Cryptocurrency

Bitcoin Rises 5.2% Amid U.S.-Israel-Iran Conflict Tensions, capturing the attention of global investors and reigniting debate about the cryptocurrency’s role during geopolitical crises. As tensions escalate in the Middle East, financial markets have reacted with caution, volatility, and a renewed focus on alternative assets. While traditional markets fluctuated amid uncertainty, Bitcoin showed resilience, pushing higher and reinforcing its reputation as a potential hedge against global instability.

The surge in Bitcoin’s price reflects broader market sentiment shaped by the ongoing U.S.-Israel-Iran conflict. Historically, geopolitical events have triggered short-term volatility across equities, commodities, and currencies. However, in recent years, digital assets have increasingly entered the conversation as investors look beyond gold and government bonds for protection. The 5.2% rally is not just a headline number; it signals a shift in investor psychology and risk perception.

We explores why Bitcoin rises 5.2% amid U.S.-Israel-Iran conflict, how geopolitical tensions influence the crypto market, what institutional and retail investors are doing, and what this development could mean for the broader digital asset ecosystem. By examining market data, investor behavior, and macroeconomic trends, we can better understand the deeper implications of this price movement.

Bitcoin Rises 5.2% Amid

When headlines about military escalation and diplomatic breakdown dominate global news, markets react swiftly. The U.S.-Israel-Iran conflict has created uncertainty around oil supply routes, regional stability, and global economic growth. During such times, investors often shift capital into assets perceived as safe or uncorrelated to traditional financial systems.

Bitcoin rises 5.2% amid U.S.-Israel-Iran conflict largely because traders view it as a form of digital gold. The cryptocurrency’s decentralized nature and limited supply make it attractive during periods of geopolitical tension. Unlike fiat currencies, Bitcoin is not directly tied to any government or central bank. This independence becomes appealing when state-level conflicts introduce economic unpredictability.

Additionally, the broader cryptocurrency market often responds quickly to breaking news. Algorithmic trading systems, high-frequency traders, and institutional desks monitor geopolitical developments in real time. As tensions intensified, buying pressure increased, pushing Bitcoin higher. The rapid price movement reflects both speculative positioning and genuine demand for alternative stores of value.

The Safe-Haven Narrative Reemerges

For years, analysts have debated whether Bitcoin truly qualifies as a safe-haven asset. Gold has traditionally held that title, particularly during wars or economic crises. However, Bitcoin’s reaction during the U.S.-Israel-Iran conflict suggests that at least a portion of the market now considers it a hedge.

When Bitcoin rises 5.2% amid U.S.-Israel-Iran conflict, it reinforces the narrative that digital assets can act as a shield against global instability. While the correlation between Bitcoin and traditional safe havens fluctuates, moments like this strengthen the argument that crypto belongs in diversified portfolios during uncertain times.

It is important to note that Bitcoin remains volatile. A 5.2% increase is significant but not unusual for the asset. Yet the context matters. The rally coincided directly with escalating geopolitical news, highlighting a behavioral shift among investors who increasingly turn to decentralized finance solutions during crises.

