Bitcoin News

Bitcoin Pulls Back to $71K as Software Stocks Surge the global financial landscape is constantly evolving, and the relationship between cryptocurrencies and traditional technology stocks has become an increasingly important narrative for investors. Recently, Bitcoin pulls back to near $71K even as software sector soars, creating a fascinating divergence between digital assets and technology equities. While many expected the cryptocurrency market to continue its upward momentum after strong performance earlier in the year, Bitcoin experienced a temporary retreat toward the $71,000 level.

At the same time, the software sector rally has captured the attention of investors across the globe. Large technology companies and emerging software firms are seeing renewed investor interest driven by strong earnings, accelerating artificial intelligence adoption, and expanding cloud computing demand. This contrast between the cooling cryptocurrency market and booming technology stocks raises an important question: why is Bitcoin pulling back while software companies are gaining momentum.

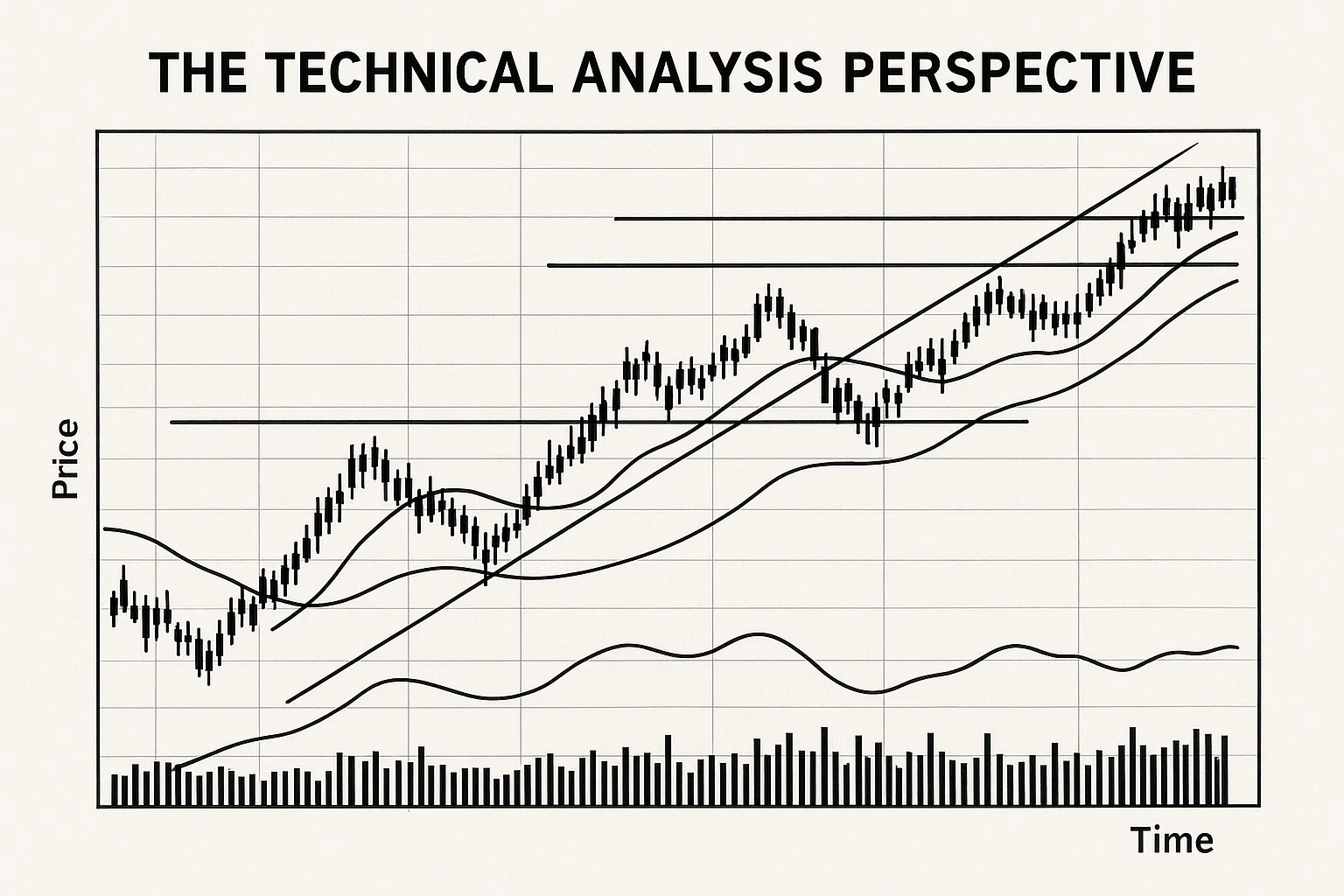

Understanding the forces behind this divergence requires analyzing broader macroeconomic trends, institutional investment flows, investor psychology, and technological innovation. Bitcoin remains the dominant digital asset and a barometer of the overall cryptocurrency market, while software companies represent the backbone of the digital economy. When these two sectors move in different directions, it often signals shifts in capital allocation and investor sentiment.

