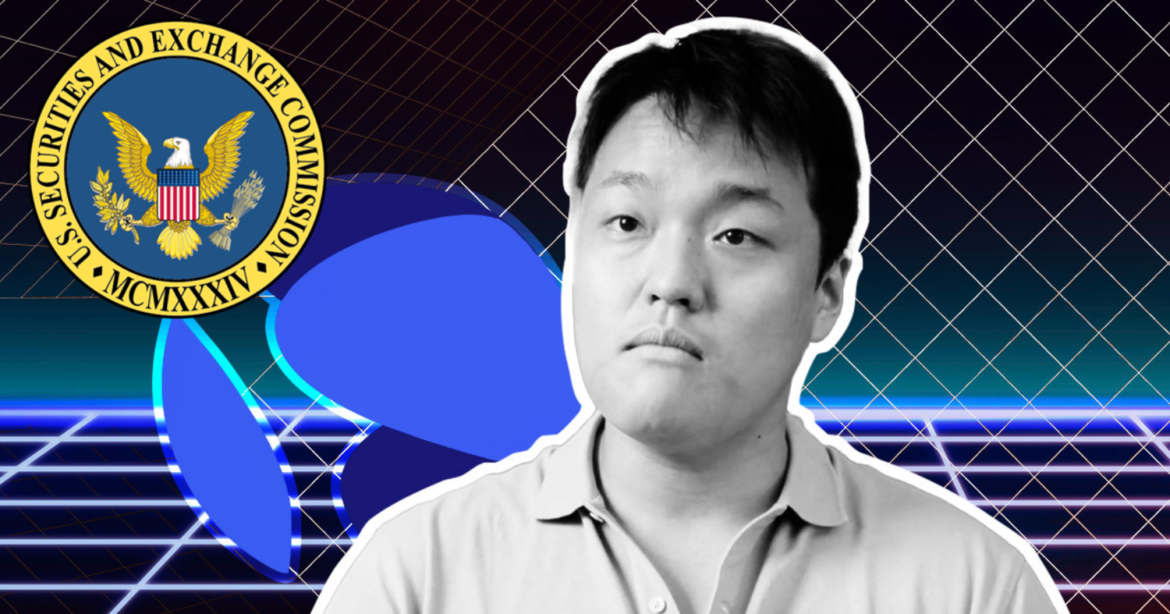

Do Kwon, the controversial Terra blockchain co-founder, and former Terraform Labs CEO, pleaded not guilty in a U.S. court after his extradition from Montenegro. Kwon faces various accusations for his alleged role in one of the largest Crypto crashes in history, drawing attention from the cryptocurrency community and authorities worldwide. Do Kwon’s Trial This article examines the claims against Do Kwon, his legal issues on the cryptocurrency market, and how his plea of not guilty may affect Crypto regulation.

Terra Collapse and Do Kwon Charges

The Terra blockchain, co-founded by Do Kwon, was a promising cryptocurrency concept with TerraUSD (UST) and LUNA, its native token. LUNA’s market worth was above $40 billion, and UST was extensively utilized in DeFi. However, TerraUSD’s collapse in May 2022 caused a chain reaction that destroyed billions of dollars in investor capital. The stablecoin lost its dollar peg, sending LUNA to near-zero prices.

The event caused a market decline and intensified regulatory scrutiny of stablecoins and DeFi initiatives. The fall prompted various investigations into Do Kwon. South Korean authorities issued an arrest order for Kwon, and Interpol put him on Red Notice. The SEC also accused him of fraud for misrepresenting TerraUSD’s stability and dangers.

Arrest and Extradition of Do Kwon

After being detained in Montenegro in March 2023 for using fake travel credentials to go to Dubai, Do Kwon’s legal issues escalated. He faced allegations of document fabrication in Montenegro after being captured. Montenegro extradited Kwon to the US and South Korea in June 2024. His extradition to the U.S. occurred in late 2024 after the authorities prioritized their request. Upon arrival in the U.S., Kwon was arrested and charged with securities fraud, wire fraud, and conspiracy to deceive investors.

Does Kwon deny guilt?

Kwon pled not guilty to all counts in his first U.S. court appearance. His defense team claimed that Terra’s downfall was caused by market factors, not fraud. According to experts, Kwon’s not-guilty plea may lead to a protracted legal struggle. The prosecution must establish that Kwon willfully deceived investors and committed fraud. Kwon’s defense will likely emphasize Crypto market complexity and algorithmic stablecoin concerns.

Cryptocurrency Market Impact

The judicial actions against Do Kwon have affected the bitcoin industry’s investor sentiment and digital asset regulation. The Terra crash revealed algorithmic stablecoin concerns, forcing authorities to examine the industry. After Terra’s failure, various nations, including the U.S., have passed or proposed cryptocurrency transparency and accountability laws. Stablecoin issuers must now disclose their reserves and price stability methods.

The bitcoin market has survived the regulatory assault. After Terra, Bitcoin and Ethereum, the two biggest cryptocurrencies by market capitalization, rebounded and continue to draw institutional interest. Market investors remain cautious, scrutinizing regulatory changes and high-profile court cases like Kwon’s.

Legal/Regulatory Implications

Does Kwon’s trial affect the Bitcoin sector? Kwon’s conviction might create a precedent for holding Crypto CEOs liable for project failures and investor losses. However, a not-guilty decision might inspire crypto entrepreneurs by indicating that they may not be personally accountable for project failures if they operate in good faith. This case highlights the Crypto industry’s escalating regulatory scrutiny. According to the SEC, many digital assets and DeFi protocols come under securities rules, therefore Crypto firms and executives are facing more regulatory proceedings.

Defense argues

Does Kwon’s defense team claim TerraUSD’s fall was a market event, not a fraud? They may argue that Terra’s demise was unrelated to the 2022 Crypto market crisis. The defense may also claim that algorithmic stablecoins are experimental and that investors knew the dangers. They may also point to Kwon’s public attempts to stabilize TerraUSD throughout the crisis as proof that he didn’t deceive investors.

In this case, What Next?

Legal actions against Do Kwon may last months or years. Both sides will argue, so a ruling is doubtful soon. Since algorithmic stablecoins are sophisticated financial instruments, the case reminds us of the hazards of investing in cryptocurrency ventures. As investors seek more safeguards against fraud and market manipulation, Crypto regulatory certainty is crucial.

Read More: Top 12 Shitcoins to Consider for January 2025 Investments

Conclusion

Do Kwon’s not guilty plea is a turning point in the Terra collapse and bitcoin sector regulation. The lawsuit may establish legal precedents for Crypto regulation and responsibility. The trial emphasizes proper diligence and the hazards of investing in new financial technology for investors. Clear laws and investor safeguards are essential as the Crypto business evolves. Do Kwon’s Trial The Do Kwon trial and Terra collapse will be watched closely to see how they may affect digital assets and the financial environment.