Geopolitical Tensions and Financial Market Volatility

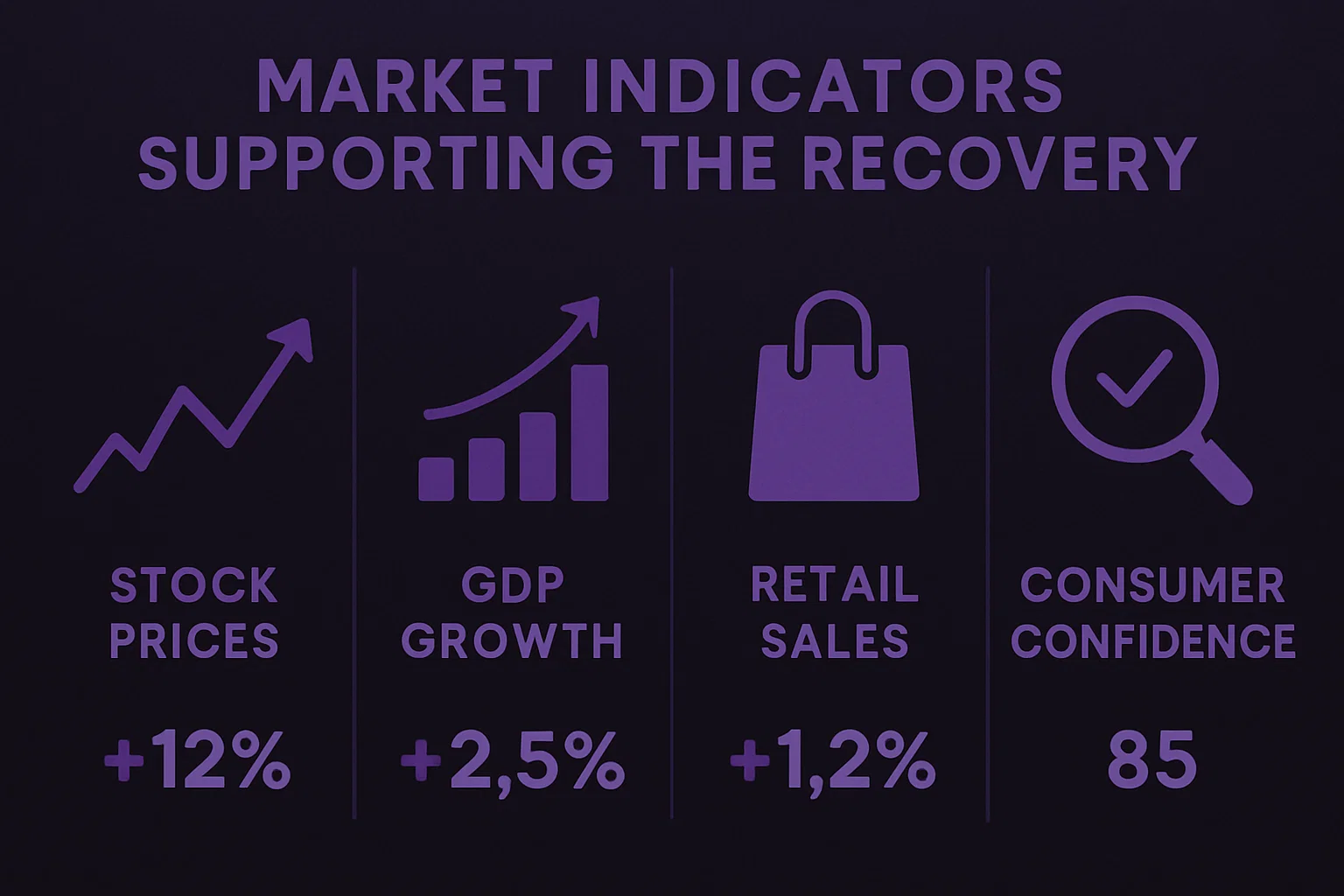

Geopolitical events have long influenced financial markets. Wars, sanctions, and diplomatic conflicts can disrupt trade routes, energy supplies, and investor confidence. The U.S.-Israel-Iran conflict has raised concerns about oil exports from the Middle East, a region critical to global energy markets.

As uncertainty spreads, traditional markets often experience heightened volatility. Equity indices may swing sharply, currency markets may fluctuate, and commodities like oil and gold typically rise. In this context, Bitcoin rises 5.2% amid U.S.-Israel-Iran conflict as part of a broader reallocation of capital.

Impact on Oil and Inflation Expectations

One of the immediate consequences of Middle East tensions is pressure on oil prices. Any threat to supply routes can trigger price spikes, which in turn fuel inflation concerns. Rising inflation expectations often weaken confidence in fiat currencies.

In such scenarios, investors may seek assets that are not subject to central bank policies. Bitcoin’s capped supply of 21 million coins contrasts sharply with inflation-prone fiat systems. As inflation fears resurface due to geopolitical instability, Bitcoin becomes increasingly attractive as an inflation hedge.

Currency Fluctuations and Capital Flight

Geopolitical conflicts can also trigger capital flight from affected regions. Investors move funds into perceived safer jurisdictions or assets. Bitcoin’s borderless nature allows capital to flow quickly without reliance on banking systems.

When Bitcoin rises 5.2% amid U.S.-Israel-Iran conflict, part of the surge may reflect cross-border demand. In regions directly or indirectly affected by instability, individuals may turn to cryptocurrencies to preserve wealth and maintain financial flexibility.

Institutional Investors and Bitcoin’s Price Surge

The cryptocurrency landscape has changed dramatically over the past few years. Institutional investors, hedge funds, and asset managers now play a significant role in price discovery. When geopolitical tensions rise, institutional desks analyze risk exposure across portfolios.

