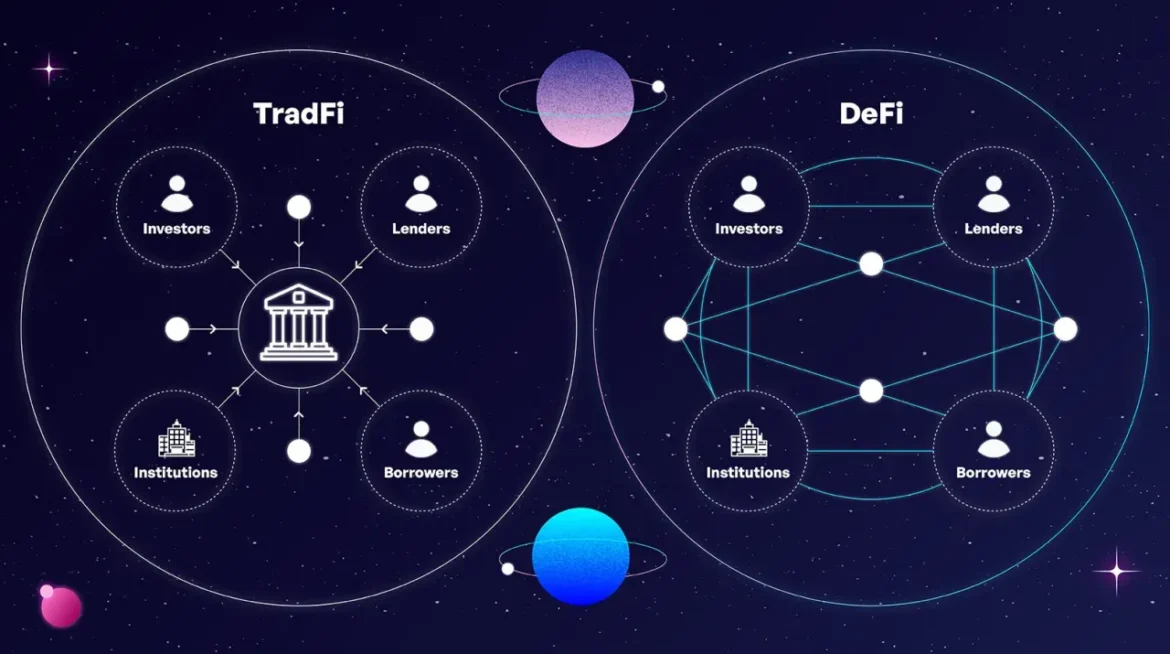

A hybrid DeFi-TradFi approach that seamlessly bridges the gap between decentralised finance and traditional financial systems. This groundbreaking strategy has catapulted the project’s presale into unprecedented territory, with analysts projecting a staggering 100x return potential. As investors increasingly seek platforms that combine the best of both worlds—the security and regulatory compliance of traditional finance with the transparency and efficiency of decentralised systems—BlockchainFX emerges as a frontrunner in this paradigm shift. The hybrid DeFi-TradFi approach represents more than just technological innovation; it signifies a fundamental reimagining of how digital assets can coexist with established financial infrastructure, creating opportunities that were previously impossible in either ecosystem alone.

Hybrid DeFi-TradFi Approach Revolution

What Makes the Hybrid DeFi-TradFi Approach Unique?

The hybrid DeFi-TradFi approach pioneered by BlockchainFX represents a sophisticated integration strategy that leverages the strengths of both decentralised finance protocols and traditional financial systems. Unlike purely decentralised platforms that operate entirely outside regulatory frameworks, or traditional finance platforms that lack blockchain transparency, this hybrid methodology creates a middle ground that appeals to institutional investors and retail participants alike.

At its core, the hybrid approach utilises smart contracts for automated execution and transparency while maintaining compliance with existing financial regulations. This dual-layer architecture ensures that users benefit from the permissionless nature of DeFi—including 24/7 market access, instant settlements, and reduced intermediary costs—while simultaneously enjoying the protection of regulatory oversight, dispute resolution mechanisms, and institutional-grade security protocols.