We explore why Bitcoin pulls back to near $71K even as software sector soars, examine the key drivers behind the movement, and analyze what this means for investors navigating the evolving landscape of digital assets, technology stocks, and the broader financial markets.

Bitcoin Pulls Back to $71K

The recent period where Bitcoin pulls back to near $71K even as software sector soars highlights the natural cycles that occur in cryptocurrency markets. Even during strong bullish phases, Bitcoin frequently experiences temporary corrections as traders take profits and reassess market conditions.

Bitcoin had been trading at higher levels earlier, fueled by strong institutional demand and the growing acceptance of digital assets. However, markets rarely move in a straight line. A pullback toward the $71,000 level represents a cooling phase rather than a fundamental shift in Bitcoin’s long-term outlook. Several factors contributed to the retracement. One key driver was profit-taking by short-term traders who had accumulated Bitcoin during earlier rallies. As prices approached psychological resistance levels, many investors decided to lock in gains, triggering a temporary downward movement.

Another factor influencing the pullback was shifting expectations regarding monetary policy and interest rates. When investors anticipate tighter financial conditions, risk assets like cryptocurrencies may experience short-term pressure. This dynamic often leads traders to move capital into other sectors, including technology stocks. Despite the recent retreat, Bitcoin continues to maintain strong support levels. Analysts emphasize that the broader crypto market trend remains intact, especially as institutional interest in digital assets continues to grow.

The Software Sector Surge: A Powerful Market Trend

While Bitcoin experienced a modest decline, the software sector boom has accelerated dramatically. Investors are pouring capital into software companies that are driving innovation in artificial intelligence, cloud infrastructure, cybersecurity, and enterprise solutions.

The surge in software stocks is largely tied to the rapid expansion of AI-powered technologies and the increasing reliance on digital platforms across industries. Companies providing tools for automation, machine learning, and large-scale data analysis are seeing massive demand. This growth is also supported by expanding cloud computing ecosystems. Businesses around the world are transitioning from traditional IT infrastructure to scalable cloud-based systems. As a result, software providers offering cloud-native applications and services are experiencing record revenue growth.

Another key driver behind the software sector rally is strong corporate earnings. Many software firms are reporting higher profit margins due to subscription-based revenue models and recurring income streams. This stability attracts investors who seek predictable growth in uncertain economic conditions. As capital flows into software companies, some investors temporarily reduce exposure to volatile assets like cryptocurrencies. This capital rotation helps explain why Bitcoin pulls back to near $71K even as software sector soars.

Diverging Market Sentiment Between Crypto and Tech

Investor sentiment plays a crucial role in explaining why Bitcoin pulls back to near $71K even as software sector soars. Financial markets often move in cycles where capital rotates between asset classes depending on perceived risk and opportunity.

During periods of strong technological innovation, investors often favor high-growth technology stocks. Software companies leading the AI revolution are currently benefiting from this dynamic. Their products are embedded in critical business operations, making them essential components of the global economy. On the other hand, cryptocurrencies are still viewed by some investors as speculative assets. While Bitcoin has achieved greater legitimacy in recent years, short-term volatility can still influence investor behavior.

When market uncertainty rises, investors may temporarily shift funds toward companies with predictable cash flows. Software firms offering enterprise solutions and cloud services fit this profile, attracting capital during periods when cryptocurrency markets experience corrections. However, this divergence does not necessarily signal long-term weakness for Bitcoin. Instead, it highlights the evolving relationship between technology innovation and digital asset markets.

