Just days before his sentence, the “Undead Apes” NFT scam prisoner committed suicide. This tragedy has tarnished the Bitcoin and NFT communities and the already contentious matter. The NFT community was alerted to the “Undead Apes” scam, which included creating and selling non-fungible tokens (NFTs) that promised high profits. Many are questioning how the convict’s tragic death would affect NFT and cryptocurrency accountability talks.

Rise of ‘Undead Apes’ Scheme

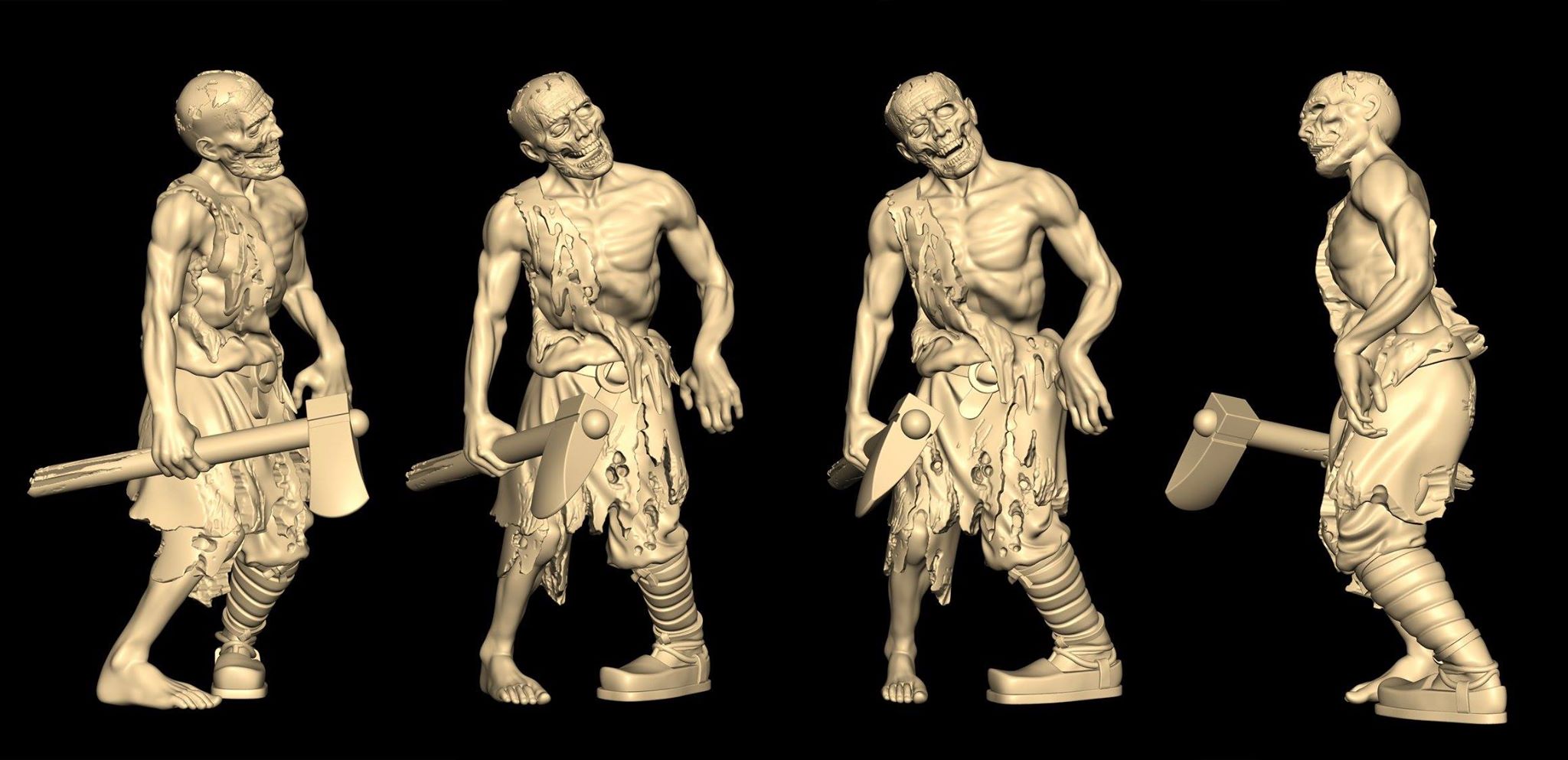

The “Undead Apes” NFT plan started as a promising digital collectibles company. Digital artists, celebrities, and even big organizations have launched NFT collections recently. A high-value NFT collection, “Undead Apes,” included zombie-themed apes in digital art. Thousands of purchasers willing to invest in these unique digital assets flocked to the collection. The swindle relied on false promises of exclusivity and profitability. Buyers believed buying an “Undead Ape” would unlock future sales and incentives.