BlockchainFX’s implementation includes custody solutions that meet banking standards, KYC/AML procedures that satisfy regulatory requirements, and insurance mechanisms that protect investor capital. These traditional finance elements are seamlessly integrated with DeFi protocols for liquidity provision, yield generation, and governance participation, creating an ecosystem that serves both crypto-native users and traditional finance participants.

The Technology Behind Hybrid Financial Systems

The technical foundation of BlockchainFX’s hybrid DeFi-TradFi approach consists of multiple interconnected layers that work in harmony. The base layer utilises established blockchain networks known for security and scalability, ensuring that all transactions are immutably recorded and publicly verifiable. Above this sits a compliance layer that interfaces with traditional banking systems through regulated payment processors and licensed financial intermediaries.

Smart contract architecture forms the operational backbone, enabling automated market-making, algorithmic trading strategies, and decentralised governance while maintaining hooks for regulatory compliance checks. These contracts are audited by both blockchain security firms and traditional financial auditors, providing dual assurance that meets standards from both ecosystems.

The platform incorporates oracles that bridge on-chain and off-chain data, allowing real-time integration with traditional financial markets, foreign exchange rates, and commodity prices. This connectivity enables trading strategies that span both decentralised and centralised markets, maximising opportunities for arbitrage and risk management.

BlockchainFX Presale Success: A 100x Growth Story

Analysing the Presale Performance Metrics

BlockchainFX’s presale has captured extraordinary attention within the cryptocurrency community, with participation rates exceeding expectations by significant margins. The presale structure implements a tiered pricing mechanism that rewards early adopters while maintaining sustainable tokenomics for long-term value appreciation. Initial rounds sold out within hours, demonstrating overwhelming market confidence in the project’s hybrid DeFi-TradFi approach.