Institutional Investment and Capital Rotation

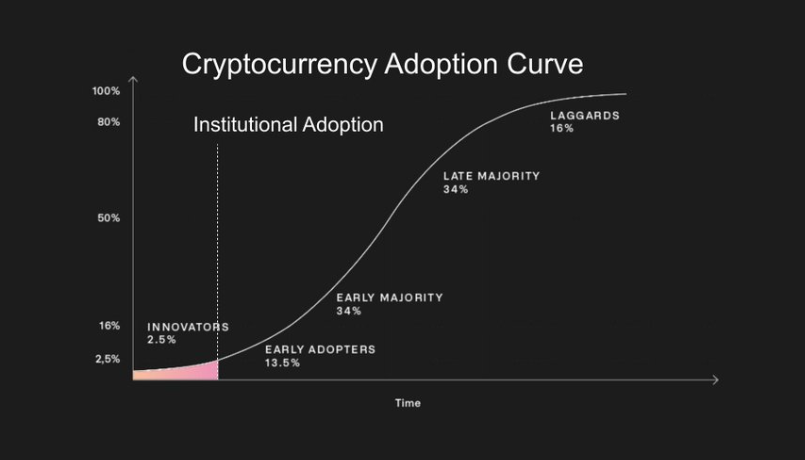

Institutional investors play a significant role in shaping market trends. Their capital allocation decisions help explain why Bitcoin pulls back to near $71K even as software sector soars. Over the past few years, institutional interest in cryptocurrencies has increased significantly. Hedge funds, asset managers, and publicly traded companies have added Bitcoin to their portfolios as part of broader diversification strategies.

At the same time, institutions continue to invest heavily in technology equities, particularly companies leading the AI revolution. Software firms are often viewed as core components of long-term growth portfolios because their products support digital transformation across industries.

When institutions rebalance portfolios, capital may temporarily move from one asset class to another. For example, if technology stocks appear undervalued relative to cryptocurrencies, investors may shift funds toward software companies. This capital rotation helps maintain balance across financial markets. It also explains why Bitcoin’s price movement does not always correlate with technology stock performance.

Macroeconomic Factors Influencing Bitcoin

Macroeconomic conditions are another key reason why Bitcoin pulls back to near $71K even as software sector soars. Global economic trends, interest rates, inflation expectations, and liquidity levels all influence cryptocurrency prices.

When central banks signal tighter monetary policies, risk assets often experience short-term pressure. Higher interest rates increase the attractiveness of traditional financial instruments like bonds, which can lead investors to reduce exposure to more volatile assets. However, Bitcoin also benefits from its reputation as a digital store of value and inflation hedge. During periods of high inflation or currency devaluation, investors often turn to Bitcoin as an alternative asset.

This dual role means Bitcoin sometimes reacts differently depending on the broader economic environment. In the short term, macroeconomic uncertainty may contribute to price pullbacks. Over the long term, the same conditions may strengthen Bitcoin’s appeal as a decentralized financial asset.

Technology Innovation Driving the Software Boom

The remarkable rise of the software sector is closely tied to major technological breakthroughs. The world is currently witnessing an unprecedented wave of innovation driven by artificial intelligence, machine learning, and cloud-based infrastructure.

Software companies are at the center of this transformation. They provide the platforms that enable businesses to automate operations, analyze massive datasets, and deliver personalized digital experiences to customers. One of the most important drivers behind the software sector growth is the rapid adoption of AI-powered enterprise tools. Businesses across industries are integrating artificial intelligence into customer service, logistics, financial analysis, and product development.

This transformation has created enormous demand for advanced software platforms capable of supporting AI workloads. As a result, investors are increasingly bullish on companies that build and manage these systems. The momentum behind these technologies explains why software stocks continue to soar even as Bitcoin pulls back to near $71K.

Bitcoin’s Long-Term Market Outlook

Despite the recent correction, many analysts remain optimistic about Bitcoin’s long-term prospects. The fact that Bitcoin pulls back to near $71K even as software sector soars does not necessarily indicate weakness in the cryptocurrency market.

Bitcoin’s fundamentals remain strong. The network continues to process billions of dollars in transactions daily, while institutional adoption continues to expand. Major financial institutions are developing cryptocurrency investment products, making it easier for traditional investors to gain exposure to digital assets. Another important factor supporting Bitcoin’s long-term growth is its limited supply. Only 21 million Bitcoins will ever exist, making it a scarce digital asset. This scarcity contributes to its appeal as a digital gold alternative.

Additionally, the broader blockchain ecosystem continues to evolve. Decentralized finance, tokenized assets, and Web3 applications are expanding the utility of cryptocurrencies beyond simple payments. These developments suggest that Bitcoin’s pullback may simply represent a temporary pause within a larger upward trend.