As the program evolved, it became evident that the architects had no intention of fulfilling these claims. Investors were left with worthless tokens and little redress after utilizing sales profits to fuel their projects. Multiple victim complaints and law enforcement investigations revealed the fraud. The offenders duped buyers into buying worthless NFTs. Once the scheme’s true nature was uncovered, its perpetrators faced fraud charges and other legal consequences.

Criminal Conviction and Repercussions

The “Undead Apes” scammer, whose name was kept secret, was arrested and convicted of fraud, conspiracy, and money laundering. Authorities found that the criminal stole millions from investors via fraudulent marketing, false promises, and market manipulation. The case shook NFT investors, which highlighted the hazards of investing in unregulated digital assets. In the months leading up to the sentence, the convict’s legal team tried to argue that their client was uninformed of the entire magnitude of the fraud or was pushed into participating.

Due to overwhelming fraud evidence and victim testimony, a guilty decision was reached. Given the seriousness of the allegations and the victims’ financial loss, many expected a substantial jail term for the convicts. Authorities said the person committed suicide days before sentencing. The announcement shocked the legal world and generated discussion about the case’s wider consequences.

Tragic End and Conviction Aftermath

Many mysteries remain after the convict’s death. The revelation has exacerbated the unfairness for “Undead Apes” victims, who will never see their money recovered or the offender prosecuted. The individual’s death may end legal proceedings, but investors with worthless NFTs and lost faith in digital assets have no closure. The absence of accountability in NFTs frustrates victims and industry watchers. The “Undead Apes” case illustrates the dangers of investing in uncontrolled digital marketplaces where fraud is rampant.

Despite NFTs’ rising popularity and potential for high returns, many investors are ignorant of their hazards. The convict’s death has sparked worries about high-profile financial criminals’ mental health. While the cause of the tragedy is unknown, experts believe that the burden of a long jail term and public attention may have contributed to the suicide. This highlights the often-overlooked psychological toll of legal fights, financial fraud, and criminal prosecutions, even if convicted.

Broader NFT Industry Implications

The “Undead Apes” controversy highlights the NFT market’s weaknesses and lack of control. NFTs are popular yet unregulated, making them ideal for fraud and fraud. NFTs and cryptocurrencies are murkier than conventional financial markets, forcing investors to fend for themselves. As the NFT business grows, investors call for more regulation and monitoring to avoid repeat fraud. Industry leaders contend that unethical actors have used NFT hype for personal advantage, while others worry overregulation might impede innovation. The “Undead Apes” occurrence illustrates that NFT participants need greater consumer protections and market transparency.

Cryptocurrency and Blockchain Communities

Initially an NFT problem, the “Undead Apes” hoax has wider repercussions for the bitcoin and blockchain ecosystems. Blockchain technology, which is safe, transparent, and decentralized, powers NFTs and cryptocurrencies. The “Undead Apes” scam shows that decentralized markets may be exploited, raising doubt about their reliability. The convict’s death has made investors skeptical of blockchain investments. Investors are vulnerable to such schemes owing to legislation and accountability gaps. The security and validity of digital assets will be addressed to protect buyers and sellers as NFT and cryptocurrency marketplaces grow.

Also Read: Crypto Art The Investment Revolution of the Decade

Conclusion

The “Undead Apes” NFT scheme’s unlucky victim’s death has exposed the risks of investing in uncontrolled digital marketplaces. While death may postpone justice, victims remain damaged. The lawsuit alerts investors and industry leaders to the need for NFT and cryptocurrency accountability and transparency. As this fast-growing market evolves, tougher protections and regulations will protect players and prevent future frauds from ruining its name.