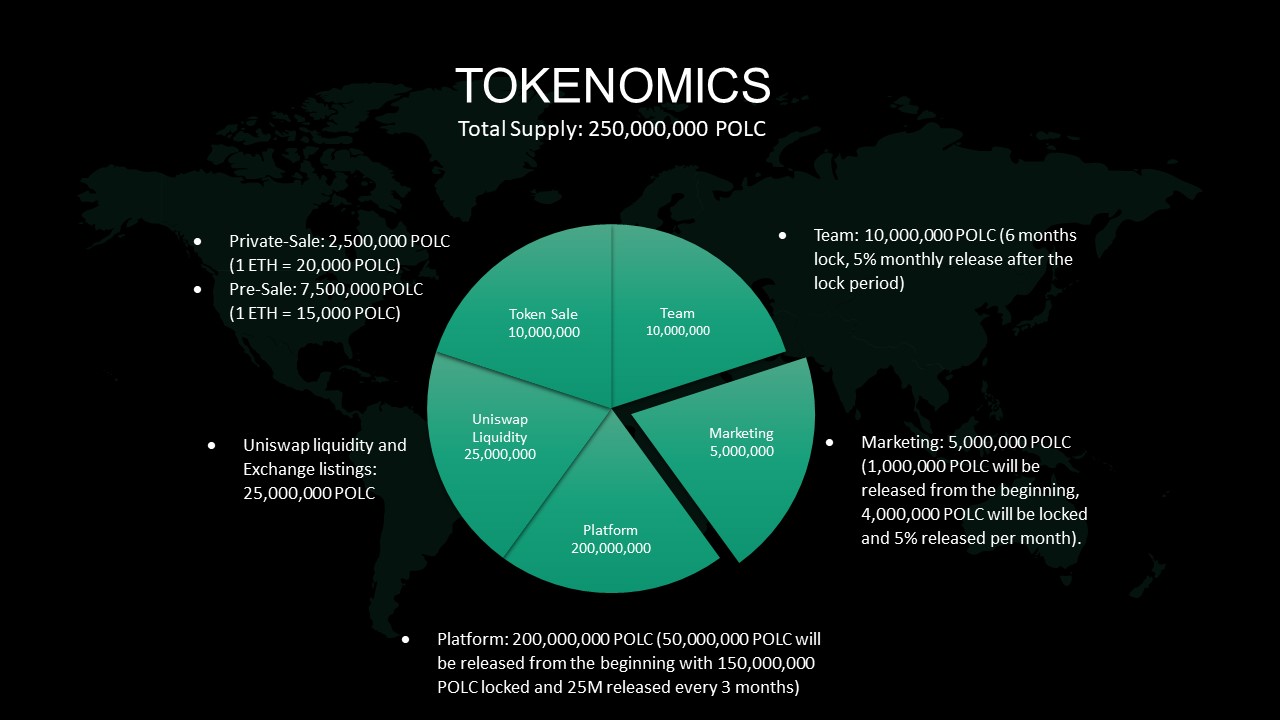

Token distribution follows a carefully calculated model that allocates resources across development, marketing, liquidity provision, and strategic partnerships. The vesting schedules for team tokens and advisor allocations demonstrate commitment to long-term project success rather than short-term profit-taking. This transparency in tokenomics, combined with third-party audits of smart contracts, has established credibility that attracts both retail and institutional capital.

The 100x projection stems from multiple growth catalysts, including limited token supply, increasing demand for hybrid financial solutions, strategic exchange listings planned post-presale, and expanding use cases within the BlockchainFX ecosystem. Comparable projects that successfully bridged DeFi and traditional finance have demonstrated similar growth trajectories, providing historical precedent for these ambitious projections.

Investor Sentiment and Market Positioning

Market analysis reveals that investor enthusiasm for BlockchainFX’s hybrid DeFi-TradFi approach reflects broader industry trends toward mainstream adoption. Traditional investors who previously avoided cryptocurrency due to regulatory uncertainty or security concerns now find the hybrid model appealing because it addresses their primary objections while maintaining exposure to blockchain’s transformative potential.

Social media sentiment analysis shows overwhelmingly positive discussions across cryptocurrency forums, with particular emphasis on the project’s regulatory compliance strategy and partnerships with established financial institutions. This credibility gap—where many DeFi projects struggle to gain traditional finance acceptance—has been effectively bridged by BlockchainFX through transparent operations and proactive engagement with regulators.

The presale’s success also reflects timing advantages, launching during a period of renewed interest in cryptocurrency markets while offering differentiation from purely speculative meme tokens. Investors increasingly prioritise projects with real utility, sustainable business models, and clear paths to revenue generation—all characteristics that BlockchainFX demonstrates through its hybrid infrastructure.

Key Features Driving the Hybrid DeFi-TradFi Integration

Regulatory Compliance Meets Decentralisation

One of the most compelling aspects of BlockchainFX’s hybrid DeFi-TradFi approach is its sophisticated compliance framework that satisfies regulatory requirements without compromising the core benefits of decentralisation. The platform implements progressive KYC procedures that verify user identities for larger transactions while maintaining privacy for smaller trades, balancing regulatory necessity with user autonomy.

Anti-money laundering protocols integrate seamlessly with blockchain analytics, using both on-chain monitoring and traditional financial surveillance techniques to identify suspicious activity. This dual-layer security approach actually enhances protection beyond what either system could achieve independently, creating a safer environment for all participants.

The regulatory strategy includes proactive engagement with financial authorities across multiple jurisdictions, establishing clear legal frameworks before launching services rather than operating in grey areas. This forward-thinking compliance posture positions BlockchainFX for longevity, avoiding the regulatory crackdowns that have disrupted many crypto projects operating without proper authorisation.

Liquidity Solutions Bridging Two Worlds

BlockchainFX’s liquidity infrastructure represents a sophisticated hybrid approach that aggregates depth from both decentralised exchanges and traditional market makers. This dual-source liquidity model ensures optimal execution prices for users regardless of trade size, eliminating the slippage problems that plague many DeFi platforms or the access restrictions common in traditional finance.

The platform employs algorithmic liquidity routing that automatically selects the best execution venue—whether DeFi pools, centralised exchanges, or OTC desks—based on real-time pricing, available depth, and transaction costs. This intelligent order routing maximises value for users while maintaining the transparency and auditability expected in decentralised systems.

Cross-chain bridge technology enables seamless asset transfers between multiple blockchain networks and traditional banking systems, expanding the range of tradable assets beyond native cryptocurrencies. Users can trade tokenised traditional assets like stocks, bonds, and commodities alongside cryptocurrencies, all within a single unified interface that simplifies complex multi-asset strategies.