Market Volatility and Investor Psychology

Financial markets are deeply influenced by investor psychology. The situation where Bitcoin pulls back to near $71K even as software sector soars reflects how sentiment can shift rapidly across asset classes. When prices rise quickly, investors often become optimistic and pour capital into trending sectors. Conversely, when markets experience corrections, fear and uncertainty can lead to rapid sell-offs.

Bitcoin is particularly sensitive to these psychological dynamics because its market operates 24 hours a day and attracts participants from around the world. News events, regulatory developments, and macroeconomic data can trigger rapid price movements. However, experienced investors recognize that volatility is a natural characteristic of cryptocurrency markets. Short-term fluctuations often occur even during long-term bull markets. Understanding this dynamic helps investors avoid emotional decisions and focus on broader market trends.

The Growing Relationship Between Crypto and Technology

Although the current situation shows divergence, the long-term relationship between cryptocurrencies and technology companies is becoming increasingly intertwined. Many software companies are exploring blockchain integration, digital asset infrastructure, and decentralized applications. These technologies have the potential to reshape financial systems, supply chains, and digital identity management.

As the blockchain ecosystem matures, collaboration between crypto platforms and technology firms may increase. This convergence could eventually align the performance of the cryptocurrency market with the broader technology sector. For now, the scenario where Bitcoin pulls back to near $71K even as software sector soars illustrates how different segments of the digital economy can move independently depending on market conditions.

Conclusion

The recent market dynamic where Bitcoin pulls back to near $71K even as software sector soars highlights the complexity of modern financial markets. Cryptocurrency prices are influenced by a wide range of factors, including macroeconomic conditions, investor sentiment, institutional capital flows, and technological innovation.

At the same time, the powerful growth of the software sector demonstrates how rapidly digital transformation is reshaping global industries. The rise of artificial intelligence, cloud computing, and enterprise software platforms has created enormous opportunities for technology companies.

While Bitcoin may experience temporary pullbacks, its long-term fundamentals remain strong. Increasing institutional adoption, limited supply, and expanding blockchain applications continue to support the cryptocurrency’s value proposition.

Ultimately, the divergence between Bitcoin and software stocks reflects the evolving nature of the digital economy. Investors who understand these dynamics can better navigate the opportunities and risks presented by both cryptocurrency markets and technology equities in the years ahead.

FAQs

Q: Why did Bitcoin pull back to near $71K while the software sector is rising?

The reason Bitcoin pulls back to near $71K even as software sector soars is largely related to capital rotation and investor sentiment. Some investors took profits after Bitcoin’s earlier rally, while others shifted funds toward technology companies benefiting from the artificial intelligence boom. Software firms are currently experiencing strong earnings growth and increasing demand for cloud-based services, which has attracted significant institutional investment. This temporary divergence does not necessarily indicate long-term weakness in Bitcoin but rather reflects normal market cycles.

Q: Does Bitcoin’s pullback mean the crypto bull market is ending?

A pullback toward $71,000 does not automatically signal the end of a cryptocurrency bull market. Bitcoin frequently experiences corrections even during strong upward trends. Market analysts often view these periods as healthy consolidations that allow prices to stabilize before the next potential rally. The long-term outlook for Bitcoin continues to be supported by institutional adoption, limited supply, and growing interest in blockchain technology.

Q: Why is the software sector performing so strongly right now?

The software sector surge is driven by several powerful trends, including the rapid adoption of artificial intelligence, increased demand for cloud infrastructure, and strong enterprise spending on digital transformation. Companies that provide AI tools, cybersecurity solutions, and scalable cloud services are seeing strong revenue growth. Investors view these businesses as essential to the future digital economy, which has contributed to the recent surge in software stocks.

Q: Is there a connection between Bitcoin and technology stocks?

There is a growing connection between cryptocurrencies and technology companies because both are part of the broader digital economy. Many software firms are exploring blockchain technology, decentralized applications, and digital asset infrastructure. However, the two markets do not always move in the same direction because they are influenced by different factors such as regulatory developments, liquidity conditions, and investor risk tolerance.

Q: What could trigger Bitcoin’s next price rally?

Several factors could drive Bitcoin’s next major rally. Increased institutional investment, favorable regulatory developments, and broader adoption of cryptocurrencies by financial institutions could all push prices higher. Additionally, macroeconomic conditions such as inflation concerns or currency instability may lead investors to view Bitcoin as a digital store of value. As the blockchain ecosystem continues to grow, demand for Bitcoin may increase, potentially leading to new price highs in the future.