Bitcoin rises 5.2% amid U.S.-Israel-Iran conflict partly because institutional players may increase allocations as a hedge against systemic risk. The emergence of spot Bitcoin ETFs and regulated crypto investment vehicles has made it easier for traditional investors to gain exposure without directly holding the asset. Large-scale inflows can amplify price movements. When institutional demand aligns with retail enthusiasm, rallies gain momentum. The 5.2% jump reflects this combined force, underscoring Bitcoin’s growing integration into mainstream finance.

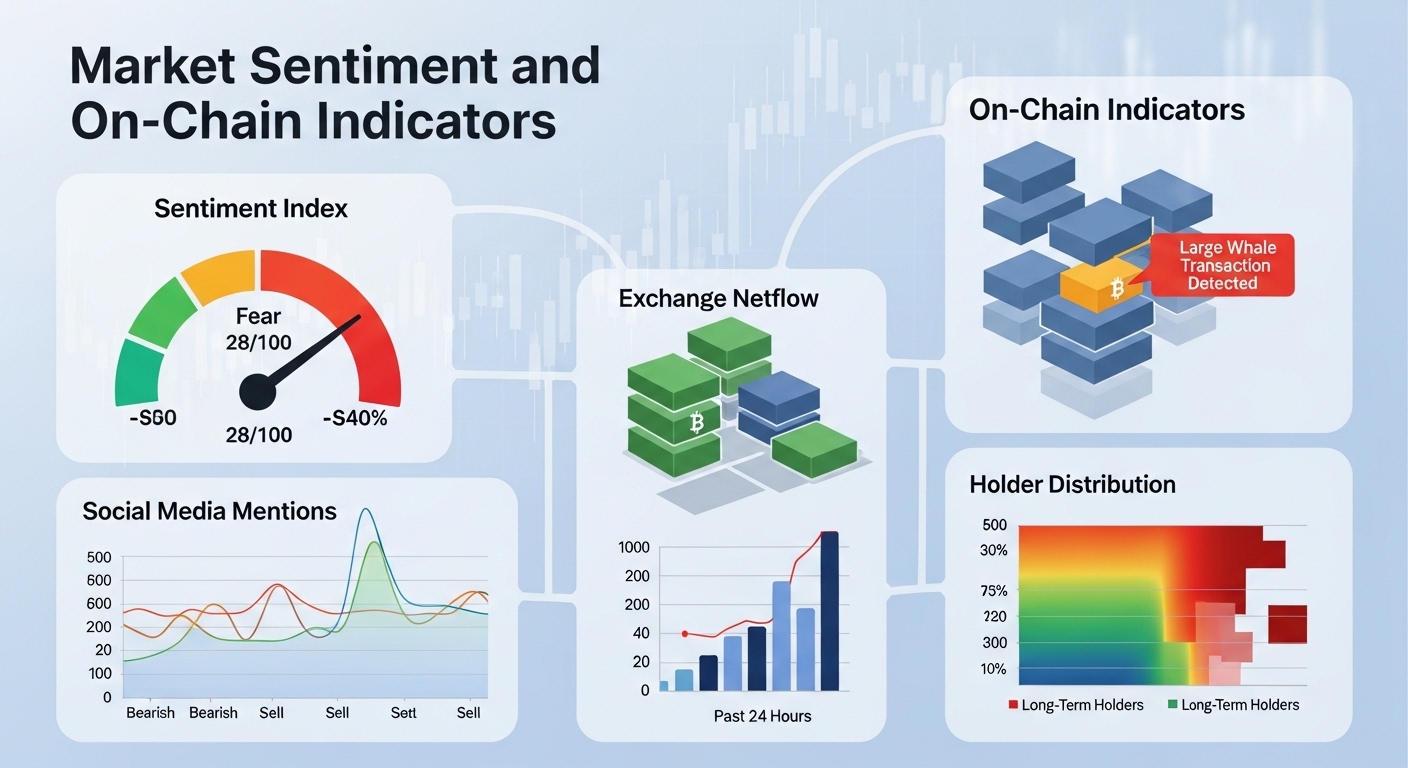

Retail Participation and Social Sentiment

Retail investors also contribute to rapid price shifts. Social media platforms and crypto communities react swiftly to geopolitical developments. The narrative that Bitcoin thrives during crises spreads quickly, attracting new buyers.