Security Architecture for Institutional Standards

The security framework underlying BlockchainFX’s hybrid DeFi-TradFi approach combines blockchain-native protections with institutional-grade safeguards. Multi-signature wallet architecture requires multiple independent approvals for significant transactions, preventing single points of failure while maintaining operational efficiency through threshold signatures and time-locks.

Cold storage solutions protect the majority of platform assets using industry-leading custody providers that meet banking security standards and carry comprehensive insurance coverage. Hot wallets necessary for operational liquidity implement advanced monitoring systems that detect anomalous behaviour and automatically halt suspicious transactions before damage occurs.

Smart contract security goes beyond typical blockchain audits to include formal verification—mathematical proofs that contracts behave exactly as intended under all possible conditions. This rigorous approach, combined with bug bounty programs that incentivise white-hat hackers to identify vulnerabilities, creates multiple defensive layers that protect user funds more effectively than either traditional or decentralised systems alone.

Market Opportunities in Hybrid Financial Ecosystems

Traditional Finance Investors Entering DeFi

BlockchainFX’s hybrid DeFi-TradFi approach opens cryptocurrency markets to traditional investors who previously avoided the space due to unfamiliarity, perceived risk, or regulatory concerns. The familiar interfaces, customer support structures, and dispute resolution mechanisms make blockchain technology accessible to this vast, untapped market, potentially driving exponential growth as traditional capital flows into DeFi.

Institutional investors, including family offices, hedge funds, and asset managers, increasingly allocate portfolio percentages to cryptocurrency as the asset class matures. However, most institutions require regulatory compliance, custody solutions meeting fiduciary standards, and integration with existing portfolio management systems—all features that hybrid platforms provide, while purely decentralised protocols cannot.

The demographic shift toward younger investors comfortable with technology but demanding professional-grade tools creates perfect conditions for hybrid platforms. These users want DeFi’s innovation without sacrificing the consumer protections and seamless experiences they expect from modern financial applications, making BlockchainFX’s value proposition particularly compelling.

DeFi Users Seeking Traditional Finance Benefits

Conversely, cryptocurrency-native users increasingly recognise limitations in purely decentralised systems, particularly regarding fiat currency on-ramps, legal recourse for disputes, and access to traditional financial products. BlockchainFX’s hybrid approach allows DeFi enthusiasts to maintain their blockchain holdings while accessing benefits like fiat-backed stablecoins, traditional banking services, and regulated investment products.

The ability to seamlessly move between DeFi protocols and traditional financial services without multiple intermediaries or conversion steps eliminates friction that currently prevents widespread adoption. Users can execute complex strategies spanning both ecosystems—for example, using DeFi lending yields to collateralise traditional loans or hedging cryptocurrency positions with regulated derivatives—all within a single integrated platform.

Tax compliance represents another area where hybrid platforms provide significant value to DeFi users. Automated tax reporting that meets jurisdictional requirements, while maintaining blockchain transaction records, simplifies the complex accounting challenges that many cryptocurrency traders face. This administrative convenience, combined with clear legal status for transactions, removes major adoption barriers.

Tokenomics and Long-Term Value Proposition

Supply Dynamics and Scarcity Models

BlockchainFX’s token economics implement carefully designed scarcity mechanisms that support long-term value appreciation while maintaining sufficient liquidity for operational needs. The total token supply is capped with no possibility of inflationary expansion, creating digital scarcity similar to Bitcoin but with added utility driving demand beyond mere speculation.

Token burning mechanisms automatically remove a percentage of transaction fees from circulation permanently, creating deflationary pressure as platform usage increases. This burn rate accelerates during high-volume periods, aligning token holder interests with platform growth and ensuring that increased activity directly benefits all stakeholders through supply reduction.

Staking requirements for platform governance and premium features lock significant token quantities out of circulation, further constraining available supply. These staked tokens generate yield through platform revenues, providing passive income streams that incentivise long-term holding rather than speculative trading. The combination of capped supply, continuous burns, and staking lockups creates powerful supply-side dynamics supporting price appreciation.

