data Releases

Economic data releases, particularly those related to inflation, employment, and Federal Reserve policy, can significantly impact Bitcoin’s price trajectory. Strong or weak data that alters expectations for monetary policy could end the sideways trading phase and establish a new trend.

Markets currently anticipate specific economic outcomes, and significant deviations from expectations could trigger volatility. Investors should maintain awareness of key economic calendar dates during periods when Bitcoin trading sideways characterises market behaviour.

Historical Patterns of Post-Consolidation Moves

Breakout Characteristics

Understanding how previous consolidation phases resolved provides context for current Bitcoin trading sideways expectations. Historical analysis reveals that Bitcoin’s sideways trading periods typically end with decisive directional moves accompanied by high volume.

The direction of breakouts often correlates with the broader trend preceding the consolidation. If Bitcoin entered sideways trading from an uptrend, the probability of upward resolution increases. Technical analysts call this “continuation patterns,” and they represent high-probability trading setups.

The duration of consolidation often influences the magnitude of subsequent moves. Longer sideways phases typically accumulate more energy, resulting in more substantial breakouts. If Bitcoin trading sideways extends beyond November into December, the eventual move could be proportionally larger.

Volume Confirmation

Volume analysis provides critical confirmation of breakout validity. True breakouts from sideways ranges occur on significantly higher volume than seen during consolidation. This increased participation confirms genuine momentum rather than false breaks that quickly reverse.

Traders should remain sceptical of breakouts on low volume, as these frequently fail and return prices to the established range. Waiting for volume confirmation reduces the risk of entering positions on false signals during Bitcoin trading sideways periods.

Alternative Scenarios to Consider

Surprise Rally Scenario

While analysts lean toward Bitcoin trading sideways for November, alternative scenarios deserve consideration. A surprise rally remains possible if unexpected positive catalysts emerge or if technical breakouts occur sooner than anticipated.

Black swan events, unexpected institutional announcements, or sudden shifts in macroeconomic conditions could all trigger upside surprises. Prudent investors maintain some exposure to potential upside even when base case scenarios suggest consolidation.

Downside Risk Scenario

Conversely, risks exist that Bitcoin could break lower from current levels rather than trading sideways. Technical support failures, negative regulatory developments, or broader financial market stress could pressure Bitcoin downward.

Risk management remains crucial regardless of whether Bitcoin trading sideways or more volatile scenarios materialise. Position sizing, stop-loss orders, and portfolio diversification help protect capital during unexpected market moves.

How to Position Your Portfolio During Consolidation

Balanced Approach

When Bitcoin trading sideways characterises the market, balanced portfolio positioning becomes optimal. Maintaining core long-term holdings while allocating smaller portions to active trading strategies provides exposure to both consolidation and potential breakout scenarios.

Diversification across different cryptocurrencies, traditional assets, and cash reserves creates flexibility to capitalise on opportunities as they emerge. Sideways markets reward patience and discipline rather than aggressive speculation.

Dollar-Cost Averaging Benefits

Consolidation periods offer ideal conditions for dollar-cost averaging strategies. When Bitcoin is trading sideways, prices remain relatively stable, allowing systematic purchasers to accumulate positions without chasing runaway rallies.

Historical evidence demonstrates that consistent accumulation during boring, sideways markets produces superior long-term returns compared to emotional buying during euphoric rallies or panic selling during crashes.

Expert Opinions on November Bitcoin Performance

Bullish Minority View

Despite the prevailing expectation of Bitcoin trading sideways, some analysts maintain bullish outlooks for November. These contrarians point to seasonal patterns, halving cycle dynamics, and institutional adoption trends as potential drivers of upside surprises.

Prominent Bitcoin advocate Anthony Pompliano suggests that November could still deliver positive returns despite consolidation expectations: “Markets often surprise when consensus forms. The setup exists for Bitcoin to prove doubters wrong.”

Bearish Minority View

Conversely, bearish analysts argue that even Bitcoin trading sideways might be optimistic. They point to overleveraged positioning, macroeconomic headwinds, and technical weakness as indicators of potential downside risk.

These sceptics recommend defensive positioning and emphasise capital preservation over aggressive speculation during uncertain market conditions. Their perspective serves as a valuable counterbalance to excessive optimism.

The Bigger Picture: Bitcoin’s Long-Term Trajectory

Four-Year Cycle Context

While short-term predictions focus on Bitcoin trading sideways in November, the bigger picture involves Bitcoin’s four-year halving cycle. Understanding current positioning within this cycle provides perspective on temporary consolidation phases.

Bitcoin historically experiences extended bull markets following halving events, punctuated by consolidation periods and corrections. If current sideways trading represents a mid-cycle consolidation, it could precede further appreciation in subsequent months and years.

Adoption and Infrastructure Growth

Regardless of whether Bitcoin trading sideways characterises November, underlying fundamentals continue strengthening. Lightning Network growth, institutional custody solutions, regulatory clarity, and mainstream payment integration all support long-term value appreciation.

Short-term price action represents noise compared to these fundamental developments. Patient investors who focus on Bitcoin’s evolving role in the global financial system often outperform those obsessed with monthly price movements.

Conclusion

The prediction that Bitcoin trading sideways will characterise November 2025 rather than the hoped-for “Moonvember” rally reflects careful analysis of technical indicators, macroeconomic conditions, and market sentiment. While this forecast may disappoint traders anticipating explosive gains, sideways markets offer unique opportunities for patient investors.

Understanding that Bitcoin trading sideways represents a natural and healthy market phase helps investors maintain perspective during consolidation. These periods allow markets to build a foundation for sustainable future growth rather than creating unsustainable speculative bubbles.

Read More: Crypto News Today Maxi Doge BlockchainFX Lead Market Trends