As Bitcoin rises 5.2% amid U.S.-Israel-Iran conflict, online discussions intensify, reinforcing bullish sentiment. Positive feedback loops can drive short-term rallies, especially when technical indicators support upward momentum.

Technical Analysis Behind the 5.2% Rally

Beyond headlines, technical factors often shape price action. Traders monitor support and resistance levels, moving averages, and trading volumes to anticipate breakouts.

When Bitcoin rises 5.2% amid U.S.-Israel-Iran conflict, it may also coincide with key technical patterns. A breakout above resistance levels can trigger automated buy orders and short liquidations. Increased trading volume confirms market participation, adding credibility to the move. Momentum indicators such as the Relative Strength Index may show renewed strength, while derivatives markets reflect rising open interest. These elements combine to fuel upward price pressure.

Bitcoin’s Evolving Role in Global Finance

The fact that Bitcoin rises 5.2% amid U.S.-Israel-Iran conflict highlights its evolving identity. Once dismissed as purely speculative, Bitcoin now plays a more nuanced role in global portfolios.

Digital Asset Diversification

Investors increasingly view Bitcoin as part of a diversified strategy. Alongside stocks, bonds, and commodities, digital assets provide exposure to a new asset class. During geopolitical crises, diversification becomes critical. The 5.2% surge reinforces the idea that Bitcoin can respond differently from traditional assets. While correlations shift over time, moments of divergence enhance its appeal.

Decentralization as Strategic Advantage

Bitcoin’s decentralized network operates independently of governments and banks. During geopolitical conflicts, this independence can be perceived as strength. The U.S.-Israel-Iran conflict underscores the vulnerabilities of centralized systems, making decentralized alternatives more attractive.

As Bitcoin rises 5.2% amid U.S.-Israel-Iran conflict, it sends a signal about investor confidence in blockchain-based systems. The underlying blockchain technology ensures transparency and immutability, qualities valued during uncertain times.

Risks and Caution Amid the Rally

While the price increase is notable, investors should remain cautious. Geopolitical-driven rallies can be short-lived. If tensions de-escalate, safe-haven demand may subside.

Bitcoin rises 5.2% amid U.S.-Israel-Iran conflict today, but volatility remains inherent. Sharp corrections are common in the crypto market. Traders must assess risk tolerance and avoid overexposure based solely on headlines. Regulatory developments also play a role. Governments may respond to crises with new policies affecting financial markets, including digital assets. Monitoring policy changes is essential.