Utility Driving Sustainable Demand

The hybrid DeFi-TradFi approach generates genuine token utility through multiple platform functions that require native token usage. Transaction fee discounts incentivise holding and using BlockchainFX tokens for trading, creating consistent demand pressure. Governance rights give token holders decision-making power over platform development, upgrades, and treasury allocation, providing intrinsic value beyond financial returns.

Access to premium features, including advanced trading tools, institutional-grade analytics, and priority customer support, requires token staking, creating additional demand from serious platform users. Partnership programs that reward token holders with preferential rates from integrated services expand utility beyond the BlockchainFX platform itself.

Revenue-sharing mechanisms distribute a portion of platform profits to token stakers, transforming the token into a productive asset generating cash flow rather than purely speculative value. This income-generating capacity attracts long-term investors seeking yield-bearing assets, fundamentally differentiating BlockchainFX from speculative meme tokens lacking genuine utility or revenue generation.

Strategic Partnerships Amplifying Growth

Traditional Financial Institution Collaborations

BlockchainFX has secured partnerships with established banks, payment processors, and financial service providers that lend credibility while expanding operational capabilities. These collaborations enable fiat currency on-ramps meeting banking regulations, integrated payment solutions for mainstream commerce, and access to traditional financial products through blockchain interfaces.

Banking partnerships provide the regulatory licenses and compliance infrastructure necessary for operating across multiple jurisdictions without each requiring separate authorisation. These relationships also facilitate traditional investors’ entry into cryptocurrency markets through familiar channels, reducing psychological barriers that prevent adoption despite growing interest.

Insurance partnerships protect platform users through coverage policies meeting institutional standards, addressing security concerns that prevent many potential users from engaging with cryptocurrency. These insurance products, combined with custodial solutions from regulated providers, create the safety infrastructure necessary for mainstream adoption and institutional capital allocation.

Blockchain Ecosystem Integration

Strategic integrations with major blockchain networks, DeFi protocols, and cryptocurrency infrastructure providers expand BlockchainFX’s capabilities while embedding the platform within the broader cryptocurrency ecosystem. Cross-chain compatibility through partnerships with interoperability protocols enables seamless asset transfers and trading across multiple networks without forcing users into any single blockchain.

Collaborations with leading DeFi protocols for lending, liquidity provision, and yield farming integrate these services directly into the BlockchainFX platform, providing users with one-stop access to the entire DeFi ecosystem. These partnerships create network effects where growth in partner protocols drives BlockchainFX usage and vice versa, generating mutually reinforcing expansion.

Technology partnerships with blockchain infrastructure providers ensure scalability, security, and performance, meeting institutional requirements. These collaborations provide access to cutting-edge developments in blockchain technology, positioning BlockchainFX to continuously integrate innovations while maintaining stability and reliability for existing users.

Comparative Analysis: Hybrid vs Pure DeFi vs TradFi

Advantages Over Pure DeFi Platforms

BlockchainFX’s hybrid DeFi-TradFi approach addresses critical limitations in purely decentralised platforms that prevent mainstream adoption. Regulatory compliance removes legal uncertainty that makes many institutional investors avoid pure DeFi, while customer support and dispute resolution mechanisms provide recourse when technical problems occur—something impossible in trustless protocols without identifiable operators.

Fiat currency integration eliminates the complex multi-step processes required to enter DeFi from traditional banking, where users must navigate multiple platforms, conversion steps, and technical knowledge barriers. Direct fiat on-ramps and off-ramps make cryptocurrency as accessible as traditional investment platforms, dramatically expanding the potential user base beyond crypto-native individuals.

Security enhancements through insurance, regulated custody, and professional auditing exceed what pure DeFi protocols typically provide, addressing the legitimate security concerns that prevent risk-averse investors from participating. While maintaining blockchain transparency and efficiency, the hybrid model adds protection layers that prevent the catastrophic losses seen in numerous DeFi hacks and exploits.

Improvements Over Traditional Finance

Compared to traditional financial systems, BlockchainFX’s hybrid approach delivers superior transparency through blockchain’s immutable record-keeping, where all transactions are publicly verifiable and cannot be altered retroactively. This transparency eliminates hidden fees, front-running, and other predatory practices common in opaque traditional systems.

Efficiency gains include 24/7 market access without geographic restrictions, near-instant settlement times compared to multi-day clearing periods, and dramatically reduced fees through disintermediation of unnecessary middlemen. These operational improvements translate directly into better returns for users and more efficient capital allocation across the economy.

Accessibility expands dramatically through permissionless participation, where anyone with internet access can engage with sophisticated financial services previously reserved for wealthy individuals or institutional investors. This democratisation of finance aligns with blockchain’s founding principles while avoiding the regulatory problems that pure DeFi platforms encounter through their rejection of all traditional oversight.

Risk Management in Hybrid Financial Systems

Mitigating Regulatory Uncertainty

BlockchainFX’s proactive regulatory strategy significantly reduces the legal risks that have derailed many cryptocurrency projects. By engaging regulators early, obtaining necessary licenses, and implementing compliance frameworks preemptively, the platform avoids the uncertainty that creates volatility and limits growth potential for projects operating in legal grey areas.

Jurisdictional diversification spreads regulatory risk across multiple regions, ensuring that changes in any single country’s policies don’t threaten the entire platform. Strategic entity structuring separates operations, custody, and development across optimal jurisdictions, creating resilience against regulatory changes while maintaining full legal compliance everywhere the platform operates.

Continuous monitoring of regulatory developments and adaptive compliance protocols ensures BlockchainFX can quickly adjust to new requirements, maintaining operational continuity as the regulatory landscape evolves. This flexibility, combined with strong relationships with financial authorities, positions the platform to thrive regardless of how cryptocurrency regulations develop globally.

Technical Security and Operational Resilience

The multi-layered security architecture protects against both traditional cybersecurity threats and blockchain-specific attack vectors. Redundant infrastructure across geographically distributed data centres ensures operational continuity even if individual facilities experience outages, while automated failover systems maintain service availability during technical problems.

Disaster recovery protocols include regular security drills, incident response plans, and backup systems that can restore full operations within hours of any catastrophic event. Insurance coverage protects users against technical failures, providing financial compensation if security breaches or operational problems cause losses despite preventive measures.

Continuous security monitoring through both automated systems and human security teams identifies threats in real-time, enabling rapid response before attacks cause damage. Bug bounty programs incentivise ethical hackers to identify vulnerabilities before malicious actors exploit them, creating an additional defensive layer through community engagement.

Future Roadmap and Expansion Plans

Platform Development Milestones

BlockchainFX’s development roadmap outlines ambitious expansion plans, building on the successful presale foundation. Near-term milestones include additional exchange listings to enhance liquidity and accessibility, mobile application launches providing on-the-go platform access, and integration of advanced trading features, including algorithmic strategies and portfolio management tools.

Mid-term development focuses on expanding the range of tradable assets through tokenisation of traditional securities, commodities, and alternative investments. These additions transform BlockchainFX into a comprehensive financial platform where users can access virtually any asset class through a unified blockchain-based interface, dramatically expanding utility and attracting new user segments.

Long-term vision includes developing proprietary blockchain infrastructure optimised specifically for hybrid financial applications, eliminating dependencies on third-party networks while maintaining interoperability. This evolution positions BlockchainFX as not just a platform but a foundational protocol that other hybrid finance applications can build upon, creating ecosystem effects similar to Ethereum’s role in DeFi.

Geographic Expansion Strategy

International expansion plans target key markets with favourable regulatory environments and large populations underserved by traditional financial systems. Priority regions include emerging markets where cryptocurrency adoption accelerates fastest due to limited banking infrastructure, currency instability, or restrictive capital controls that blockchain technology circumvents.

Localisation efforts include multilingual support, regional payment method integration, and partnerships with local financial institutions that provide familiar entry points for new users. This geographic diversification not only expands market opportunity but also reduces concentration risk from any single region’s economic or regulatory conditions.

Institutional services tailored for professional traders, asset managers, and corporate treasuries represent significant expansion opportunities as traditional finance increasingly allocates to cryptocurrency. Developing enterprise-grade tools, dedicated support, and customised solutions for institutional needs positions BlockchainFX to capture this high-value market segment as mainstream adoption accelerates.

Community Building and Governance

Decentralised Governance Structures

Token-based governance gives BlockchainFX community members direct influence over platform development, parameter adjustments, and treasury allocation. This decentralised decision-making balances the platform’s traditional finance compliance requirements with blockchain’s ethos of community ownership and transparent governance.