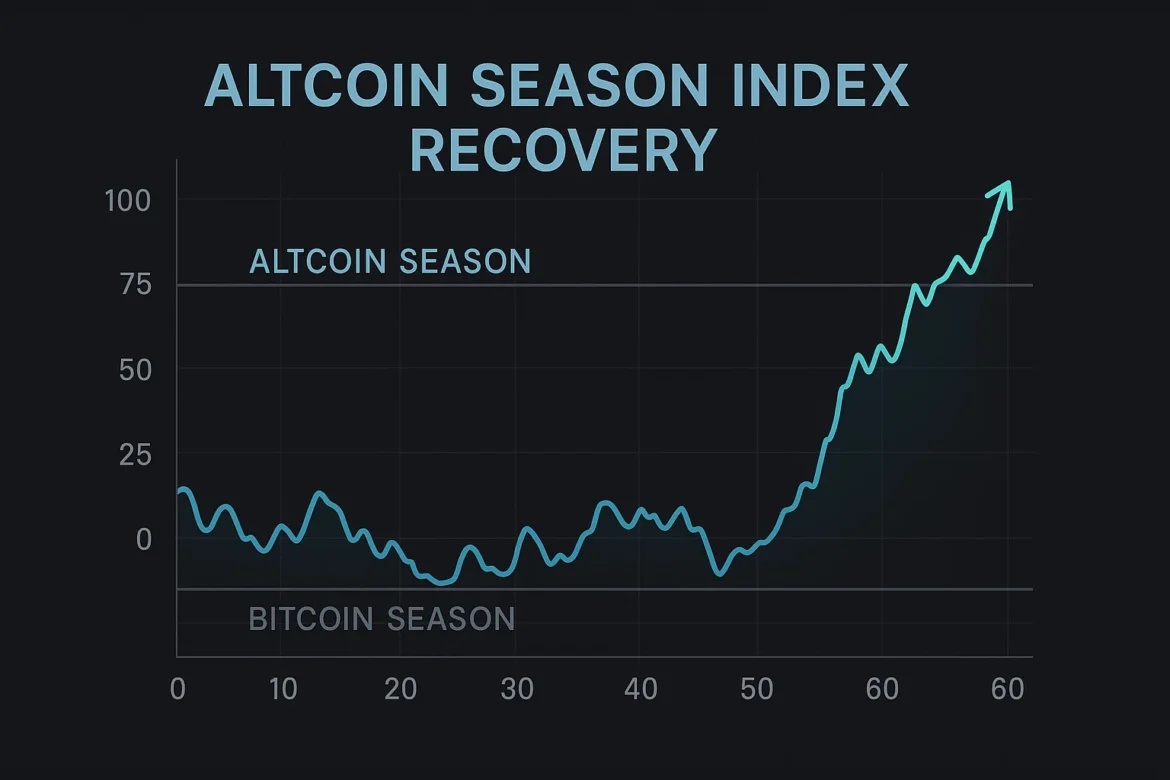

Broader Cryptocurrency Market Reaction

Bitcoin’s rally often influences the broader crypto market. When the leading cryptocurrency moves, altcoins frequently follow. As Bitcoin rises 5.2% amid U.S.-Israel-Iran conflict, other digital assets may experience correlated gains. Increased trading activity boosts liquidity and market capitalization across the sector.

However, Bitcoin’s dominance may also rise during crises, as investors prefer established assets over smaller tokens. This dynamic reflects risk management strategies within crypto portfolios.

Conclusion

Bitcoin rises 5.2% amid U.S.-Israel-Iran conflict, demonstrating how geopolitical tensions can reshape financial market dynamics. The rally reflects growing acceptance of Bitcoin as a potential hedge against instability, inflation, and currency risk. Institutional participation, retail enthusiasm, and technical momentum all contributed to the surge.

While uncertainty persists, this price movement reinforces Bitcoin’s evolving role in global finance. Whether the rally sustains or retraces will depend on geopolitical developments, macroeconomic conditions, and investor sentiment. For now, the 5.2% increase stands as a powerful reminder that digital assets are increasingly intertwined with world events.

FAQs

Q: Why did Bitcoin rise 5.2% amid the U.S.-Israel-Iran conflict?

Bitcoin rose 5.2% amid the U.S.-Israel-Iran conflict because investors sought alternative assets during heightened geopolitical uncertainty. As tensions increased fears of economic disruption and inflation, many traders viewed Bitcoin as a decentralized store of value similar to digital gold. Institutional inflows, retail participation, and technical breakouts further amplified the upward price movement.

Q: Is Bitcoin considered a safe-haven asset during geopolitical conflicts?

Bitcoin is increasingly viewed by some investors as a safe-haven asset during geopolitical conflicts, although this classification remains debated. When Bitcoin rises 5.2% amid U.S.-Israel-Iran conflict, it strengthens the narrative that cryptocurrencies can serve as hedges against instability. However, Bitcoin’s volatility means it does not always behave like traditional safe havens such as gold.

Q: How does geopolitical tension impact the broader cryptocurrency market?

Geopolitical tension often increases volatility across financial markets, including cryptocurrencies. When Bitcoin rises 5.2% amid U.S.-Israel-Iran conflict, it can trigger broader gains across the crypto sector as investor sentiment improves. However, risk-off behavior may also concentrate capital into Bitcoin rather than smaller altcoins, increasing Bitcoin dominance.

Q: Could the 5.2% Bitcoin rally be temporary?

Yes, the 5.2% rally could be temporary depending on how the geopolitical situation evolves. If tensions ease or market sentiment shifts, prices may retrace. Bitcoin rises 5.2% amid U.S.-Israel-Iran conflict due to immediate uncertainty, but long-term trends will depend on macroeconomic factors, regulatory developments, and sustained investor demand.

Q: What should investors consider before reacting to geopolitical-driven crypto rallies?

Investors should consider volatility, risk tolerance, and portfolio diversification before reacting to geopolitical-driven rallies. While Bitcoin rises 5.2% amid U.S.-Israel-Iran conflict may signal growing confidence in digital assets, it is important to evaluate long-term fundamentals rather than making decisions based solely on short-term headlines.