Proposal systems allow any token holder to suggest platform improvements, with voting power proportional to stake size, but implement quadratic voting mechanisms to prevent excessive concentration. This governance structure ensures that large stakeholders cannot unilaterally control platform direction while preventing dilution of decision quality through excessive fragmentation.

Treasury management through community governance directs platform revenues toward development priorities, marketing initiatives, and strategic partnerships aligned with token holder interests. This financial transparency and collective resource allocation create alignment between platform success and token holder returns, fostering long-term community engagement beyond speculative trading.

Educational Initiatives and User Support

Comprehensive educational resources help users understand both cryptocurrency fundamentals and the specific advantages of BlockchainFX’s hybrid DeFi-TradFi approach. Tutorial content, webinars, and documentation lower entry barriers for traditional investors unfamiliar with blockchain technology while helping DeFi users understand how traditional finance integration enhances platform capabilities.

Customer support infrastructure meeting traditional financial service standards provides responsive assistance through multiple channels, including live chat, email, and phone support. This professional service level differentiates BlockchainFX from many cryptocurrency platforms, where users struggle to resolve issues, creating trust and confidence that encourages larger capital allocations.

Community engagement through social media, forums, and ambassador programs fosters strong network effects where existing users actively promote the platform and assist newcomers. This organic growth through genuine user enthusiasm proves more sustainable and cost-effective than paid marketing, creating viral expansion as community members recognise their stake in platform success through token ownership.

Investment Considerations and Market Analysis

Evaluating the 100x Potential

The 100x return projection for BlockchainFX tokens stems from multiple converging factors, including limited supply, expanding utility, growing user base, and favourable market timing. Comparable cryptocurrency projects that achieved mainstream adoption through superior technology and strategic positioning have demonstrated similar or greater appreciation, providing historical precedent for ambitious projections.

Market capitalisation analysis reveals significant growth potential when comparing BlockchainFX’s current valuation to established cryptocurrency projects with similar utility but larger user bases. As the platform captures market share from both pure DeFi protocols and traditional financial services through its differentiated hybrid approach, proportional market cap expansion supports substantial token appreciation.

Network effects accelerate as platform adoption reaches critical mass, where each new user increases value for existing participants through enhanced liquidity, more trading pairs, and broader ecosystem integration. These positive feedback loops have characterised successful technology platforms across industries, suggesting that early adoption phases offer disproportionate return potential before exponential growth begins.

Risk Factors and Mitigation Strategies

Potential investors should carefully consider risks, including regulatory changes that could restrict cryptocurrency operations, technical vulnerabilities despite security measures, and market competition from emerging projects with similar hybrid approaches. These risks, while real, are actively mitigated through BlockchainFX’s proactive compliance, robust security architecture, and continuous innovation, maintaining competitive advantages.

Market volatility represents inherent cryptocurrency risk, with token prices subject to broader market sentiment beyond platform fundamentals. However, the genuine utility driving token demand provides downside protection absent in purely speculative assets, creating more stable value propositions during market downturns when speculative projects suffer catastrophic declines.

Execution risk exists around delivering promised features, maintaining partnerships, and achieving user adoption targets outlined in roadmaps. The experienced team, proven track record of meeting presale milestones, and transparent communication reduce these concerns while acknowledging that unforeseen challenges inevitably arise in ambitious technology projects.

Conclusion

BlockchainFX’s groundbreaking hybrid DeFi-TradFi approach represents the inevitable evolution of financial systems toward models that combine blockchain’s technological advantages with traditional finance’s regulatory framework and institutional infrastructure. The presale’s extraordinary success, with 100x potential supported by strong fundamentals, reflects growing recognition that purely decentralised or purely centralised systems cannot individually address the complex requirements of modern finance.

As traditional investors increasingly seek cryptocurrency exposure through compliant, secure platforms, and DeFi users recognise the limitations of operating entirely outside regulatory systems, hybrid models like BlockchainFX emerge as the optimal solution satisfying both constituencies. The platform’s comprehensive approach—addressing security, compliance, liquidity, and user experience—positions it to capture significant market share as mainstream adoption accelerates.